Within the first month of 2025, European equities noticed the biggest month-to-month capital inflows in 25 years, based on Financial institution of America. This stunning growth comes after the European STOXX EUROPE 600 index recorded simply 6% development for 2024 in comparison with 24% for the US S&P 500 index.

The euro space economic system grew by simply 0.9% within the third quarter, whereas the US economic system grew by 2.7%. Preliminary knowledge for the fourth quarter shall be revealed this week. Though the eurozone managed to tame inflation to 2.4%, this led to a broad-based financial slowdown.

The outlook for 2025 suggests rising divergence between US and eurozone financial coverage, partly because of the Trump administration’s deliberate actions. ECB rates of interest are already greater than 1% decrease than within the US and the hole may widen additional. Economists anticipate the ECB to chop charges by as much as one proportion level this 12 months, whereas the US is predicted to drop by solely half a proportion level. This has a unfavorable impact on the euro-dollar alternate charge, which has already reached parity.

Europe nonetheless faces many dangers. Inflation, an financial slowdown, the danger of a tariff battle with the US or China, a collapsing automobile trade, rising vitality costs… the listing is lengthy.

So what brings buyers again to European markets?

Banks

Within the US, banks historically kicked off the earnings season in fashion. Most of them beat expectations because of robust curiosity revenue and a restoration in buying and selling exercise on Wall Road, particularly in areas equivalent to buying and selling and funding banking.

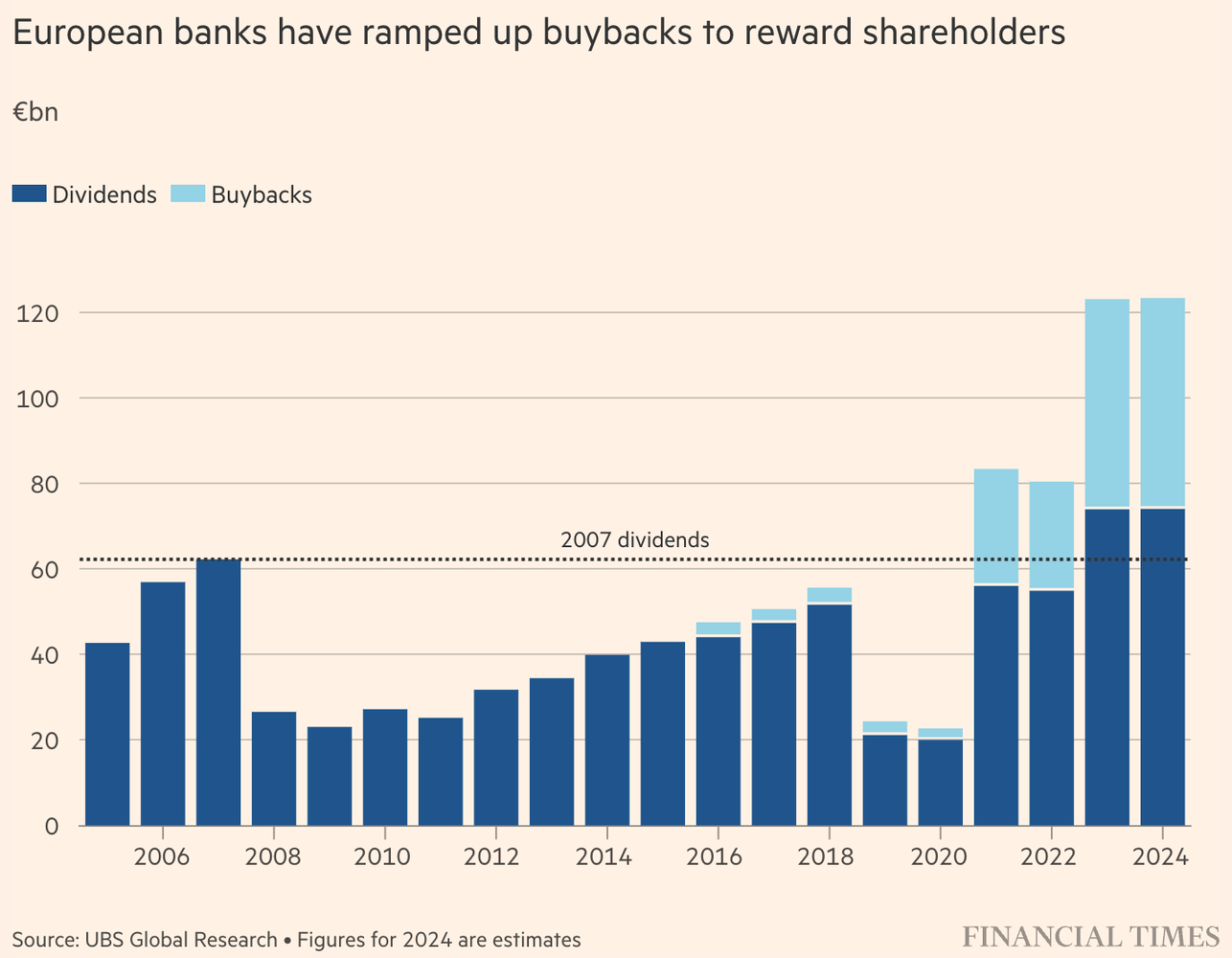

However European banks additionally attracted media consideration. UBS estimates that shareholder compensation for 2024 may exceed $123 billion for the second 12 months in a row. After an extended interval of low and even unfavorable rates of interest, the outlook for banks has improved considerably because the Covid pandemic.

European financial institution shares are reaching all-time highs because of high-interest yields. And though the ECB has already began to chop rates of interest, banks nonetheless have the chance to make the most of this case and maximise earnings in 2025 because of the financial restoration of customers.

Regardless of the constructive developments, nonetheless, valuations of European banks nonetheless lag behind their US counterparts. Many European titles are buying and selling at lower than their ebook worth, suggesting room for development.

Then again, the deregulation of the US banking sector poses a major aggressive danger for European banks. Much less stringent guidelines could permit US banks to broaden extra aggressively, which may put stress on European gamers in worldwide markets.

The luxurious sector

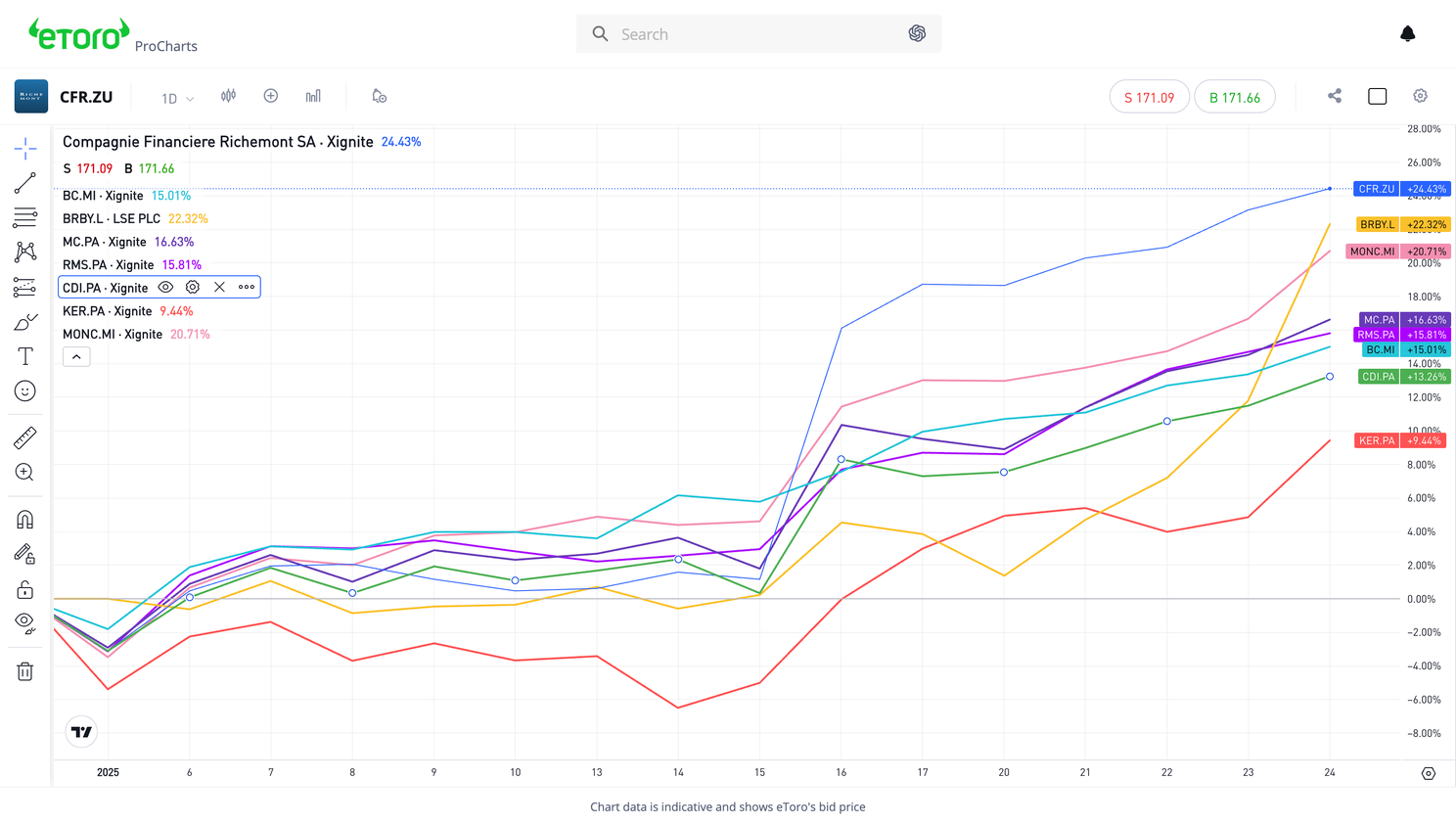

With the beginning of the This autumn 2024 earnings season, we had been in a position to get a glimpse into the efficiency of a number of main European gamers within the luxurious items sector. Brunello Cucinelli, Richemont and Burberry reported outcomes, whereas we anticipate additional reviews within the coming weeks. What developments did these outcomes reveal?

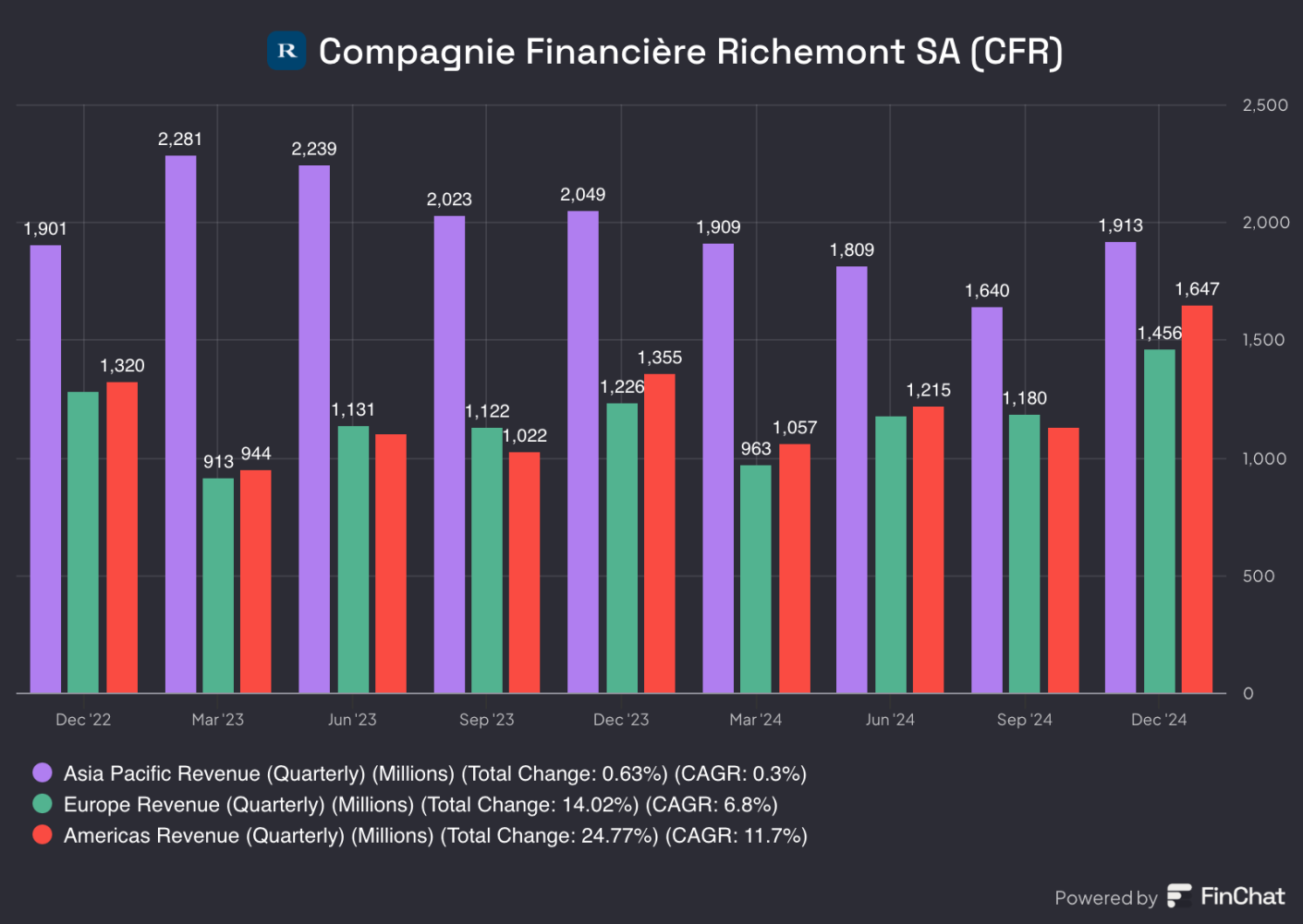

Richemont

Richemont, recognized for its luxurious jewelry and watches equivalent to Cartier, Piaget and Montblanc, reported double-digit gross sales development in all areas besides Asia.

In Asia, gross sales fell 7%, pushed by an 18% drop in mainland China. However, that is an enchancment on the 16-19% year-on-year decline in earlier quarters. Asia accounts for as much as 40% of Richemont’s gross sales, making it a key area.

Europe recorded robust development of 19%, boosted by tourism from the Americas and the Center East. The Americas grew essentially the most of all areas, pushed by robust shopper and financial growth. It is a important acceleration in each areas, as income development in current quarters was solely 5% and 10% respectively.

Brunello Cucinelli

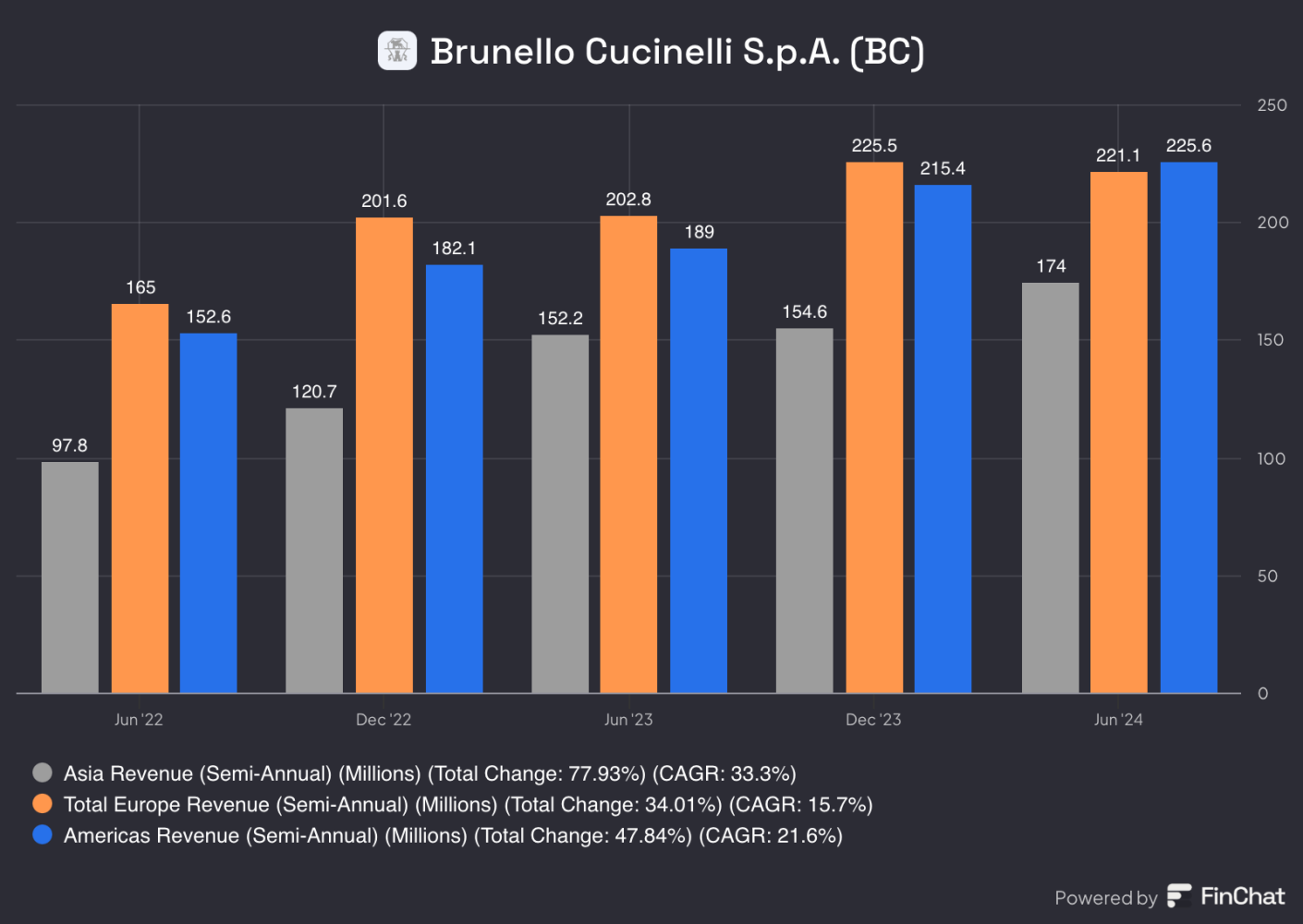

Brunello additionally reported ” enchanting” This autumn ends in January.

Within the Americas, gross sales rose 17.8%, underlining robust demand from US customers. Europe noticed barely extra modest development at 6.6%.

In Brunello’s case, development in Asia was surprisingly robust, even after the corporate raised its expectations to 11-12% development in December from an preliminary 10%. Fourth-quarter gross sales had been up 12.6%.

Brunello advantages from a singular place in Asia because it targets ultra-high-net-worth shoppers that haven’t been affected by the widespread financial slowdown. Hermes can also be in an analogous place. Brunello additionally advantages from the truth that Asia accounts for under ~27% of its gross sales.

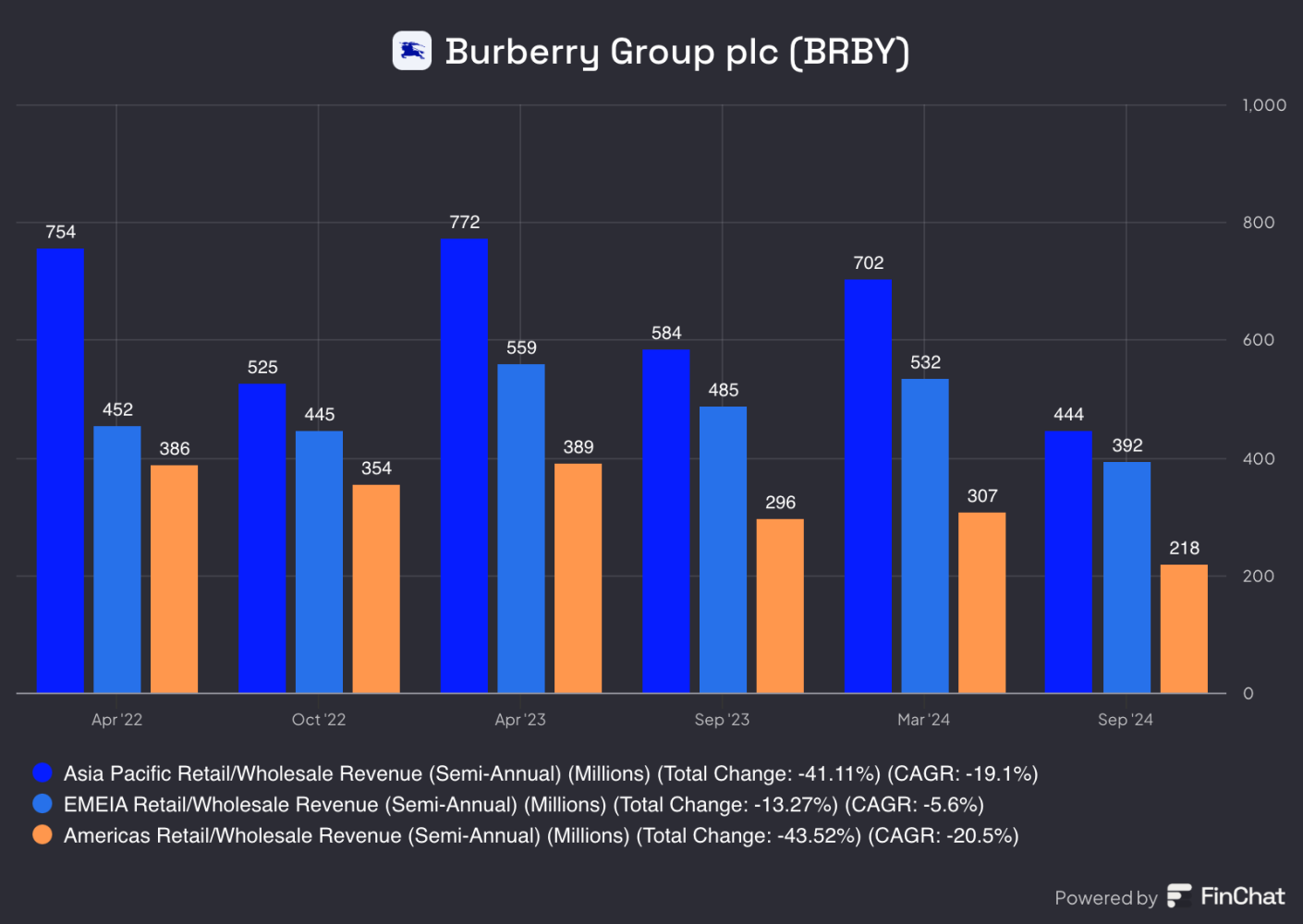

Burberry

Burberry is dealing with a tough time given the continued efforts to revive the model. Regardless of this, gross sales within the Americas recorded 4% development. Europe noticed a 2% decline, whereas gross sales in China unsurprisingly fell essentially the most, down 7%.

Nonetheless, the outcomes had been nonetheless higher than analysts anticipated, main to an enormous rally in Burberry shares.

All the sector rode the wave of optimism from these outcomes, particularly the power within the US and the restoration of European customers. Within the second half of final 12 months, buyers misplaced confidence in some manufacturers on condition that the unsure extent of the financial issues in China posed a major danger to a lot of them. However evidently buyers had been a little bit too pessimistic.

Not all the things is as rosy because it appears

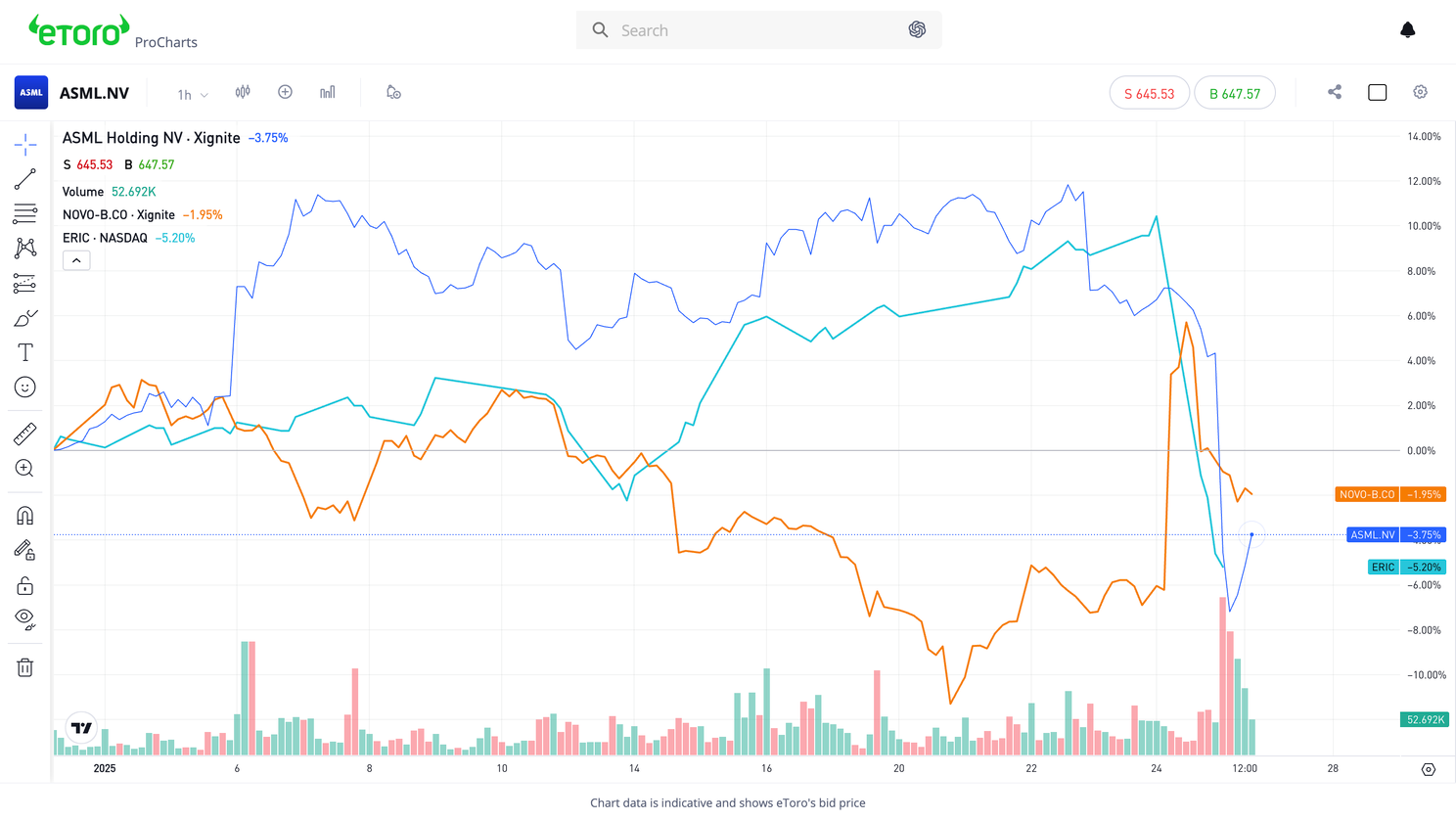

Whereas the banking and luxurious items sectors in Europe are displaying promising developments, different European favourites face important challenges. The earnings season in Europe could also be off to a slower begin than within the US, however there are already early indicators of dangers that might have an effect on 2025.

For instance, ASML shares not too long ago weakened after Dutch Prime Minister Dick Schoof hinted at the opportunity of renewing strict export bans on AI chips at a discussion board in Davos, this time beneath the management of Donald Trump. Such restrictions, just like these beneath Joe Biden, may considerably disrupt provide chains and export prospects for European expertise companies.

Considerations had been additionally expressed by Ericsson, whose shares fell after its outcomes had been revealed. The corporate warned of the unfavorable impression of the tariffs, which it mentioned posed a critical risk to Europe’s data and telecoms trade.

Novo Nordisk, one of many darlings of the European market, will not be within the clear both. Its shares benefited final 12 months from optimism round weight problems medication, notably Wegovy and Mounjaro, which had been initially developed as diabetes remedies however have proved efficient in lowering urge for food. Nonetheless, demand didn’t match investor expectations. Furthermore, the outcomes of scientific trials of the brand new drug have produced combined conclusions. Novo Nordisk won’t publish its quarterly outcomes till 5 February.

And what about Davos?

Final Friday, probably the most essential world conferences of the 12 months came about in Davos, Switzerland. The World Financial Discussion board is a platform that brings collectively leaders from politics, enterprise, academia, economics and different fields. Yearly, greater than 3,000 members collect on this picturesque city within the Swiss Alps to debate and discover options to world issues.

This 12 months’s occasion, entitled “Cooperation for the Clever Age”, came about at a pivotal second for world politics – coinciding with the conclusion of the Gaza ceasefire and the inauguration of the brand new President of america.

Trump’s “carrot and stick” strategy

Donald Trump was one of many principal matters of debate this 12 months. Guests had been notably involved about his strategy to tariffs, deregulation and vitality coverage. Trump has brazenly careworn that his principal objective is to make sure America’s dominance on the worldwide stage – even at the price of strained relations with its allies. China was additionally an enormous matter, because it has quickly remodeled from the “manufacturing facility of the world” into a world energy, which Trump sees as a rising risk.

As a result of the discussion board started on the day of his inauguration, Trump joined the world leaders just about by way of dwell stream. In his speech, he declared, “Underneath a Donald Trump administration, there shall be no higher place on Earth to create jobs, construct factories or develop firms than proper right here within the good outdated USA.”

What dangers does Trump pose to Europe?

On his first day as President of america, Donald Trump repealed numerous energy-related rules. In his phrases, America should considerably improve vitality manufacturing to make sure not solely its vitality independence, but in addition adequate vitality provides for its rising AI infrastructure.

One other key goal of Trump’s coverage is to decrease vitality costs to fight inflation and scale back Russian revenues from the vitality sector. In accordance with him, this step is essential for ending the battle in Ukraine.

One notable impact of those insurance policies is his push for Europe to buy extra American vitality. If Europe refuses, Trump has threatened to impose tariffs. His current commerce dispute with Colombia demonstrates that he’s not hesitant to make use of tariffs as a bargaining software.

Trump goals to make use of tariffs to handle commerce imbalances with main companions like Europe and China. Simply final week, he signed a memorandum directing federal companies to overview commerce agreements, with a deal with addressing unfair commerce practices and market manipulation. Europe is standing on skinny ice in terms of commerce with the USA, and now we have but to see how this case develops.

What lies forward for Europe in 2025?

Regardless of optimism in a couple of chosen areas, Europe’s structural issues stay unchanged. The brand new 12 months nonetheless holds many unknowns. Key areas for buyers to deal with embody:

Geopolitical pressures: competitors with China and the US, who don’t hesitate to resort to unfair practices, could hamper European development.

A robust greenback: It continues to push up the value of imports and weaken the euro, elevating prices for European companies.

Vitality disaster and regulation: Dependence on vitality imports and regulation could stay key components affecting European firms.