JPMorgan & Coinbase have introduced a partnership that can permit Chase clients to hyperlink their wallets to the financial institution and convert rewards to crypto.

JPMorgan Has Partnered Up With Crypto Change Coinbase

As introduced through a press launch, JPMorgan and Coinbase have made a strategic partnership to roll out a set of options aimed toward making crypto entry mainstream.

JPMorgan Chase is the biggest financial institution within the US and one of many greatest globally, holding over $4 trillion in property. Coinbase, in the meantime, is the main American crypto change, serving main institutional entities and performing as custodian for many of the Bitcoin and Ethereum spot exchange-traded funds (ETFs).

The 2 giants are becoming a member of forces to launch three new choices for the financial institution’s 80 million+ clients: the flexibility to make use of Chase bank cards for making purchases on Coinbase, redemption of Chase Final Reward Factors for the stablecoin USDC, and a direct hyperlink between financial institution accounts and Coinbase wallets. The bank card buy service is anticipated to go reside in fall of this 12 months, whereas the opposite two are deliberate for 2026.

“This marks the primary time a serious bank card rewards program might be used to fund a crypto pockets,” learn the press launch. Underneath the scheme, 100 Chase Final Reward Factors will equal $1 in USDC redemption.

The partnership isn’t the primary foray into digital property for JPMorgan. A report from earlier within the month revealed that the financial institution is contemplating providing loans backed on Bitcoin and Ethereum collateral. Additionally, CEO Jamie Dimon has stated that JPMorgan will discover stablecoins.

“This partnership marks a big step ahead in empowering our clients to take management of their monetary futures,” stated Melissa Feldsher, Head of Funds and Lending Innovation at JPMorgan Chase.

The financial institution’s involvement in crypto might be particularly related for the sector given its huge scale. JPMorgan Chase is taken into account a International Systematically Vital Financial institution (G-SIB), which signifies that world financial stability is hinged on it.

Max Branzburg, Head of Client & Enterprise Merchandise at Coinbase, stated:

We’re excited to companion with JPMorganChase to onboard the subsequent era of shoppers into crypto. Collectively, we’re increasing selection and reducing boundaries to entry for shoppers to take part in the way forward for monetary companies onchain.

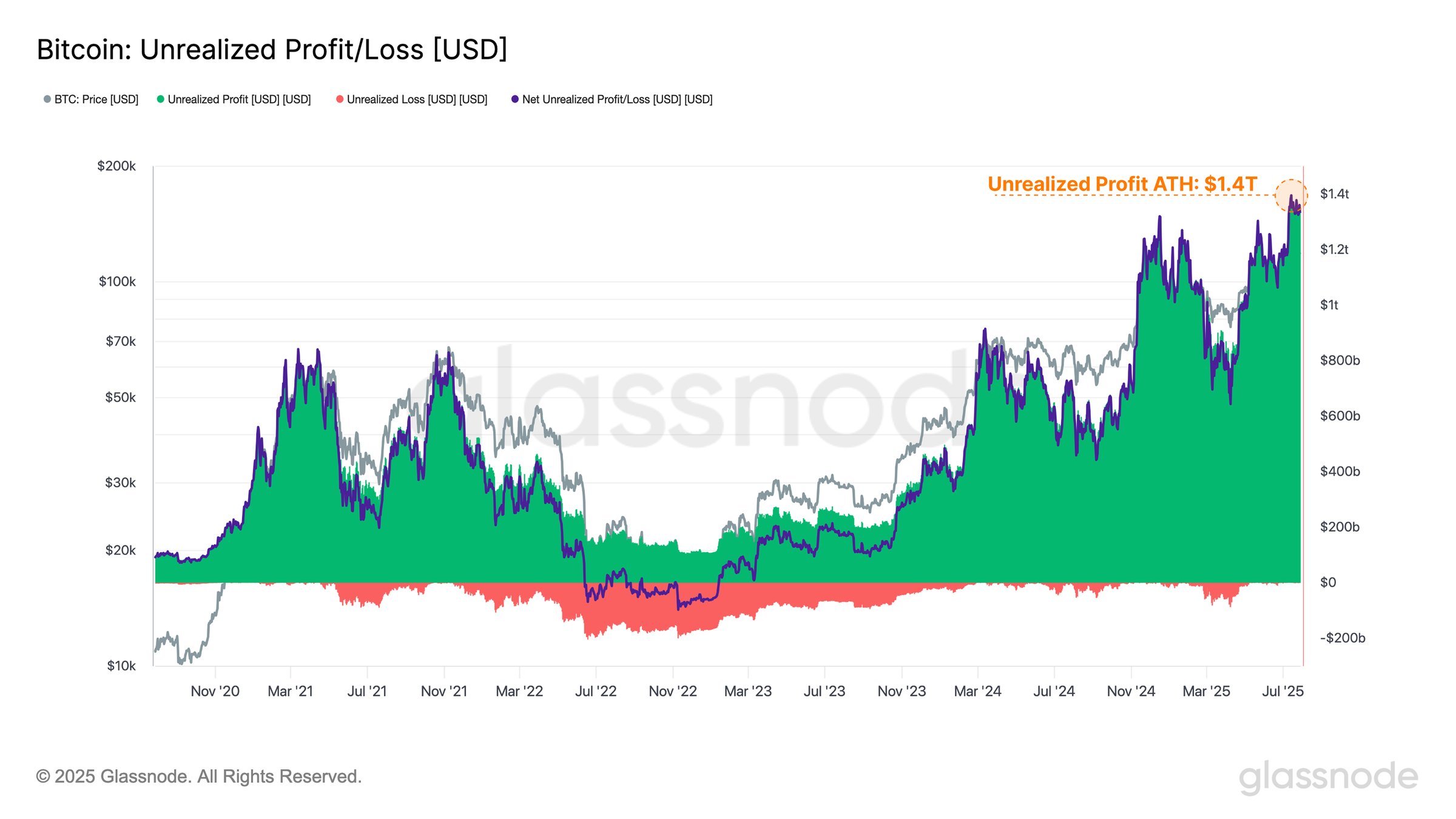

Whole Bitcoin Unrealized Revenue Held By Traders Has Set A New Document

In line with knowledge from on-chain analytics agency Glassnode, the whole unrealized revenue of the Bitcoin traders not too long ago touched the $1.4 trillion mark, a brand new all-time excessive.

The pattern within the unrealized revenue and loss held by BTC traders through the years | Supply: Glassnode on X

“This huge paper achieve focus units the stage for potential future distribution stress if costs proceed increased,” defined Glassnode. To this point, although, since this report has been reached, Bitcoin has succumbed to sideways motion, with its worth nonetheless buying and selling round $117,700.

Seems like the worth of the crypto has been flat since some time now | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.