Bitcoin (BTC) mining juggernaut MARA Holdings as we speak introduced the profitable completion of a $950 million upsized providing of zero-interest convertible senior notes. A portion of the proceeds will go towards accumulating extra BTC, with the rest allotted to basic company functions.

MARA Holdings To Enhance Bitcoin Publicity

In an announcement as we speak, Florida-based Bitcoin mining agency MARA Holdings said that it had raised $950 million. It’s value noting that the deal was upsized from an preliminary goal of $850 million, reported final week.

Notably, the agency has granted preliminary purchasers a 13-day possibility to accumulate an extra $200 million in convertible senior notes. After accounting for preliminary purchasers’ reductions and commissions, MARA acquired internet proceeds to the tune of $940 million.

Of the $940 million acquired, round $18.3 million was used to repurchase $19.4 million in present convertible notes due 2026. Equally, roughly $36.9 million was deployed towards capped name hedges to mitigate potential dilution from future share conversions.

The remaining funds will probably be used towards shopping for extra BTC and for different basic functions, reminiscent of strategic acquisitions, working capital, growth of present belongings, and reimbursement of extra debt.

To elucidate, zero-interest convertible senior notes are debt securities that pay no curiosity however might be transformed into firm shares later. They’re thought of “senior” as a result of they’ve precedence in reimbursement over different money owed within the occasion of liquidation.

Based on CoinGecko, MARA presently holds 50,000 BTC, valued at roughly $5.9 billion at present market costs. This represents about 0.24% of Bitcoin’s whole circulating provide, inserting it forward of Twenty One Capital, which holds 37,230 BTC.

At the moment’s $950 million increase is anticipated to widen MARA’s lead over Twenty One Capital. Nevertheless, the agency nonetheless trails Michael Saylor’s Technique, which dominates with 607,770 BTC on its stability sheet.

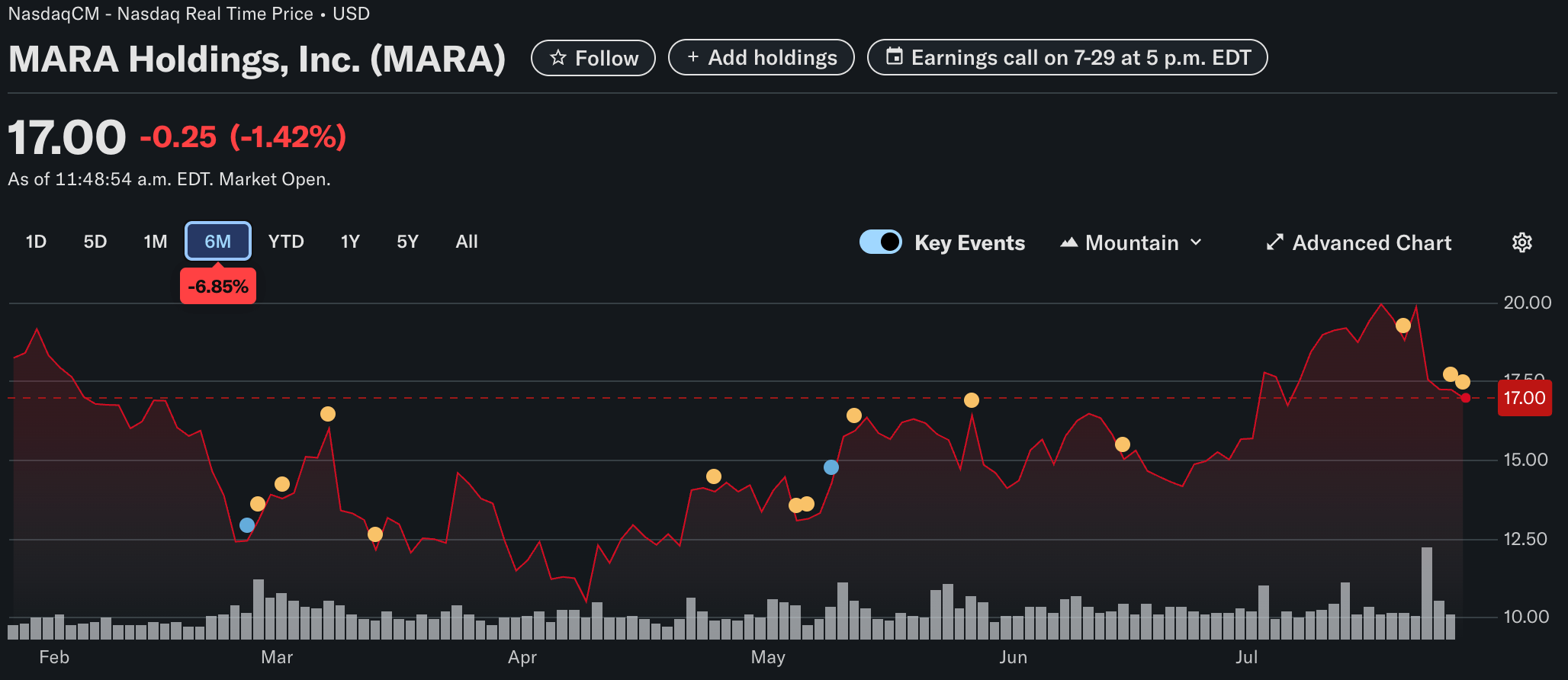

MARA Holdings’ shares recorded slight pullback following the announcement, as they traded at $17 – down 1.42% on the day. Notably, the Nasdaq-listed agency’s inventory has declined 6.85% over the previous six months.

BTC Frenzy Amongst Corporates

That MARA Holdings needed to upsize its $850 million providing exhibits the sturdy institutional curiosity on this planet’s largest cryptocurrency by market cap. It underscores the latest pattern of firms allocating vital sums towards rising their BTC holdings.

Earlier this month – between July 14 and 19 – 21 firms added $810 million value of BTC to their stability sheets. A few of the corporations that purchased BTC had been Technique, Metaplanet, Semler Scientific, and Sequans, amongst others.

Bitcoin’s latest bullish momentum additionally helped it overtake e-commerce big Amazon when it comes to whole market cap. At press time, BTC trades at $118,058, down 0.6% up to now 24 hours.

Featured picture from Unsplash.com, charts Yahoo! Finance from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.