The Decentralized Finance (DeFi) panorama consistently evolves, and at its forefront, Pendle Protocol drives a major shift: the maturation of fixed-yield markets. This deep dive explores how Pendle essentially re-engineers TradFi (Conventional Finance) rules like zero-coupon bonds and tranches, introducing much-needed predictability into inherently unstable crypto belongings.

Pendle Yield Tokenization: Principal Tokens (PT) and Yield Tokens (YT)

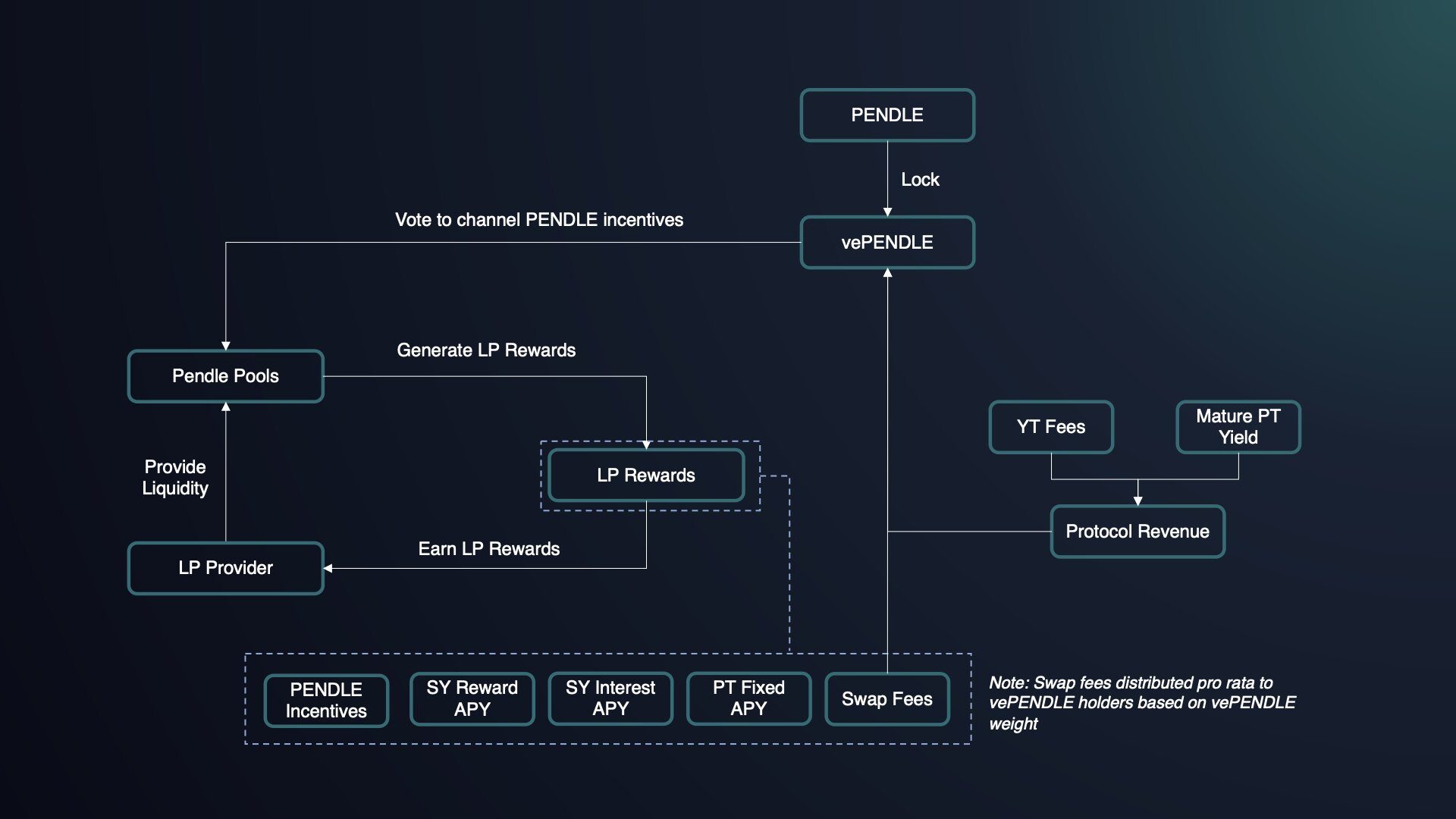

Pendle Finance’s foundational innovation lies in its yield tokenization mechanism, a course of that essentially redefines how customers work together with yield-bearing belongings in DeFi. It ingeniously separates the longer term yield stream from the underlying principal asset, creating two distinct, independently tradable tokens.

Pendle protocol takes any yield-bearing asset, resembling staked Ethereum (stETH), Compound’s cUSDT, or Yearn Finance’s yvUSDC, and splits it into two distinctive parts: a Principal Token (PT) and a Yield Token (YT).

Supply: Pendle Finance

Pendle Yield Tokenization: Principal Tokens (PT)

Earlier than this splitting, Pendle protocol wraps the underlying yield-bearing tokens right into a Standardized Yield token (SY), which then serves as the bottom from which PT and YT are minted. A vital side of this design is that customers can mix 1 PT and 1 YT at any time earlier than maturity to reconstruct and redeem the unique underlying asset.

The PT represents the underlying asset’s principal quantity. It’s designed to be redeemable 1:1 for the deposited asset at its maturity date. PTs are sometimes acquired at a reduction to the underlying asset’s present worth, that means that holding a PT till maturity ensures a set yield.

Functionally, PTs are analogous to zero-coupon bonds in conventional finance. Their volatility naturally decreases as they method maturity, making them engaging for conservative yield methods and extremely appropriate as collateral in DeFi lending protocols.

For extra: A Complete Evaluation of Yield and Fee Stablecoins

Supply: Pendle Finance

Pendle Yield Tokenization: Yield Tokens (YT)

Conversely, the YT embodies the yield generated by the underlying asset. Holders of YT tokens are entitled to assert periodic yield (curiosity) and may successfully “lengthy the yield,” speculating on its future enhance or fluctuation. YTs thus allow direct hypothesis on future rate of interest actions. This progressive mechanism unlocks a various array of monetary methods.

Customers can promote their future yield (YT) prematurely to realize instant liquidity, buy PTs at a reduction to lock in a set return, or actively commerce YTs to revenue from anticipated adjustments in Annual Share Yields (APYs). This course of considerably enhances liquidity for yield-generating belongings and boosts general capital effectivity inside DeFi.

Supply: Pendle Finance

This transformation of passive yield into energetic, tradable monetary primitives marks a major leap in DeFi’s monetary engineering capabilities. Conventional yield farming usually includes merely locking belongings to earn passive rewards, which might scale back liquidity and restrict strategic flexibility.

By disaggregating the principal and yield, Pendle adjustments a static, passive place into two dynamic, tradable parts, permitting customers to “time-travel” their earnings by promoting future yield upfront or to precise granular views on rate of interest actions by means of hypothesis. This stage of granularity and management is essential for attracting extra skilled and institutional contributors, who require exact instruments for threat administration, hedging, and alpha era.

The composability of PTs and YTs

The simultaneous existence and tradability of PTs (mounted yield) and YTs (variable yield hypothesis) inside Pendle’s market creates a dynamic interaction. The market-determined costs of those tokens inherently replicate the “implied price” for the underlying asset. This mechanism permits for natural rate of interest worth discovery, an important factor usually missing in earlier fixed-rate DeFi protocols.

Importantly, this worth discovery is achieved with out counting on exterior oracles or handbook changes , embedding the speed dedication inside the protocol’s personal market dynamics. This architectural alternative enhances the protocol’s general safety and trustworthiness, lowering reliance on exterior, probably manipulable, information feeds. This contributes to the long-term stability and reliability of the decentralized monetary system.

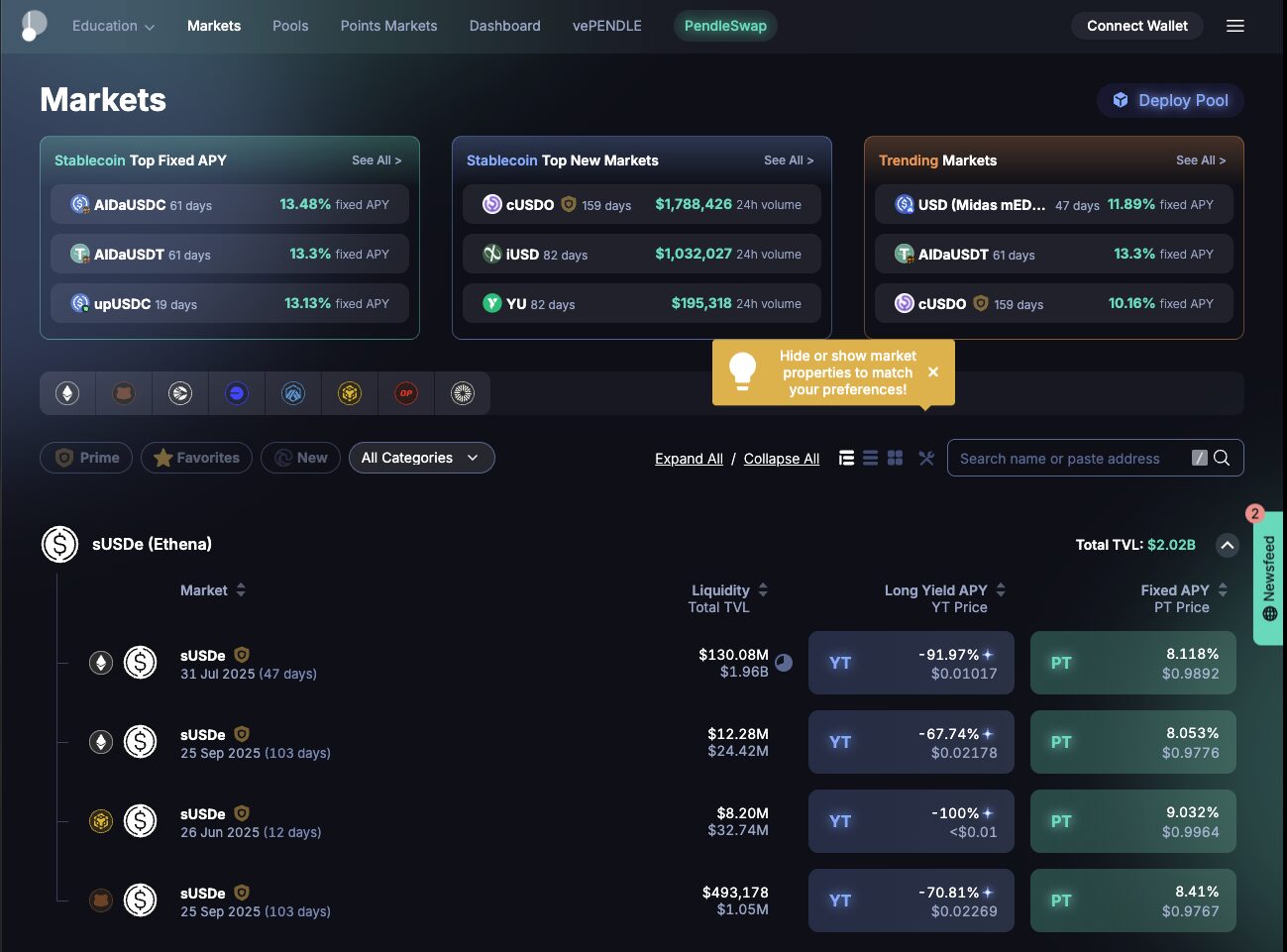

The Pendle AMM: Enabling Environment friendly Yield Buying and selling

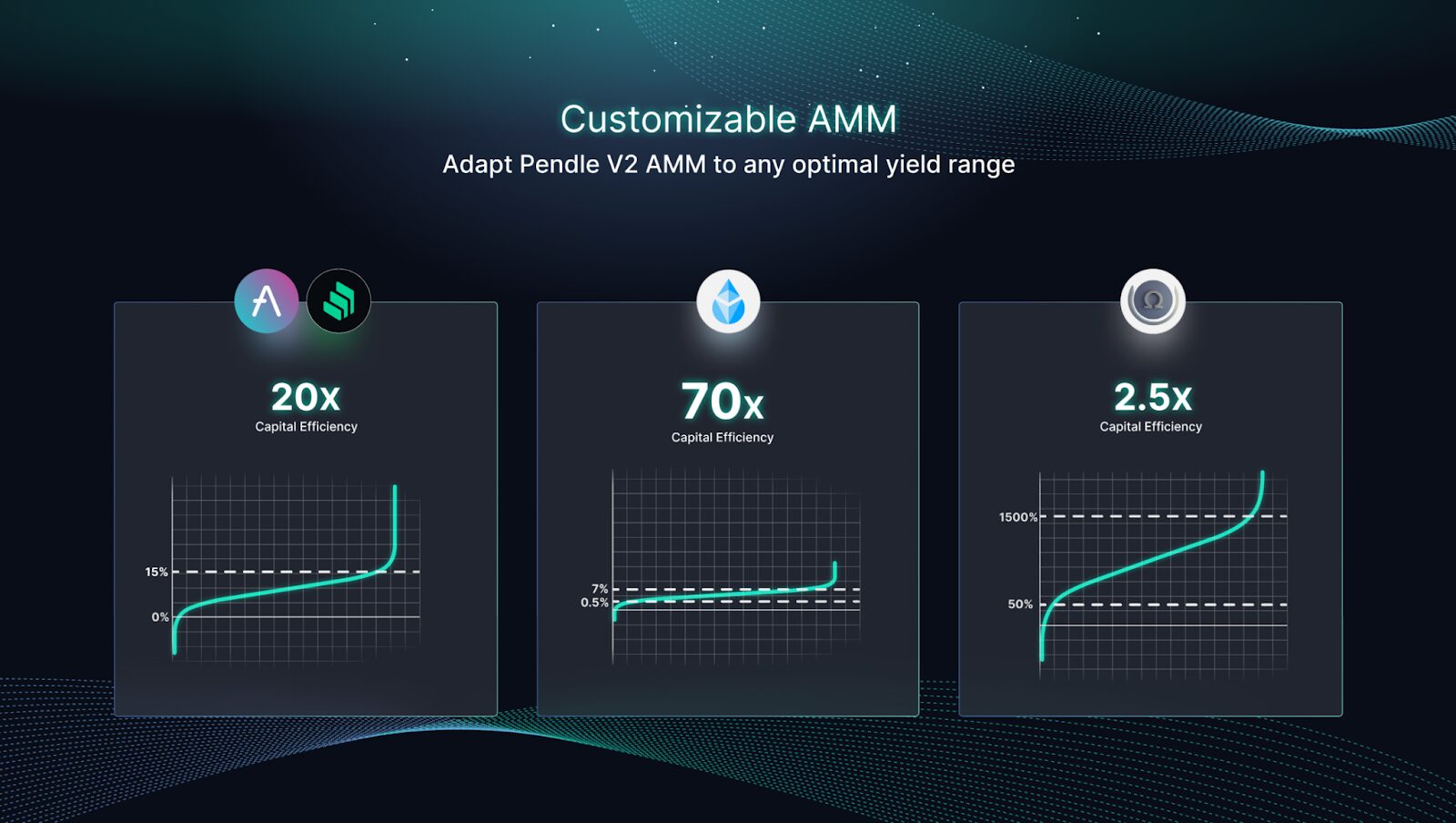

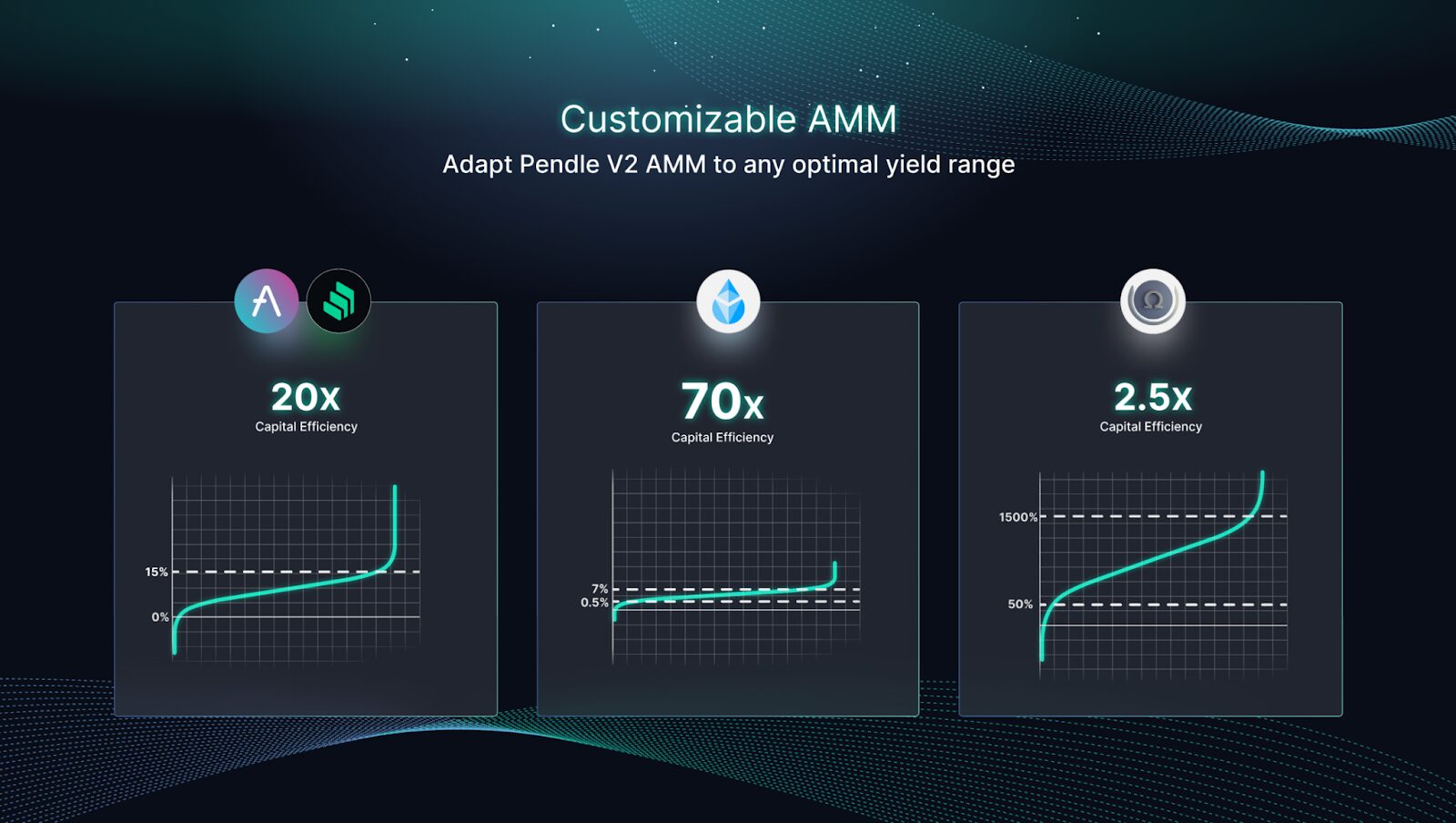

The Automated Market Maker (AMM) is the central engine of Pendle’s operations, particularly designed to facilitate the environment friendly buying and selling of PT and YT tokens. Its distinctive design is optimized for the nuances of yield buying and selling, incorporating options that considerably improve capital effectivity and liquidity whereas mitigating frequent AMM-related dangers.

Pendle Finance deploys a devoted AMM for every Standardized Yield (SY) occasion, enabling the buying and selling of its corresponding PT and YT tokens from the second they’re minted. This AMM is explicitly “designed for yield buying and selling with concentrated liquidity, twin fee-structure, and negligible IL considerations”.

Supply: Pendle Finance

Pendle’s AMM employs a concentrated liquidity mannequin. This lets liquidity suppliers (LPs) strategically allocate capital inside particular worth ranges. This focused method maximizes capital effectivity and minimizes impermanent loss (IL).

A novel function is its time-decaying mannequin, ruled by capabilities like _getRateScalar(). This perform’s worth will increase because the underlying asset’s maturity date nears. This design ensures smaller worth impacts early on, permitting bigger PT transactions. As maturity approaches, worth sensitivity naturally will increase. This incentivizes market makers to rebalance positions nearer to honest redemption worth. This mechanism ensures PT costs converge to their redemption worth at expiry. It requires no exterior oracles or handbook interventions.

Growing an AMM “designed for yield buying and selling” is an important step in DeFi evolution. Most DeFi protocols use generic AMMs. Pendle’s specialization, with concentrated liquidity and its time-decaying mannequin, addresses the distinctive traits of yield-bearing belongings. These inherently converge to a set worth at maturity.

Supply: Pendle Finance

This transfer towards extremely specialised monetary primitives signifies a maturing DeFi infrastructure. Such specialization boosts effectivity and accuracy in worth discovery. It additionally reduces particular dangers, like impermanent loss, for area of interest asset courses. This makes DeFi extra aggressive with conventional monetary markets.

The inherent time-decaying mechanism is a important safety alternative. It ensures PT costs align with redemption worth with out counting on exterior oracles. Oracle manipulation is a expensive DeFi vulnerability. By embedding this worth convergence logic straight into the AMM, Pendle considerably reduces its assault floor. This enhances protocol safety and trustworthiness. That is key for institutional adoption. It alerts extra sturdy, self-contained DeFi primitives that reduce exterior dependencies, contributing to decentralized monetary system stability.

For extra: Fastened Yield DeFi vs. Conventional Fastened Earnings in Yield Farming Rewards

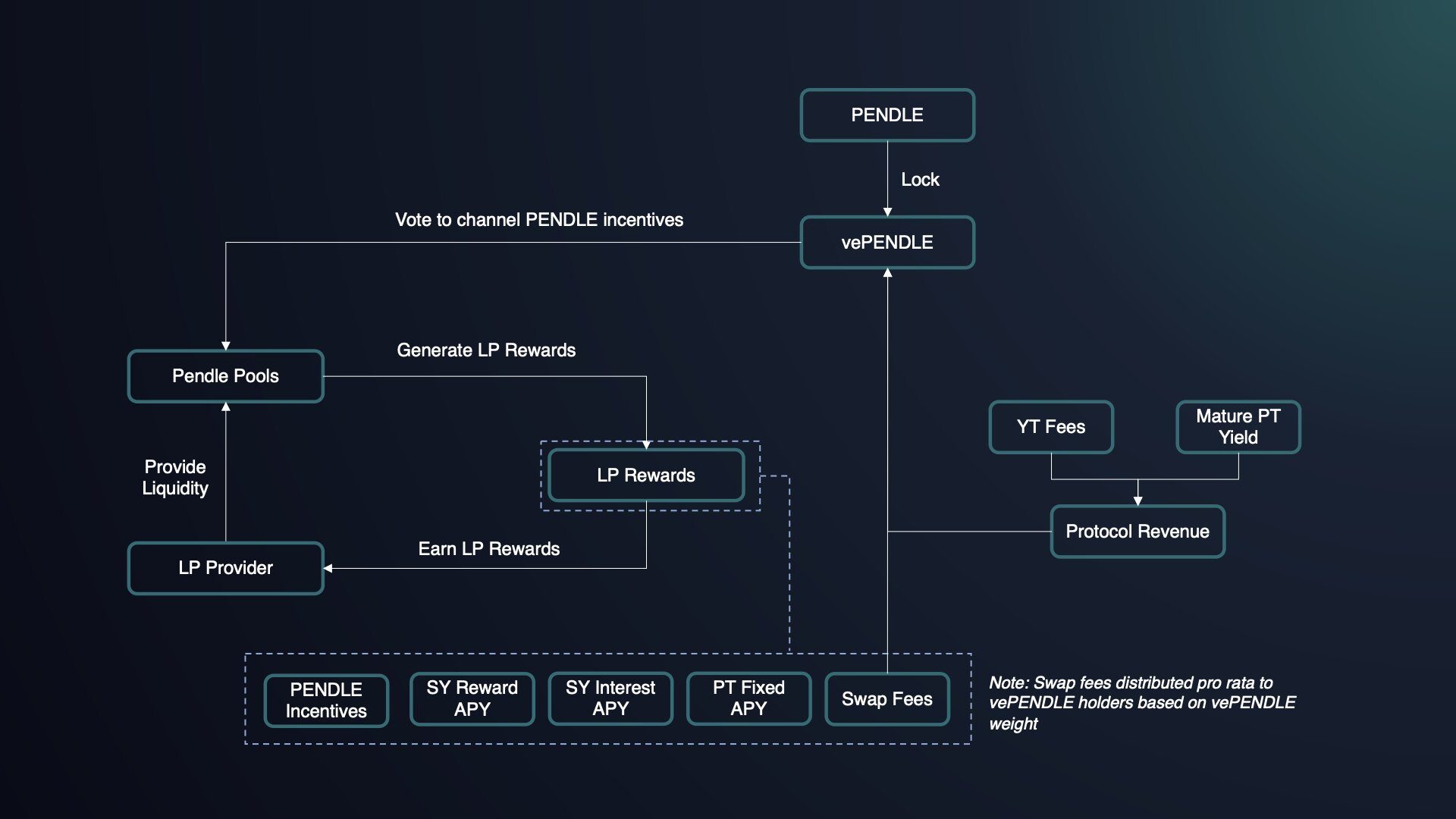

vePENDLE: Governance and Protocol Alignment

The vePENDLE token mechanism drives Pendle’s strategic method. It considerably boosts decentralized governance and, moreover, encourages sturdy long-term group engagement. This progressive mannequin, actually, attracts clear inspiration from profitable vote-escrowed token designs that different distinguished DeFi protocols efficiently make use of.

Particularly, PENDLE token holders actively lock their tokens for various durations; consequently, this motion earns them vePENDLE. In return, vePENDLE grants them not solely enhanced voting rights on essential protocol selections but additionally the flexibility to spice up their rewards from the platform. This extensively adopted design, due to this fact, inherently strengthens group engagement and, crucially, aligns token holder pursuits straight with the protocol’s long-term success, consciously mirroring efficient methods from protocols like Curve.

Supply: Pendle Finance

Pendle’s governance construction has matured. Over 60% of token holders actively vote. Specialised governance committees now deal with threat administration, growth, and treasury administration. On-chain governance ensures transparency and immutability of selections.

This design is vital for Pendle’s fixed-yield choices to be sustainable and dependable. The vePENDLE mannequin tackles “mercenary capital” by requiring token locking. This turns short-term yield farmers into long-term stakeholders. It builds a loyal group, making the ecosystem extra resilient and secure. That is important for attracting and protecting subtle capital.

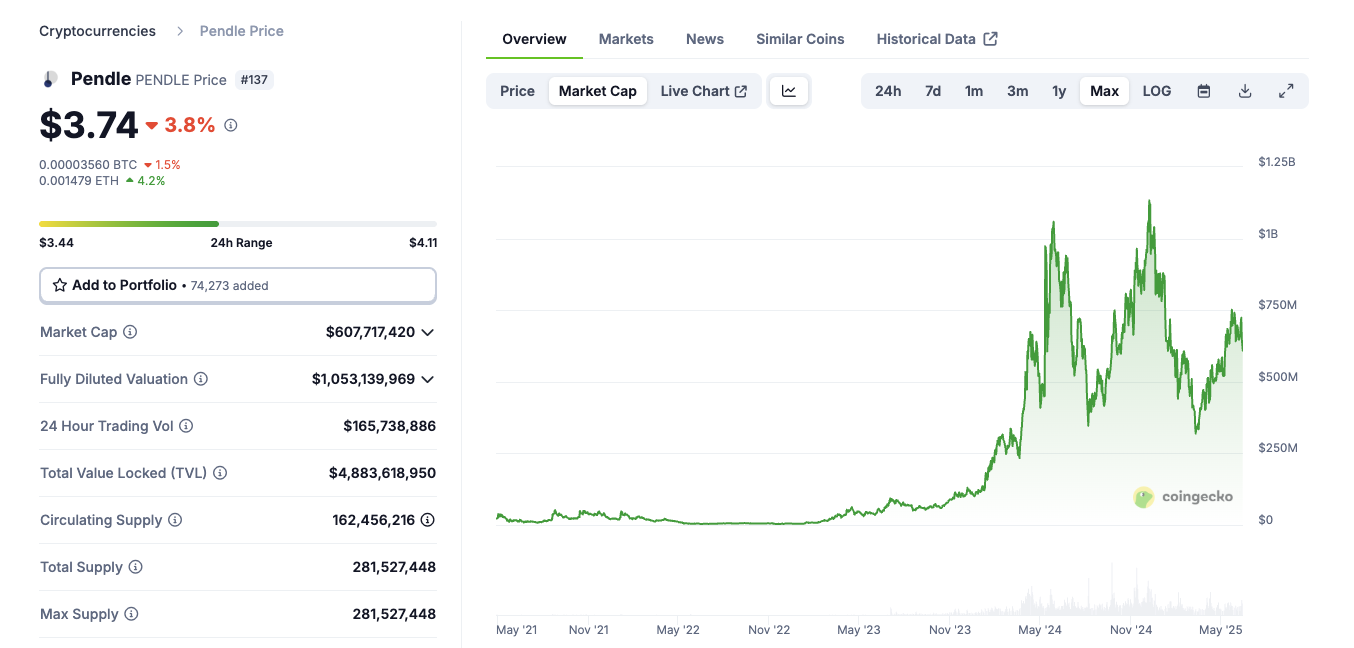

Understanding the PENDLE Token

The PENDLE token acts because the native utility and governance token for the Pendle protocol, which primarily operates throughout Ethereum and a rising variety of Layer 2 options. Essentially, its goal is to empower holders by leveraging the vePENDLE mechanism, thereby permitting them to actively take part within the protocol’s decentralized governance. Consequently, this involvement contains voting on essential parameters resembling upgrades, payment buildings, market incentives, and even the particular yield swimming pools which are launched.

At present, the full provide of PENDLE tokens is capped at roughly 281 million, with the circulating provide naturally various primarily based on latest market information. By staking PENDLE to amass vePENDLE, holders acquire important advantages. These embrace not solely enhanced voting energy but additionally boosted rewards, straight aligning token holder incentives with the protocol’s long-term success and general sustainability.

Supply: Coingecko

Pendle Protocol Dangers and Challenges

Good Contract Vulnerabilities and Exploits

The DeFi ecosystem carries inherent dangers, with good contract vulnerabilities being a main concern. Whereas Pendle implements sturdy safety measures, the broader panorama exhibits a persistent menace of exploits. DeFi good contracts can include bugs resulting in important monetary losses; flash mortgage assaults are a standard technique.

Pendle Finance Auditors.

Pendle addresses this with complete safety practices. Its good contracts are open supply and have undergone quite a few audits by respected corporations. Nevertheless, even intensive audits don’t assure full security.

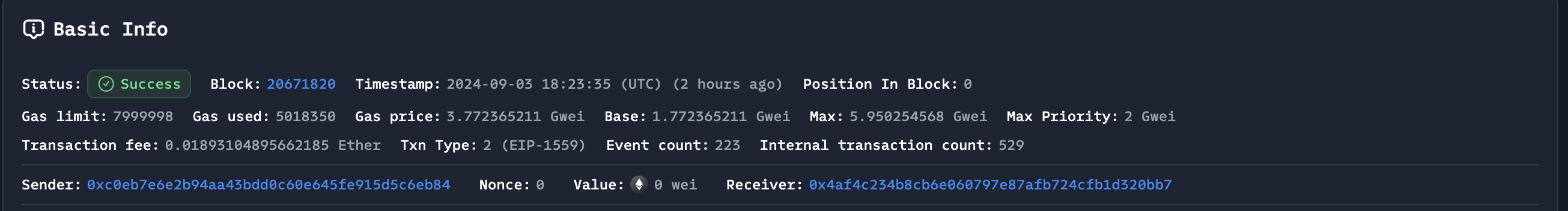

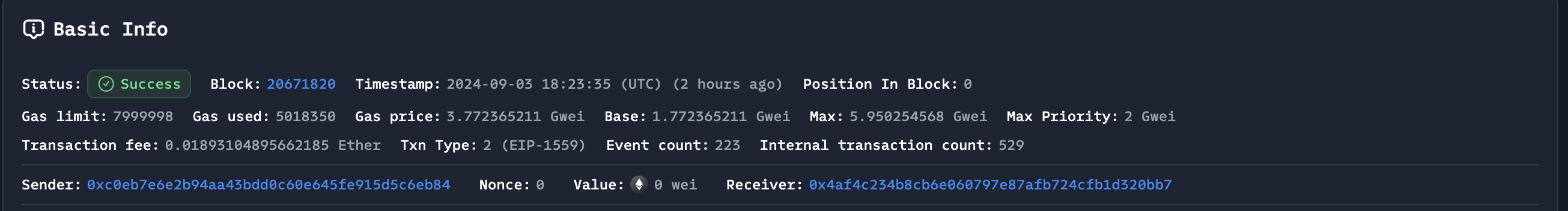

A notable incident concerned Penpie, a yield farming protocol hosted on Pendle Finance, which suffered a $27 million exploit in September 2024. This hack leveraged a reentrancy vulnerability, highlighting that audits are crucial however inadequate. Steady vigilance and sturdy incident response are equally important.

Supply: BlockSec

This occasion, together with points recognized by an audit of Jigsaw Finance’s Pendle methods, underscores the systemic threat in DeFi’s composable “cash legos” structure. A flaw in a single built-in protocol can cascade, even when the core protocol itself is safe. This calls for a holistic threat evaluation past particular person good contracts.

Liquidity and Worth Discovery Challenges

Sustaining deep liquidity and making certain correct worth discovery are ongoing challenges in fixed-yield DeFi markets. Certainly, this problem intensifies considerably because of the inherent complexities of yield-bearing belongings.

Earlier fixed-yield fashions, like these primarily based on zero-coupon bonds, usually triggered liquidity fragmentation throughout completely different maturities. This made establishing sturdy markets tough. Moreover, DeFi generally depends on exterior worth oracles. These may be susceptible to manipulation, risking important monetary losses.

Regulatory Uncertainty and Institutional Adoption Obstacles

The evolving regulatory panorama undeniably casts a major shadow, straight impacting institutional engagement with DeFi. Consequently, a persistent lack of clear frameworks can deter broader adoption, even amidst rising institutional curiosity. Certainly, the DeFi sector operates inside a quickly altering setting, the place governments and regulators are nonetheless meticulously defining applicable oversight. This inherent uncertainty, due to this fact, constantly creates formidable challenges for attracting large-scale institutional funding and, moreover, for increasing into essential new markets.

Nevertheless, Pendle is proactively addressing these formidable obstacles. For example, its 2025 roadmap notably contains “Citadels.” Certainly, these are not any atypical instruments; somewhat, such specialised infrastructure is exactly designed to offer compliant DeFi companies particularly tailor-made for institutional customers. Consequently, this successfully bridges the important hole between conventional finance and decentralized markets.

Furthermore, Pendle’s partnership with Ethena’s new Converge blockchain provides native KYC capabilities, thereby enabling compliant entry for establishments to Pendle’s yield merchandise. Past this, Pendle’s strategic deal with Actual World Property (RWAs) additionally serves as a important bridge between TradFi and DeFi, successfully tokenizing acquainted conventional belongings straight onto the blockchain.

Finally, this strategic emphasis on KYC-compliant merchandise and RWAs is completely essential. By doing so, it straight attracts the huge swimming pools of institutional capital that inherently demand regulatory certainty earlier than partaking deeply. Subsequently, by tokenizing TradFi belongings and fostering key partnerships like Ethena’s iUSDe, the Pendle protocol straight meets institutional demand for various yields, concurrently unlocking substantial new liquidity and accelerating broader DeFi adoption.