The crypto market noticed one other tense session on Wednesday as Bitcoin briefly dumped to $115,000 earlier than recovering hours later again to the important thing $118K help degree: a battle that’s been occurring for days now. Merchants are watching intently as BTC holds this degree with its enamel, regardless of rising macro stress. Whereas the broader market confirmed fatigue, the query now could be: what’s one of the best crypto to purchase on this surroundings?

The Federal Reserve introduced Wednesday that it could not reduce rates of interest for July, holding regular between 4.15% and 4.25%. The choice got here regardless of public stress from the Trump administration, which has been calling for a 0.25% price reduce to guard financial development amid rising tariffs. Fed Chair Jerome Powell pushed again, citing inflation dangers and the financial uncertainty brought on by Trump’s tariff plans.

.@FederalReserve Chair Jerome Powell: "At this time the Federal Open Market Committee determined to depart our coverage rate of interest unchanged." pic.twitter.com/FnLmx3NOMn

— CSPAN (@cspan) July 30, 2025

EXPLORE: Greatest New Cryptocurrencies to Spend money on 2025

BONK and USELESS: Nonetheless the Greatest Crypto to Purchase in a Drained Market?

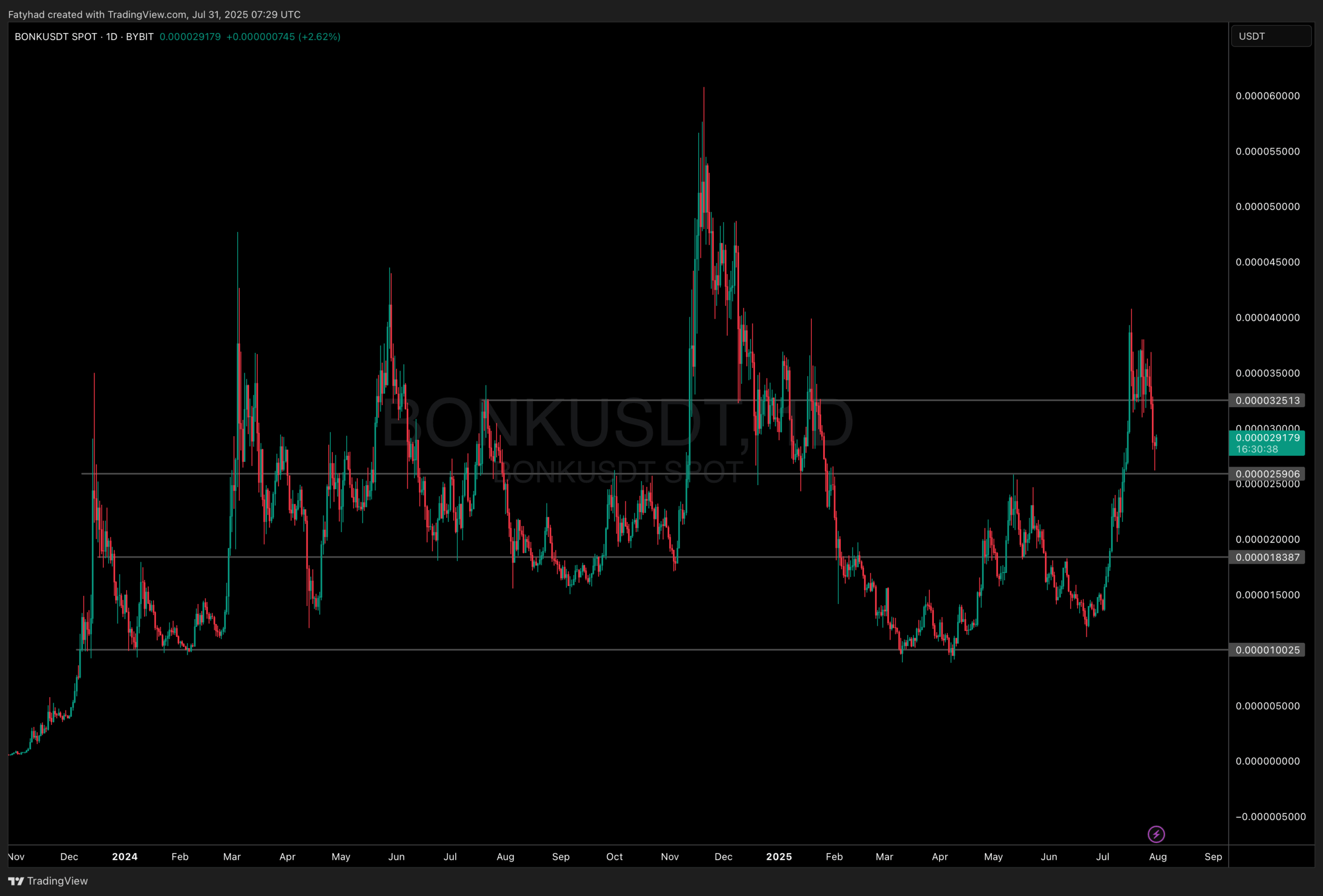

Meme coin BONK misplaced its key help at $0.0000328 simply days in the past and dropped over 20% to retest the decrease degree round $0.000026. However now it’s bouncing, buying and selling close to $0.0000287. If it reclaims $0.0000328, bulls would possibly get again in cost. Basically, Bonk’s rising ecosystem provides it an edge: LetBonk, its personal launchpad, has outcompeted Pump.Enjoyable in simply weeks. Over 80% of graduated meme tokens are actually born on Bonk’s launchpad, which implies extra income charges feeding again into BONK itself.

One other identify bouncing again? USELESS coin. After a 38% dip from its $408 million ATH, it’s again on the radar. The coin — half satire, half meme-fuel — has been embraced by degens on the lookout for the subsequent Fartcoin. And let’s be trustworthy: if Fartcoin hit $2.6 billion, why not USELESS? It’s uncooked, ironic, and performs immediately into the no-utility meme meta. No staking, no claims, simply pure community-driven chaos. For some, that’s precisely the purpose.

NFT Gross sales Surge 47% in July as Ethereum Rallies — Is the OpenSea Airdrop Behind the Spike?

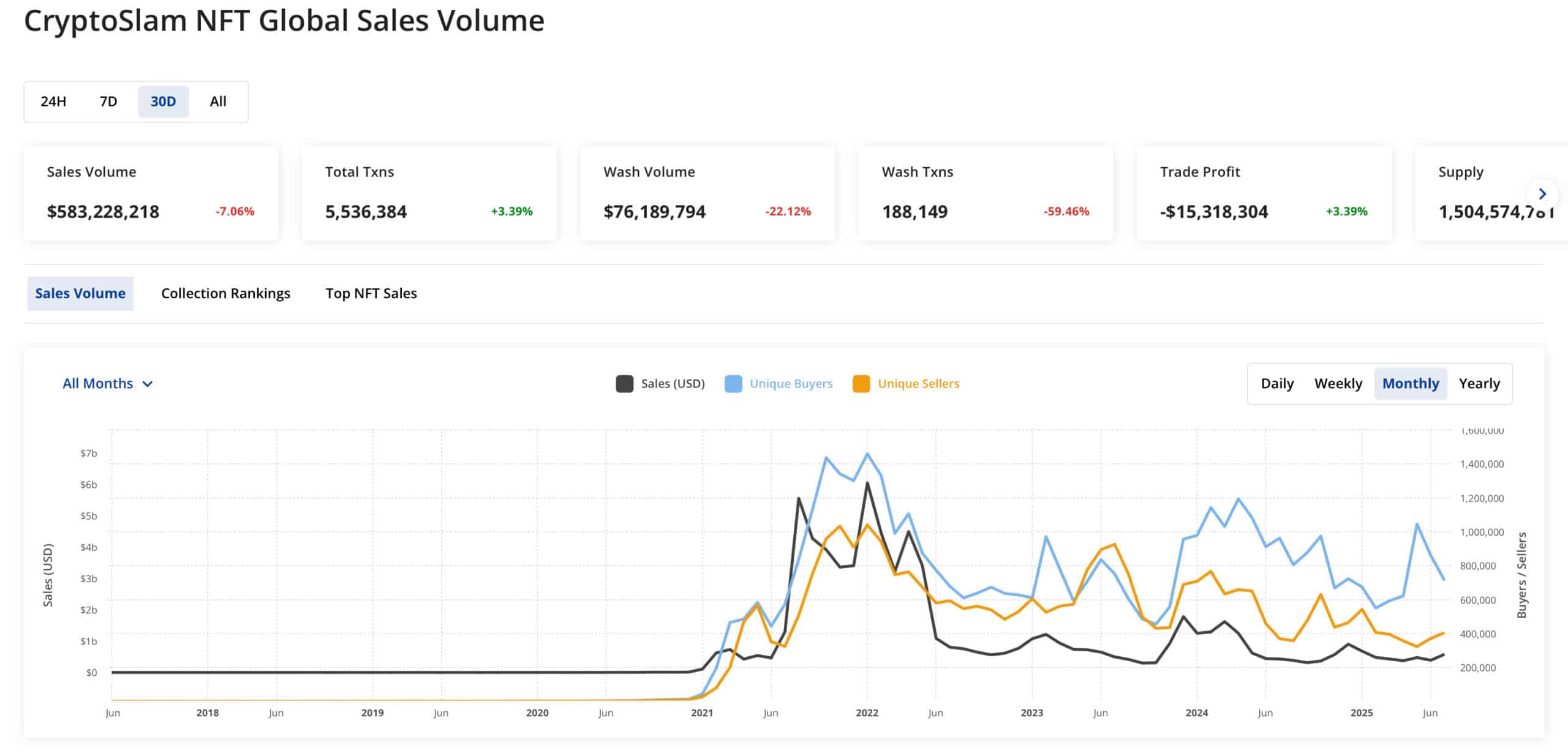

NFT gross sales soared to $583 million, marking the second-highest month-to-month complete of 2025. This represents a 47.6% leap from June’s $388.9 million, pushed by rising ETH costs and a shift towards high-value belongings. Ethereum-based collections led the cost, accounting for $275.6 million in quantity, up 56% month-over-month.

Whereas transaction counts dropped by 9%, the typical sale value climbed to $113, the very best in six months, as consumers consolidated round premium NFTs. Some locally speculate the surge could also be tied to anticipation of an upcoming OpenSea airdrop. Adam Hollander, an OpenSea’s CMO, not too long ago hinted that previous exercise and person profiles (e.g., OGs vs. newcomers) could issue into distribution.

In the meantime, platforms like Blur and LooksRare proceed to lose floor, and the NFT lending market has cratered 97% from 2024 highs. Regardless of fewer consumers, bullish sentiment stays robust with NFT market cap hitting $8 billion.

SharpLink Buys 11,259 ETH for $43M, Now Holds $1.73B in Ethereum

In response to on-chain tracker Lookonchain, SharpLink (@SharpLinkGaming) simply spent 43.09 million USDC to buy 11,259 ETH at a mean value of $3,828.

This brings SharpLink’s complete Ethereum holdings to 449,276 ETH, at the moment valued at round $1.73 billion. The sizable purchase underscores rising institutional confidence in Ethereum, as ETH trades close to key resistance.

With this transfer, SharpLink strengthens its place as one of many largest ETH holders, persevering with a development of strategic accumulation amid broader market volatility. Lookonchain flagged the transaction as half of a bigger sample of whale exercise this week.

What’s Subsequent for Quant (QNT) Crypto? Down 10% in a Week

Quant (QNT) crypto is down over 10% within the final seven days. Regardless of beginning the month robust, and going from 103 to over 134. This over 30% pump occurred after introducing Quant Fusion, which is the first-ever 2.5-layer.

Now this complete transfer up virtually bought worn out, and the coin is at the moment at 118 with a market cap of over 1.7B.

Impartial Technicals: Can They Shift?

Learn The Full Article Right here

The put up [LIVE] July 31 Crypto Updates – Bitcoin Holds $118K as Powell Freezes Charges Regardless of Trump’s Stress: Greatest Crypto to Purchase Now? appeared first on 99Bitcoins.