Reduce Me In: The Shares That Love a Charge Reduce

Markets have spent a lot of the summer time taking part in Fed-roulette, betting on when Jerome Powell will lastly blink and lower charges. The most recent jobs report, which got here in very weak, might have sealed the deal for September, pushing market odds of a lower above 70%. And portfolios are adapting earlier than it lands.

These are some corporations and sectors that will profit immediately from decrease rates of interest as a result of structural publicity to capital prices, shopper demand, or rate-sensitive monetary fashions.

1. Homebuilders & Housing-Associated Shares

Examples: D.R. Horton (DHI), PulteGroup (PHM), NVR Inc. (NVR)

Why they profit: Mortgage charges decline when the Fed cuts charges, boosting housing demand, affordability, and margins. Builders additionally borrow closely and profit from decrease financing prices. It’s price noting how skeptical the sell-side stays on homebuilders. DR Horton (DHI) and Lennar (LEN) are the 2 largest names within the group and every are lined by 21 analysts. However solely 33% and 29%, respectively, suggest ‘purchase’ rankings. When the technical image improves whereas analyst sentiment lags, it typically exhibits up as a good risk-reward image.

2. Financials (Banks & Brokers)

Examples: JPMorgan (JPM), Goldman Sachs (GS), Truist (TFC), Residents Monetary Group (CFG)

Why they profit: A steepening yield curve (short-term charges fall whereas long-term keep larger) improves web curiosity margins, and better market exercise from looser financial circumstances drives buying and selling and funding banking revenues.

Cyclicals & Industrials

Examples: Caterpillar (CAT), Eaton (ETN), Freeport-McMoRan (FCX)

Why they profit: These sectors are economically delicate. A price lower indicators and helps continued financial growth, growing demand for tools, infrastructure, and supplies.

4. Tech & Development Shares

Examples: Meta (META), Broadcom (AVGO), Cisco (CSCO)

Why they profit: These are large-cap tech corporations with predictable earnings and robust money stream, however they’ve macro-linked income strains (promoting, enterprise spend, industrial demand). Their valuations nonetheless rely partly on discounting future money flows, so decrease rates of interest enhance current worth, particularly related when charges are falling from excessive ranges. Decrease charges = cheaper financing for R&D, acquisitions, infrastructure (e.g., knowledge facilities, chip fabrication, AI compute buildout). That issues for corporations like Broadcom ({hardware} publicity), Cisco (enterprise infrastructure), or Meta (capex-heavy AI and metaverse investments). In order that they mirror each the growth-premium impact from falling charges and the real-economy increase that price cuts goal to create.

The “No-Reduce Membership”: Firms That Can Keep Robust If Powell Stands Agency

Jackson Gap speech (August 23) is anticipated to mark a tonal shift from Powell towards easing however we nonetheless keep warning on reversal dangers. If inflation stays sticky or the Fed flexes its “independence” muscle, the Fed may maintain and a special group of shares may take the lead. These corporations could also be higher positioned for a higher-for-longer rate of interest surroundings, typically due to steady demand, pricing energy, or ties to inflation and employment.

1. Employment-Levered Companies

Examples: ADP, Workday (WDAY)

Why they profit: A powerful labor market helps demand for HR, payroll, and enterprise software program providers. These corporations are revenue-levered to sturdy job progress, which means no speedy Fed easing.

2. Shopper Staples

Examples: Mondelez (MDLZ), Basic Mills (GIS), Altria (MO), Philip Morris (PM)

Why they profit: Defensive sectors outperform in unsure macro environments. Excessive inflation tolerance and pricing energy make them resilient in a no-cut or delayed-cut state of affairs.

3. Inflation Beneficiaries

Examples: McKesson (MCK), Waste Administration (WM), Freeport-McMoRan (FCX)

Why they profit: These corporations have publicity to commodity pricing, important providers, and healthcare, sectors that are likely to hold tempo or outperform when inflation is persistent and charges keep elevated.

In sum, if the Fed cuts, sectors like homebuilders, financials, and progress shares stand to learn from cheaper capital and stronger demand. If charges maintain, the benefit shifts to employment providers, shopper staples, and inflation hedges because of their defensiveness and pricing energy.

MAG 7 Nonetheless the Development Engine However It’s Getting Lonely on the Prime

Whereas the “Magnificent 7” proceed to energy forward with web revenue progress, the broader S&P 493 is shedding steam. In Q2 2025, web revenue for the MAG 7 is estimated to develop +25.6%, whereas the remainder of the index (S&P 493) is forecasted to rise simply +1.8%.

The hole is most stark when isolating the Huge 4 (Microsoft, Amazon, Alphabet, and Meta), that are spending aggressively, almost $95 billion in capex final quarter alone to dominate the AI race. Their mixed full-year capex forecast has now surged to $364 billion, up 12% from prior estimates. That stage of spending would have rivaled authorities stimulus pre-COVID.

Wanting forward, progress prospects for the S&P 493 are uninspiring, with consensus forecasting simply +2.6% and +3.0% web revenue progress in Q3 and This fall, respectively. With valuations elevated, the shortage of breadth in earnings momentum may pose dangers to the broader market narrative within the second half of 2025.

US Charge Reduce Priced In, All That’s Lacking Is Affirmation

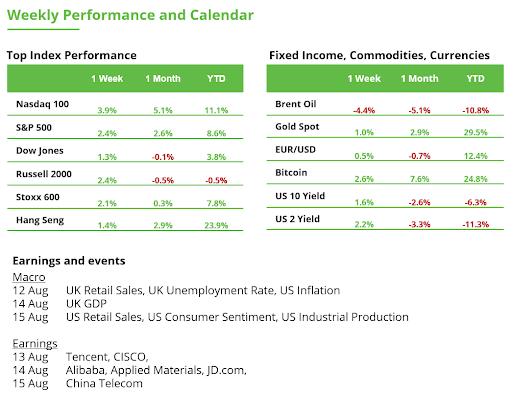

The prospect of falling rates of interest within the US is at the moment the dominant theme in monetary markets. At current, the market is pricing in three price cuts by the tip of the yr, with the chance of a lower in September at 89%. Nevertheless, these expectations could also be considerably untimely. Because the Federal Reserve acts data-dependently, the Shopper Worth Index (CPI) on Tuesday takes on explicit significance.

A weaker-than-expected inflation price may additional gas the rally in U.S. equities. The next than anticipated worth, alternatively, would possible dampen price lower hopes. In that case, buyers may shift to taking income within the brief time period. Given the robust upward motion for the reason that April lows, a normal pullback of three% to five% or extra from the document highs would hardly be uncommon. All it wants is the appropriate set off. Core inflation at the moment stands at 2.9%, nonetheless nicely above the Fed’s 2% goal. Additional progress is required to actually justify price cuts. The forecast for July factors to a rise to three.0%.

For the US, the perfect state of affairs can be an surroundings the place progress slows reasonably however tariffs don’t gas inflation. In that case, the Fed may decrease charges with out concern. A recession can be prevented, whereas authorities debt may very well be financed extra cheaply. In such a “goldilocks state of affairs” shares in sectors like know-how, communication providers, and actual property may emerge as prime performers. These sectors are thought-about particularly interest-rate delicate, whereas additionally providing long-term progress potential.

Robust Week for Apple: Pattern Reversal or Only a Momentary Rally?

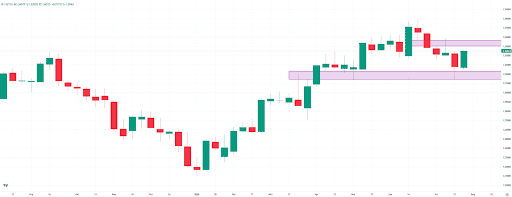

Apple inventory has posted a powerful comeback, rising 13.5% over the previous week to shut at $229.35. Since its April low of $168.96, the inventory has now gained over 36%, marking not solely a sturdy restoration but additionally a possible technical pattern reversal.

With the break above the earlier resistance stage at $224.83, the prior sample of decrease highs and decrease lows has been decisively damaged. This shift suggests rising momentum and a change in market sentiment. Because of this, the previous decrease highs from the medium-term downtrend now function potential upside targets, particularly at $249.49 and $259.61, the latter representing Apple’s all-time excessive.

Because of this robust rally, the drawdown from the document excessive has narrowed to simply 11%. In the meantime, on the draw back, the $224.83 breakout stage and the current low at $201.20 from two weeks in the past now act as necessary short-term help zones.

Apple inventory within the weekly chart. Supply: eToro

Two Buying and selling Zones for GBPUSD

GBPUSD rose by 1.3% final week to 1.3451, absolutely recovering the earlier week’s losses. The weekly chart highlights two key Truthful Worth Gaps (FVGs), which can function potential zones for both pattern continuation or reversal:

Zone 1 (1.3144–1.3233):Efficiently defended 3 times, most just lately two weeks in the past – thought-about help.

Zone 2 (1.3503–1.3562):Final held three weeks in the past – potential resistance.

Presently, GBPUSD is buying and selling proper between these two FVG zones. What issues now’s which zone the market approaches subsequent, and the way it reacts there. Persistence is essential. Merchants ought to await clear worth reactions and affirmation indicators earlier than coming into or exiting positions.

Since markets are fractal, this idea may also be utilized to decrease timeframes. No matter timeframe, it’s price noting {that a} packed macro calendar this week – particularly knowledge releases from the UK and the US – may act as key drivers for worth motion.

GBPUSD within the weekly chart. Supply: eToro

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any explicit recipient’s funding targets or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.

![[LIVE] Latest Crypto News, August 11 – Bitcoin Crosses $122K, Ethereum Marks 3-Year High: Best Crypto To Buy?](https://i1.wp.com/99bitcoins.com/wp-content/uploads/2025/08/IMG_0837-scaled.png?w=75&resize=75,75&ssl=1)