Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

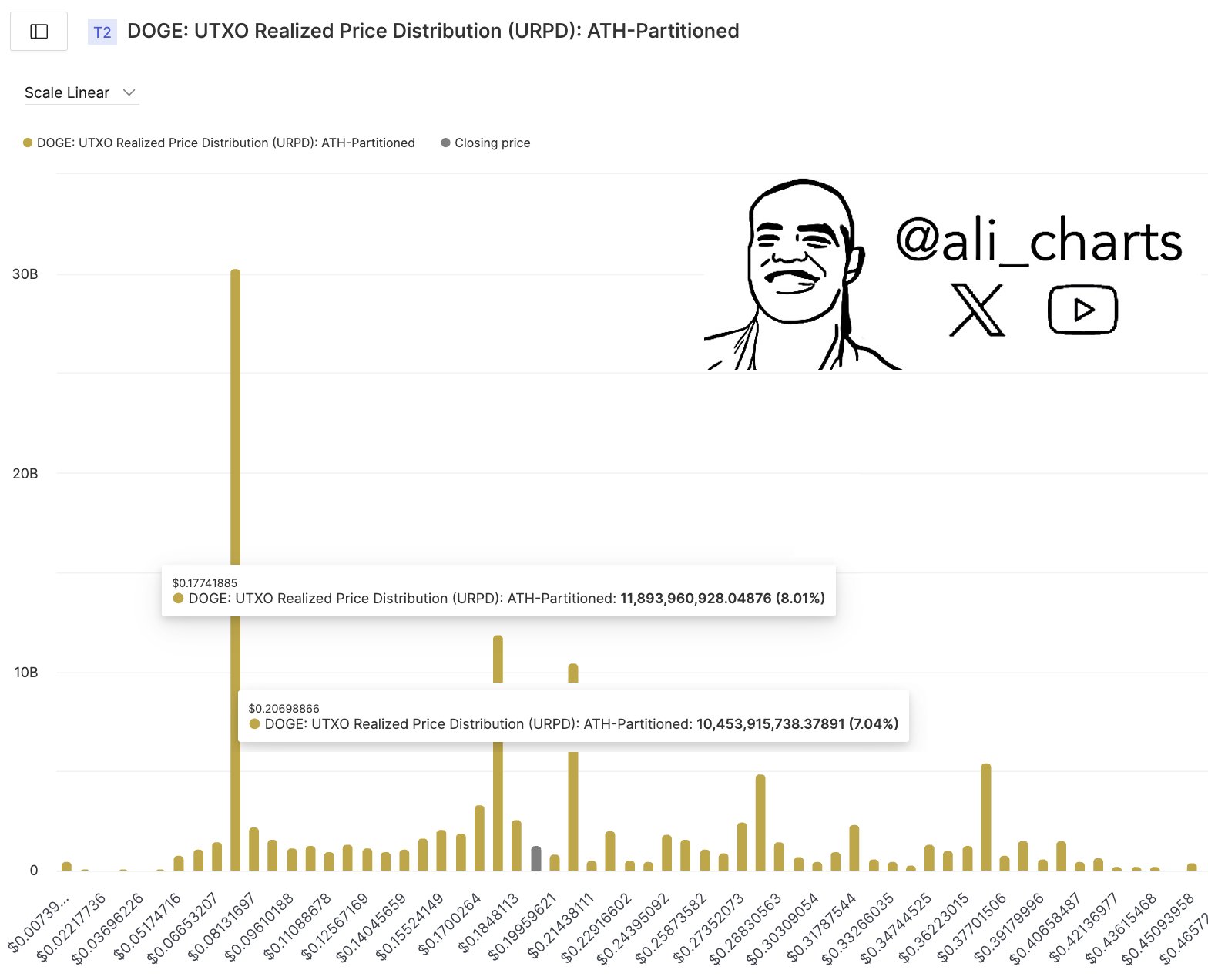

Crypto analyst Ali Martinez (@ali_charts) revealed a brand new UTXO Realized Value Distribution (URPD) chart on X that provides a deep have a look at the place massive chunks of DOGE have final modified fingers. This histogram reveals distinct clusters of on-chain exercise, pinpointing essentially the most important value ranges that would outline the meme coin’s subsequent main transfer.

Martinez particularly singled out $0.177 as sturdy assist and $0.207 as notable resistance, suggesting that Dogecoin is successfully sandwiched between these two essential value limitations. Whereas $0.177 and $0.207 stand out for speedy buying and selling selections, the chart additionally reveals different conspicuous value ranges that warrant nearer inspection.

What This Means For Dogecoin Merchants

The chart reveals Dogecoin’s largest URPD cluster round $0.177, accounting for roughly 8.01% of DOGE’s whole provide (about 11.89 billion tokens). This focus signifies a excessive quantity of cash final transacted in that vary. Due to the massive variety of DOGE holders with price bases round $0.177, analysts usually view this stage as an essential assist zone—the place consumers might step in to defend their positions.

Associated Studying

One other notable cluster seems at $0.2069, representing about 7.04% of the whole provide (roughly 10.45 billion tokens). Martinez labels it as key resistance, reflecting a major group of holders who acquired DOGE at or close to this value. If the market approaches $0.207, some contributors may look to interrupt even or lock in small good points, doubtlessly creating promoting stress.

Probably the most putting observations is the massive spike at $0.06653, the place roughly 30 billion tokens had been transacted. This by far highest bar dwarfs most of the smaller clusters on the chart, indicating {that a} large quantity of DOGE provide shifted at that value up to now.

Associated Studying

Although the market is presently effectively above $0.06653, this stage could possibly be important if costs had been ever to right sharply. It represents a considerable price foundation for a big portion of holders, doubtlessly turning it into a robust space of assist if Dogecoin experiences a deeper draw back transfer beneath $0.177.

On the upside, the histogram highlights two main concentrations above present costs. Round $0.2753, barely beneath 5 billion tokens had been transacted, and at $0.3622, barely above 5 billion tokens exchanged fingers. These tall bars might act as key resistance hurdles if Dogecoin can break above the shorter-term ceiling at $0.207.

As soon as DOGE sustains good points past $0.207, consumers may search for momentum to hold the token towards $0.2753, the place recent resistance might seem. If bullish sentiment stays strong, the area round $0.3622 may develop into the subsequent essential stage to observe.

At press time, DOGE traded at $0.196.

Featured picture created with DALL.E, chart from TradingView.com