The on-chain analytics agency Santiment has revealed how the vast majority of the altcoins are at present in what has traditionally been a purchase zone.

Mid-Time period Buying and selling Returns Are Extraordinarily Unfavourable For Most Altcoins

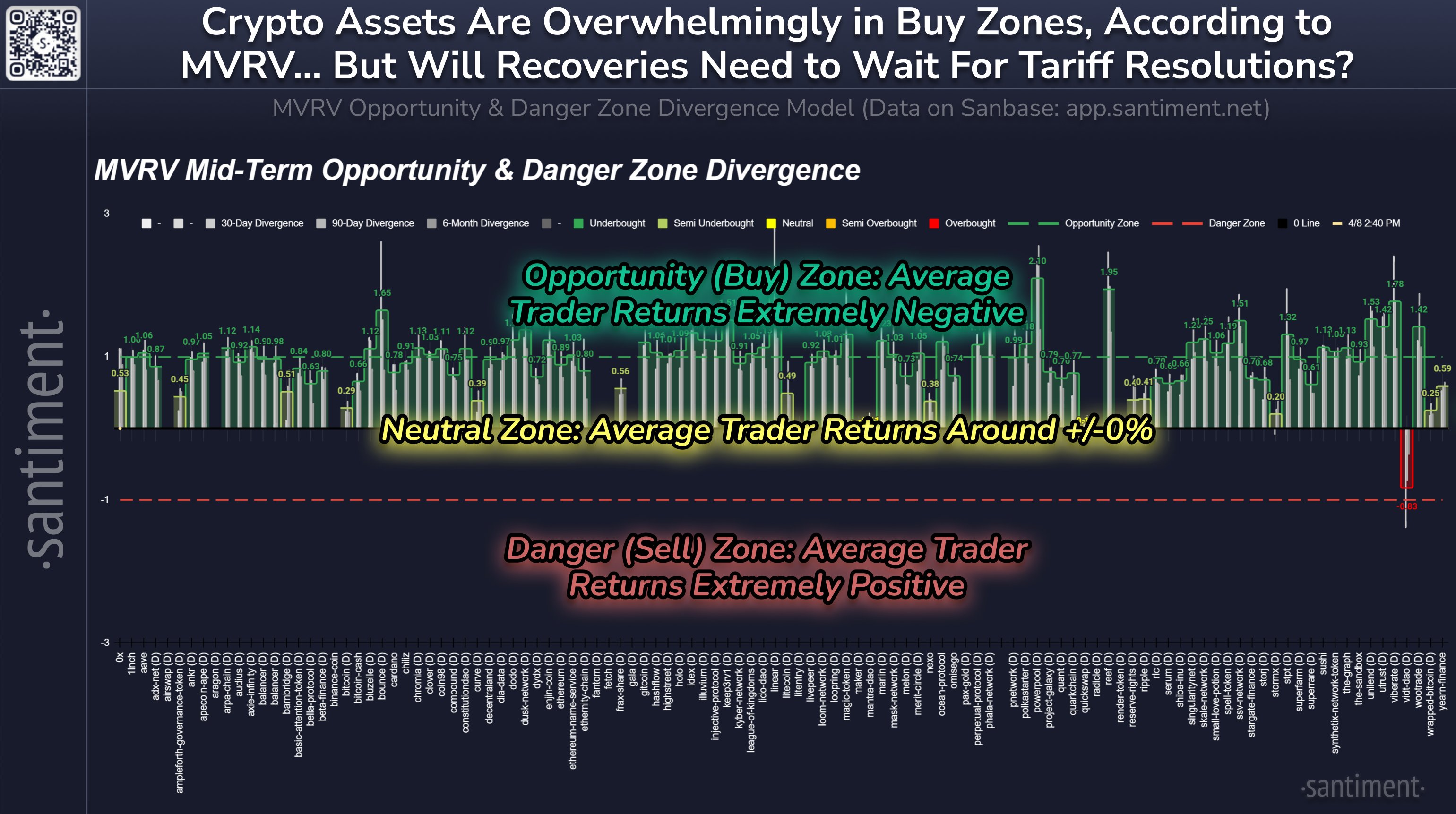

In a brand new submit on X, Santiment has shared an replace for its MVRV Alternative & Hazard Zone Divergence Mannequin for the assorted altcoins within the sector. The mannequin is predicated on the favored “Market Worth to Realized Worth (MVRV) Ratio.”

The MVRV Ratio is an on-chain indicator that principally tells us whether or not the traders of a cryptocurrency as an entire are holding their cash at a internet revenue or loss.

When the worth of this metric is larger than 1, it means the common investor is holding a revenue. Alternatively, it being below this threshold suggests the dominance of loss.

Traditionally, holder profitability is one thing that has tended to affect the costs of digital property. Each time the traders are in massive earnings, they’ll develop into tempted to promote their cash so as to notice the piled-up positive aspects. This could impede bullish momentum and end in a high for the worth.

Equally, holders being considerably underwater ends in market circumstances the place profit-takers have run out, thus permitting for the cryptocurrency to achieve a backside.

Santiment’s MVRV Alternative & Hazard Zone Divergence Mannequin exploits these information so as to outline purchase and promote zones for the altcoins. The mannequin calculates the divergence of the MVRV Ratio on numerous timeframes (30 days, 90 days, and 6 months) to search out whether or not an asset is inside one among these zones or not.

Right here is the chart shared by the analytics agency that reveals how the totally different altcoins are at present wanting primarily based on this mannequin:

Appears like a lot of the sector is at present within the purchase area | Supply: Santiment on X

On this mannequin, a price higher than zero suggests common dealer returns are unfavourable for that timeframe and that beneath it’s constructive. That is the other orientation of what it’s like within the MVRV Ratio, with the zero degree taking the function of the 1 mark from the indicator.

From the graph, it’s seen that just about the entire altcoins have their MVRV divergence higher than zero on the totally different timeframes. Out of those, most of them have their mid-term MVRV divergence higher than 1. The chance zone talked about earlier lies past this mark, so the mannequin is at present displaying a purchase sign for almost all of the altcoins.

The common unfavourable returns have come for these cash because the market has been in turmoil following the information associated to tariffs. Whereas the mannequin could also be displaying a purchase sign for the altcoins, it’s potential that this uncertainty will proceed to hang-out the market. As Santiment explains,

If and when a worldwide tariff resolution is reached, it could undoubtedly set off a really fast cryptocurrency restoration,” notes Nevertheless, that is at present a really huge “if” primarily based on the most recent media protection on what’s shortly being known as a full-fledged “commerce conflict” between the US and the vast majority of the world.

BTC Worth

On the time of writing, Bitcoin is floating round $76,900, down greater than 9% within the final seven days.

The value of the coin has already erased its try at restoration | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Santiment.internet, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.