Bitcoin has persistently outperformed all main asset lessons over the previous decade, solidifying its position because the benchmark for digital asset buyers. For these dedicated to Bitcoin’s long-term imaginative and prescient, the final word monetary aim usually shifts from buying extra {dollars} to maximizing their Bitcoin holdings.

Bitcoin is the Hurdle Fee

Bitcoin is to digital belongings what treasury bonds are to the legacy monetary system—a foundational benchmark. Whereas no funding is with out danger, Bitcoin held in self-custody eliminates counterparty danger, dilution danger, and different systemic dangers frequent in conventional finance.

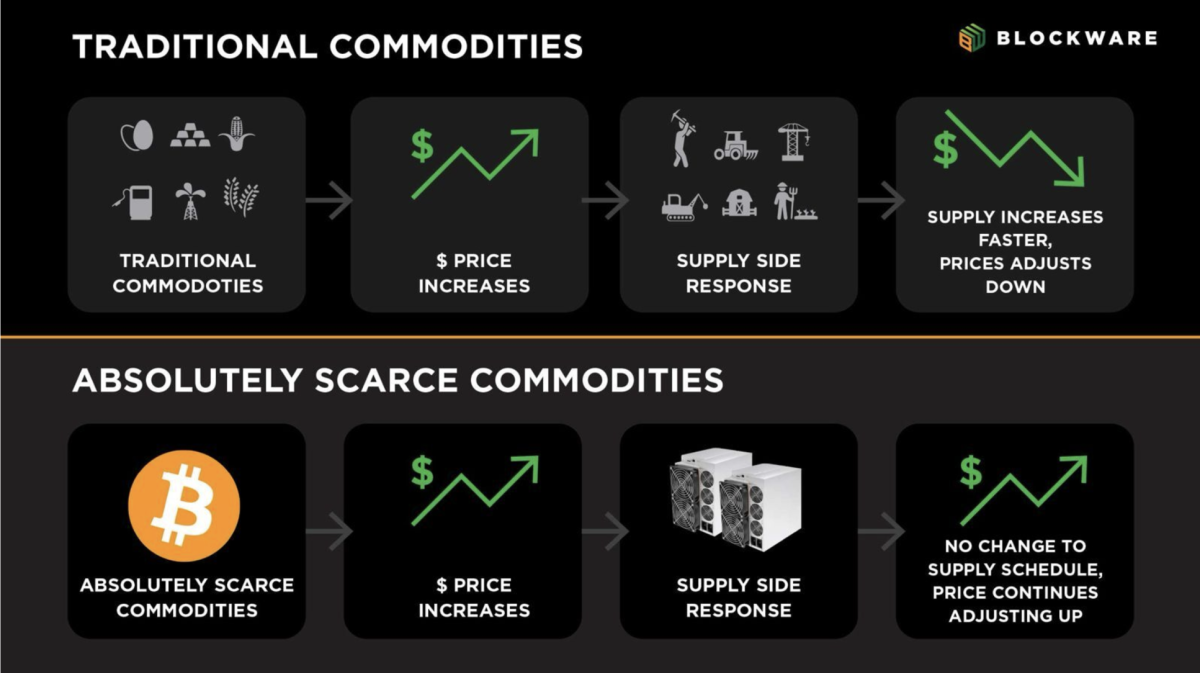

With BTC outperforming each different asset class in 9 of the previous 12 years (by orders of magnitude), it’s no shock that it has usurped treasury bonds because the “danger free price” within the minds of many buyers – particularly these educated about financial historical past and thus the enchantment of Bitcoin’s verifiable shortage.

One other solution to phrase this may be that the monetary goal of digital asset buyers is to accumulate extra BTC relatively than purchase extra {dollars}. All investments or spending are seen by way of the lens of BTC being the chance price.

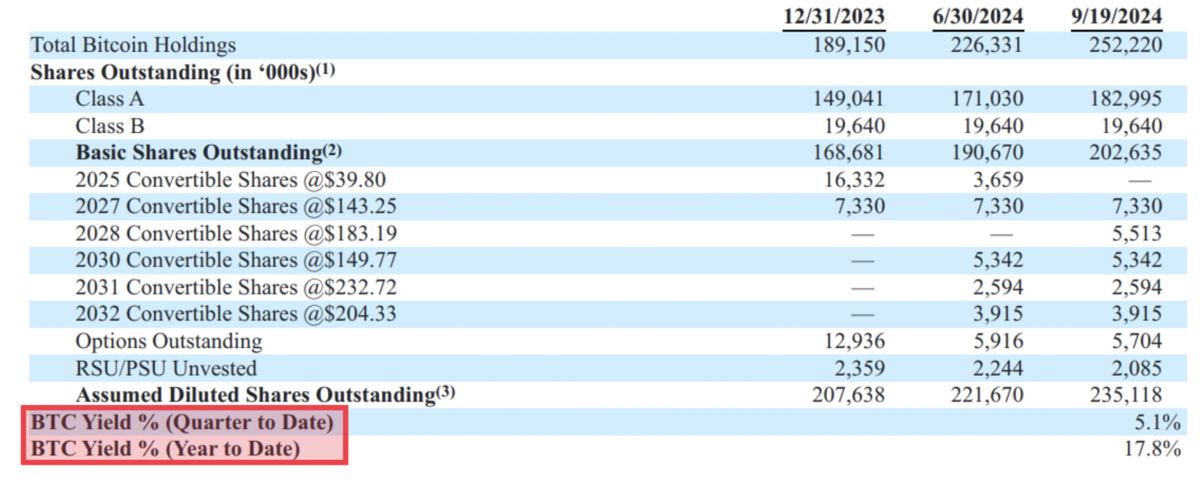

MicroStrategy has demonstrated what this appears to be like like within the company world with their new KPI: BTC Yield. To cite from their September twentieth, 8-Ok kind: “The Firm makes use of BTC Yield as a KPI to assist assess the efficiency of its technique of buying bitcoin in a fashion the Firm believes is accretive to shareholders.” MicroStrategy has taken full benefit of the instruments accessible to them as a multi-billion greenback public firm: entry to low rate of interest debt and the power to concern new shares. This KPI reveals that they’re buying extra BTC per excellent share even supposing they’re participating within the historically dilutive exercise of latest share issuance.

Mission completed: they’re buying extra bitcoin.

However MicroStrategy has a bonus that the common fund supervisor or retail investor doesn’t: they’re a publicly traded firm with the power to faucet into capital markets at little to no relative price. Particular person holders are unable to concern shares into the general public market with a purpose to increase capital and purchase BTC. Nor can we concern convertible notes and borrow {dollars} at a close to zero % rate of interest.

In order that begs the query: how can we accumulate extra bitcoin? How can we have now a constructive ‘BTC Yield’?

Bitcoin Mining

Bitcoin miners purchase BTC by contributing computational energy to the Bitcoin community, and receiving a better quantity of BTC than what it prices in electrical energy to function their machine(s). Now that is simpler stated than finished. The Bitcoin protocol enforces a predetermined provide schedule utilizing “problem changes” – that means that extra computational energy devoted in the direction of Bitcoin mining ends in the finite block rewards getting cut up up into smaller items.

The simplest Bitcoin miners are people who maximize their computational energy whereas minimizing their operational prices. That is completed by buying the most recent, most-efficient Bitcoin mining {hardware}, and working with the bottom attainable electrical energy price.

Below present market situations (as of 11/21/2024), 1 bitcoin has a value of ~$98,000. Nonetheless, an Antminer S21 Professional mining with an electrical energy price of $0.078/kWh is ready to produce 1 BTC for ~$40,000 in electrical energy. That is an working margin of practically 145%. A enterprise is usually thought-about to have “wholesome revenue margins” if they’re within the 5-10% vary – mining beats this simply. That is despite the truth that as of the April 2024 Bitcoin halving, they earn half as a lot BTC per unit of compute.

Value Progress Outpacing Problem Progress

The worth of a monetary asset – particularly bitcoin – is ready on the margin. Which means the asset’s value is set by the latest transactions between patrons and sellers. In different phrases, the worth displays what the final purchaser is prepared to pay and what the final vendor is prepared to simply accept.

This, partly, is what permits BTC’s notoriously unstable value motion. A scarcity of sellers at value X means patrons should bid the worth greater than X with a purpose to discover the subsequent marginal vendor. Inversely, a scarcity of patrons at value X means a vendor should decrease their ask to seek out the subsequent marginal purchaser. BTC can rapidly transfer up or down primarily based on a scarcity of sellers or patrons in a selected vary.

Consequently, the speed at which the Bitcoin value can transfer is way greater than that of community mining problem. Substantial development in community mining problem shouldn’t be achieved by marginal bid/ask spreads, it’s achieved by the fruits of ASIC manufacturing, power manufacturing, and mining infrastructure improvement. There’s not shortcutting the time and human capital essential to extend the whole computational energy on the Bitcoin community.

This dynamic is what creates alternatives for Bitcoin miners to build up huge quantities of bitcoin.

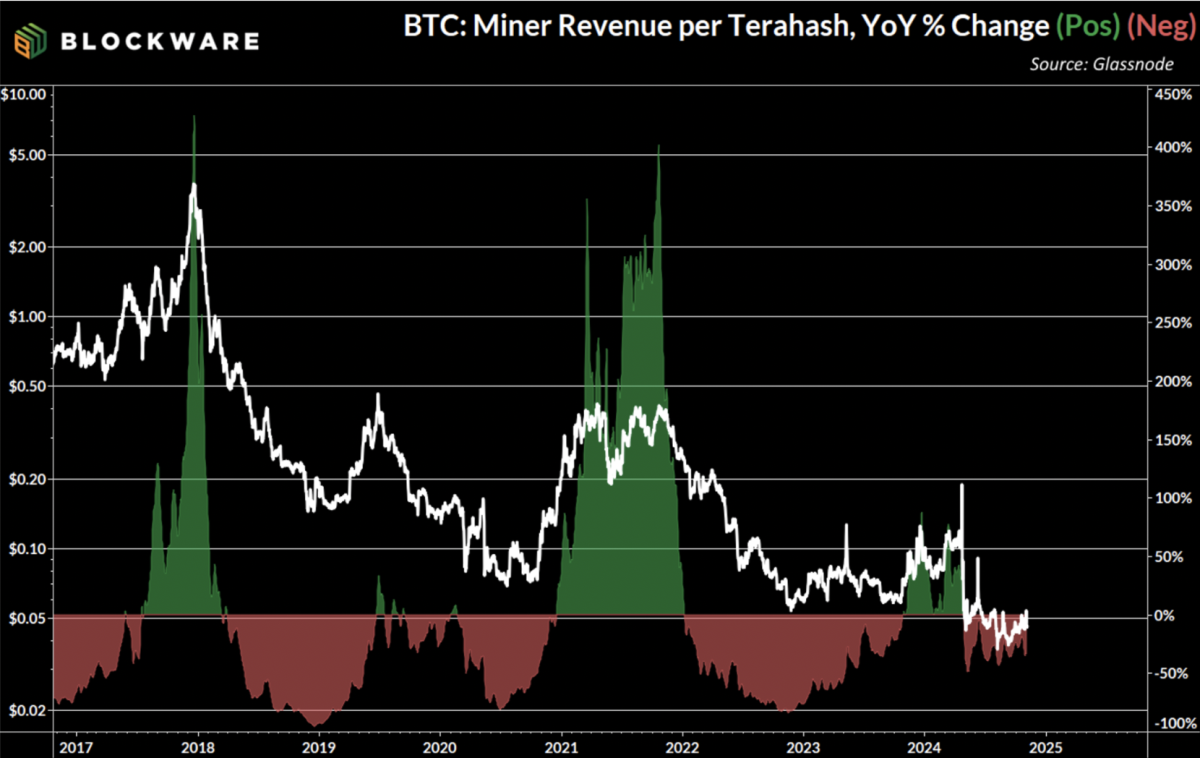

The chart right here illustrates the explosive development of Bitcoin mining profitability that takes place throughout bull markets. “Hashprice” measures the quantity of income that Bitcoin miners earn per unit of compute each day. On a year-over-year foundation, hashprice has elevated by greater than 300% on the top of every bitcoin mining cycle. Which means miners have had their revenue margins greater than triple in a 12-month span.

Over the long-run this metric developments down as extra entities start mining bitcoin, miners improve to extra highly effective & environment friendly machines, and the block subsidy is minimize in half each 4 years. Nonetheless, throughout bull markets, the mix of the forces which are a constructive catalyst for mining problem (and thus net-negative for mining profitability) pale compared to the speedy development within the value of bitcoin.

Value Volatility in Bitcoin Mining {Hardware}

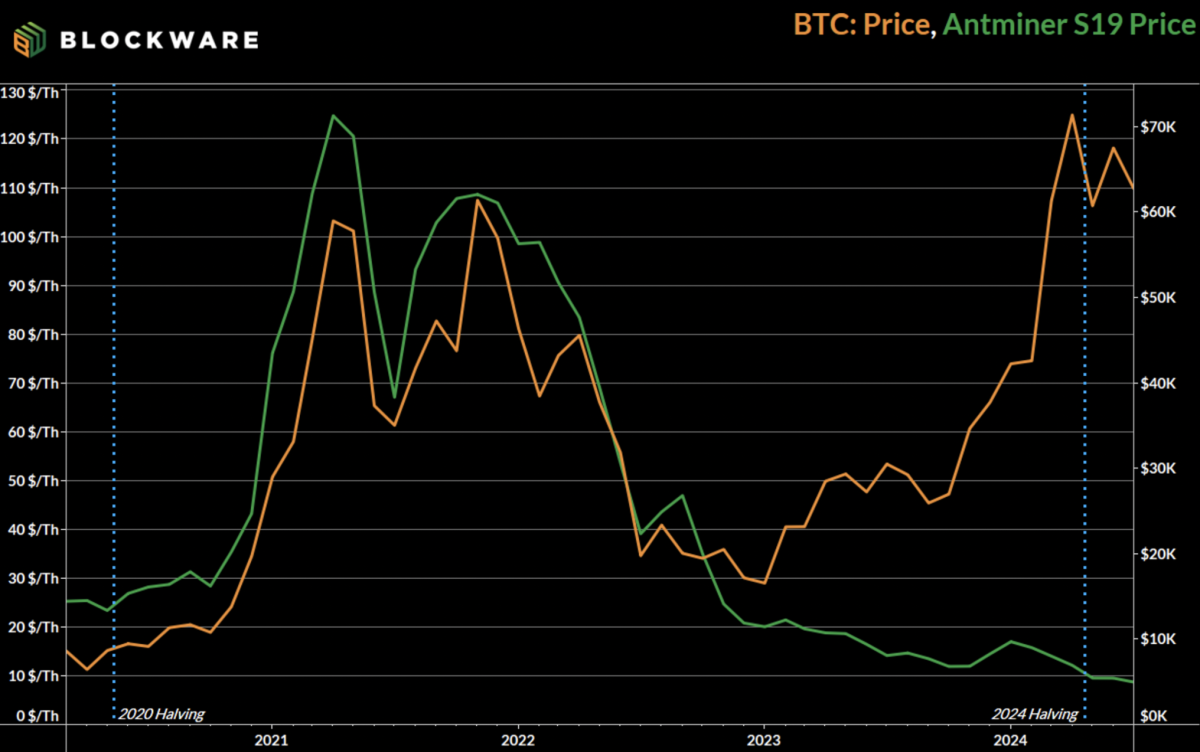

Along with wider revenue margins throughout bull markets, Bitcoin miners have the simultaneous good thing about the truth that ASIC costs have a tendency to maneuver in tandem with the Bitcoin value. In the course of the 2020 – 2024 cycle, the Antminer S19 (most effective ASIC on the time) started buying and selling at ~$24/T. By November 2021 – when the BTC value was peaking – they started buying and selling for north of $120/T.

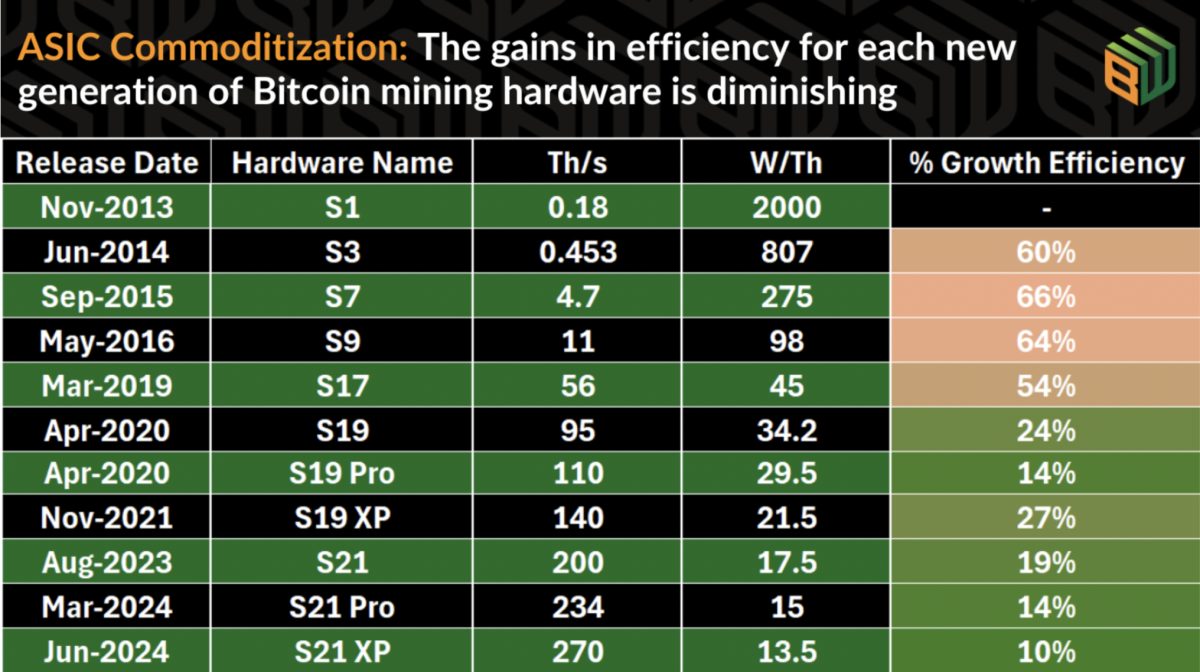

Bitcoin mining {hardware} retaining resale worth is changing into more and more the case with every new era of {hardware}. Within the early days of Bitcoin mining, technological developments had been swift and forceful – to the purpose that new ASICs would make older fashions out of date in a single day. Nonetheless, the marginal positive aspects of latest ASICs have diminished to the purpose that older fashions are in a position to stay aggressive for a number of years after launch.

Because the S19 was launched in 2020 and retains a non-zero market value at this time, it’s cheap to count on that the S21 line of machines will be capable to retain worth for even longer. This offers miners a big leg-up in relation to accumulating bitcoin, as a result of the upfront price of buying machines is now not “sunk”. Their machines have a value, one that’s correlated to bitcoin, and there’s a useful resource accessible to get liquidity.

Blockware Market

Blockware developed this platform to allow any investor – institutional or retail – the chance to achieve direct publicity to Bitcoin mining. Customers of {the marketplace} are in a position to buy Bitcoin mining rigs which are hosted at considered one of Blockware’s tier 1 information facilities and have entry to industrial energy costs. These machines are on-line already, eliminating prolonged lead occasions which have traditionally brought on some miners to overlook out on these key months within the cycle through which value is outpacing community problem.

Furthermore, this platform is constructed by Bitcoiners, for Bitcoiners. Which implies that machines are bought utilizing Bitcoin because the medium of alternate, and mining rewards are by no means held by Blockware – they’re despatched on to the customers personal pockets.

Lastly, this offers miners with the aforementioned alternative, however not obligation, to promote their machines at any time and value. This allows miners to capitalize on volatility in ASIC costs, recoup the price of their machines, and accumulate extra BTC quicker than they’d with a conventional “pure play” method.

This innovation removes the obstacles which have traditionally made hosted mining troublesome, enabling miners to focus on the mission: accumulating extra Bitcoin.

For institutional buyers searching for bulk pricing on mining {hardware}, contact the Blockware workforce straight.