The DeFi lending house has seen speedy progress, however with so many platforms promising improved entry, sooner transactions, and higher safety, it’s tough to inform which of them will truly ship long-term worth.

One platform producing vital consideration is Mutuum Finance, a decentralized resolution that leverages blockchain expertise to make on-chain credit score extra accessible, providing a clear and decentralized different to conventional monetary methods.

However with daring claims and a extremely aggressive DeFi house, the query stays: Can Mutuum Finance actually reshape decentralized lending, or is it simply one other experiment in a quickly evolving house?

What’s Mutuum Finance?

Mutuum Finance is a decentralized lending platform that wishes to repair what’s damaged in conventional finance. It cuts out banks and middlemen through the use of blockchain tech, giving folks sooner, cheaper, and fairer entry to credit score. You possibly can borrow and lend immediately, and every part runs by way of code (good contracts), not paperwork.

In a world the place getting a mortgage usually is dependent upon your financial institution or credit score rating, Mutuum is attempting to open issues up utilizing Web3 instruments, giving folks extra management over their monetary choices.

How Mutuum Finance Works

Mutuum Finance blends good contracts with decentralized credit score scoring to create a versatile lending ecosystem. It helps each overcollateralized and trust-based undercollateralized lending, providing choices for conventional DeFi customers and people with verified real-world identities.

Step-by-Step Lending Course of

Join Pockets & Set up Belief

Debtors start by connecting their crypto pockets to the Mutuum platform. For undercollateralized loans, they endure a credit score analysis powered by underwriters, trusted companions who assess a borrower’s real-world id and monetary historical past. This off-chain belief is tokenized right into a soulbound token (SBT), completely tied to the borrower’s pockets.

Select Collateral and Mortgage Phrases

Debtors deposit crypto property as collateral. Because of the belief system, they’ll entry loans with decrease collateral necessities than typical DeFi platforms. For normal lending, Mutuum enforces overcollateralization, requiring the worth of collateral to exceed the mortgage quantity, based mostly on strict Mortgage-To-Worth (LTV) ratios assigned to every asset.

As soon as permitted, debtors obtain their mortgage in Mutuum-issued stablecoins, that are minted on-demand and backed by collateral. These stablecoins can be utilized freely whereas the borrower’s place stays inside secure limits.

Automated Mortgage Administration

Good contracts automate your entire lifecycle of the mortgage, from disbursement to curiosity calculation to compensation monitoring. There aren’t any preset deadlines, and debtors can repay partially or totally at any time, so long as they keep the required collateral ratio.

Danger Monitoring & Liquidation

If the collateral worth drops under a sure liquidation threshold, Mutuum’s automated system kicks in. Liquidators can repay a part of the borrower’s debt in alternate for collateral at a reduction, sustaining the protocol’s solvency. This additionally applies to multi-asset collateral, the place a weighted liquidation threshold is calculated to replicate complete danger.

How Lenders Take part

Present Liquidity to Devoted Swimming pools

Lenders deposit property like ETH, USDT, or DAI into devoted liquidity swimming pools for every supported crypto. In return, they obtain mtTokens (e.g., mtETH, mtDAI) minted at a 1:1 ratio. These mtTokens constantly accumulate worth as curiosity is earned from borrower repayments.

Earn Curiosity Based mostly on Danger

Rates of interest regulate dynamically based mostly on the utilization charge of the pool and the borrower’s belief score. Greater danger = increased potential returns. Lenders profit from versatile, clear curiosity accrual with out having to handle particular person loans.

mtToken Flexibility & Rewards

mtTokens are ERC-20 compliant, to allow them to be transferred or traded in secondary DeFi markets. They will also be redeemed at any time for the unique asset plus accrued curiosity. When redeemed, mtTokens are burned, holding the provision in steadiness.

Function of $MUTM Token within the Mutuum Finance Ecosystem

The platform’s native token, $MUTM, performs a vital function by driving person interplay, platform governance, and the broader decentralized lending surroundings. Right here’s the way it works:

Incentives

$MUTM rewards customers for collaborating within the platform. Lenders earn $MUTM for offering capital, whereas debtors can earn $MUTM for repaying their loans responsibly. This creates a system the place good habits is rewarded, encouraging customers to have interaction with the platform in a approach that advantages your entire group.

Governance

Token holders are empowered to actively form the way forward for Mutuum Finance. $MUTM serves as a governance token, which means customers can vote on vital choices like:

Protocol upgrades: How you can enhance the platform’s performance and options.Danger parameters: Changes to loan-to-value ratios, liquidation thresholds, and different danger controls.Asset listings: Choices about which tokens ought to be obtainable for lending or borrowing on the platform.

Ecosystem Utility

The $MUTM token is the spine of the platform’s rewards and incentive methods. It underpins:

Platform rewards: $MUTM is used to reward lively individuals—whether or not that’s by way of staking, liquidity provision, or different contributions.Underwriter compensation: Underwriters (who assist handle danger and guarantee mortgage compensation) are compensated with $MUTM tokens for his or her function in sustaining platform stability.Consumer engagement: From staking to incomes rewards, $MUTM ensures that customers keep engaged and incentivized to maintain utilizing the platform.

$MUTM is a vital a part of what makes the decentralized lending expertise on Mutuum Finance each dynamic and sustainable.

Safety and Danger Administration

Mutuum Finance employs a complete safety and danger administration framework to safeguard each debtors and lenders inside its decentralized lending ecosystem.

Good Contract Audits and Safety Measures

Mutuum Finance has engaged CertiK, a number one blockchain safety agency, to conduct thorough audits of its good contracts and danger administration protocols. This audit goals to determine and mitigate potential vulnerabilities, guaranteeing the platform’s lending and borrowing mechanisms are safe and dependable.

Dealing with Unstable Property and Borrower Defaults

Mutuum Finance addresses the challenges of risky property by implementing conservative loan-to-value (LTV) ratios and liquidation thresholds. As an example, lower-volatility property like stablecoins and ETH can have LTVs as much as 75%, whereas extra risky tokens are restricted to LTVs within the 35–40% vary. These measures be certain that sudden worth drops don’t result in undercollateralization and subsequent liquidation occasions.

Within the occasion of borrower defaults, the platform’s danger administration protocols, together with underwriter ensures and escrowed collateral, are activated to mitigate losses and keep the steadiness of the lending ecosystem.

Comparability with Opponents: How Does Mutuum Finance Stack Up?

Right here’s a transparent side-by-side comparability of how Mutuum Finance evaluate current rivals:

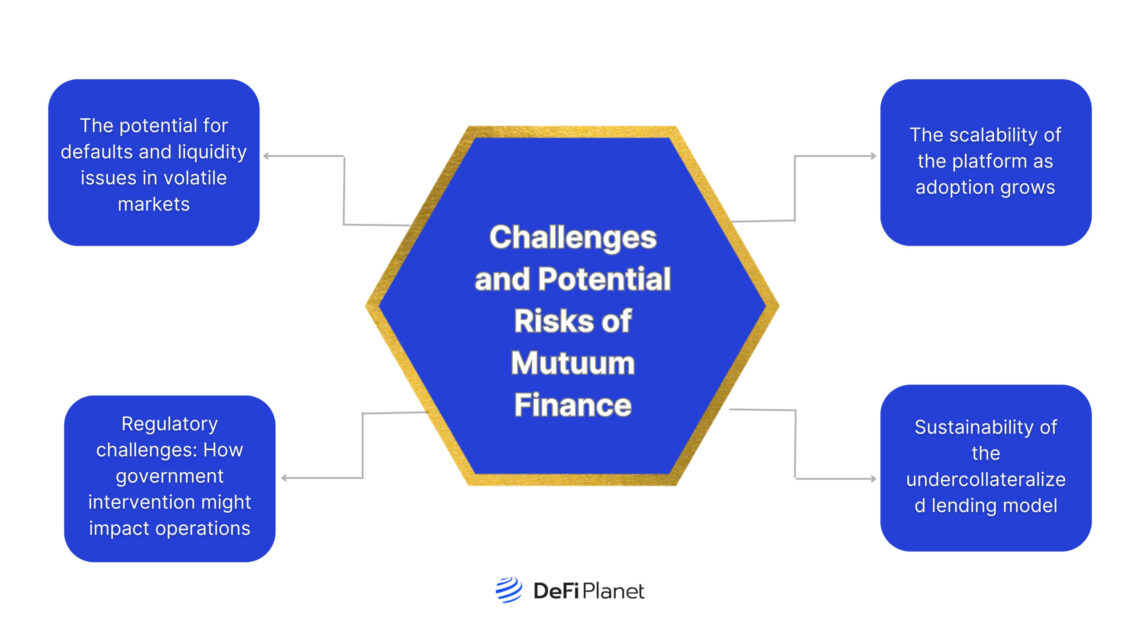

Challenges and Potential Dangers of Mutuum Finance

Whereas Mutuum Finance presents varied advantages, there are a number of challenges and potential dangers, resembling:

Sustainability of the Undercollateralized Lending Mannequin

Mutuum’s undercollateralized lending mannequin depends on trusted underwriters to evaluate creditworthiness utilizing real-world information. Whereas this permits for extra versatile lending, dangers embody potential incorrect assessments or borrower defaults, which might result in liquidity points. Collateral could not totally cowl the mortgage in risky markets.

Regulatory Challenges

DeFi platforms like Mutuum face uncertainty round laws, notably concerning lending providers. Potential future laws, resembling AML and KYC necessities, might disrupt operations. If undercollateralized lending is restricted, or if liabilities come up from defaults, Mutuum’s operations might be impacted.

Defaults and Liquidity Points in Unstable Markets

Crypto market volatility is a danger, as sudden worth drops could result in borrower defaults. Liquidations could not at all times get better the collateral’s true worth in a downturn, resulting in potential losses for lenders. Moreover, liquidity points could come up if funds in lending swimming pools are inadequate.

Scalability Challenges

As Mutuum grows, scalability could develop into a problem as a result of community congestion on platforms like Ethereum, resulting in gradual transactions and better charges. To scale successfully, the platform might have Layer 2 options, optimized good contracts, and enhanced safety measures to deal with elevated complexity and forestall vulnerabilities.

Is Mutuum Finance the Way forward for Decentralized Lending?

Mutuum Finance has the potential to be a game-changer on the planet of decentralized lending. By providing undercollateralized loans, it breaks away from the standard mannequin the place debtors should lock up extreme collateral. That is made attainable by way of trusted underwriters and soulbound tokens that assess creditworthiness, making a extra versatile and inclusive lending surroundings.

Mutuum’s strategy might bridge the hole between conventional finance and DeFi, providing borrowing alternatives to people who could not have entry to standard monetary methods. Its decentralized construction and revolutionary danger administration methods place it as a possible chief in increasing monetary inclusion.

Nonetheless, the platform’s long-term success hinges on overcoming regulatory challenges, managing market volatility, and scaling successfully. If Mutuum continues to innovate and adapt to the evolving panorama, it might play a pivotal function in shaping the way forward for decentralized lending and the broader monetary ecosystem.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of economic loss. At all times conduct due diligence.

If you need to learn extra articles like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.