Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is beginning to inch nearer towards $110,000 once more, lately pushing to an intraday excessive of $108,116 and now steadily buying and selling above $107,000. Regardless of the retracement under $99,000 previously week, Bitcoin’s present value motion reveals that the broader market continues to be bullish.

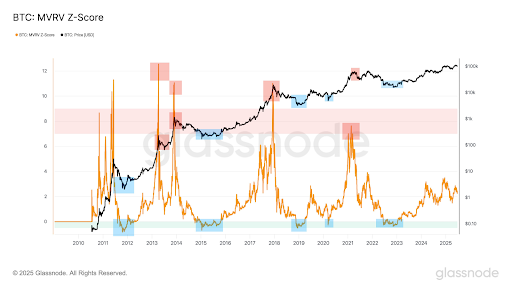

Notably, the latest value motion previously 24 hours is starting to quiet questions on whether or not Bitcoin has already reached its prime for this cycle. The MVRV Z-Rating could also be providing a transparent reply, and it factors in a really totally different course from what some may count on.

MVRV Z-Rating Says Bitcoin Has Room To Run

Based on crypto analyst Physician Revenue, who initially posted an on-chain evaluation of Bitcoin on the social media platform X, the MVRV Z-Rating signifies that BTC continues to be removed from its cycle prime. The MVRV Z-Rating is a longtime on-chain metric used to find out whether or not Bitcoin is overvalued or undervalued.

Associated Studying

As identified by the analyst, the present stage on the MVRV Z-Rating metric is barely barely above 2, which has been a comparatively impartial zone since Bitcoin’s creation. Bitcoin solely reached its main tops in previous cycles when this metric climbed into the purple zone and above a price of round 8 and above.

The general Bitcoin value chart shared by Physician Revenue helps this declare. Peaks within the orange MVRV Z-Rating line are proven with purple shaded zones within the chart under. These purple zones have aligned virtually completely with Bitcoin’s value tops in 2011, 2013, 2017, and 2021. Then again, regardless of the latest surge to new all-time highs in Could, the present cycle has but to push BItcoin’s value into that overheated area. As a substitute, the chart reveals the Z-Rating nonetheless in a a lot decrease band. This boils down to indicate that the Bitcoin value might have a really vital upside left.

MVRV vs Value: What The Present Setup Means For Bitcoin

One element that stands out within the present cycle is the sample of decrease highs forming within the MVRV Z-Rating, as seen within the chart. In contrast to in outdated cycles, the place the metric surged into excessive overvaluation zones above 10, the newest peaks have been noticeably extra subdued. This development could possibly be interpreted as a sign that the market is starting to mature or that Bitcoin might even already be approaching the height of its present cycle.

Associated Studying

Nonetheless, though this sample is value keeping track of, it’s removed from conclusive. The one conclusive reality is that Bitcoin’s value has by no means reached a definitive cycle prime till the MVRV Z-Rating has pushed into the purple zone, which it has but to do that time round. Though there isn’t a set value peak from the metric, different analysts have provided a variety of predictions for the place it would land. Predictions of Bitcoin value peaks vary anyplace from $150,000 to as excessive as $500,000.

On the time of writing, Bitcoin is buying and selling at $107,740, up by 1.4% previously 24 hours.

Featured picture from Getty Pictures, chart from Tradingview.com