Retail is likely to be final to this bull market however we’re seeing massive cash pointing up for BTC ▲0.96% in actual time. Establishments, quant merchants, and crypto-native markets are all beginning to echo the identical name: Bitcoin 2025 worth to $150,000 and quick.

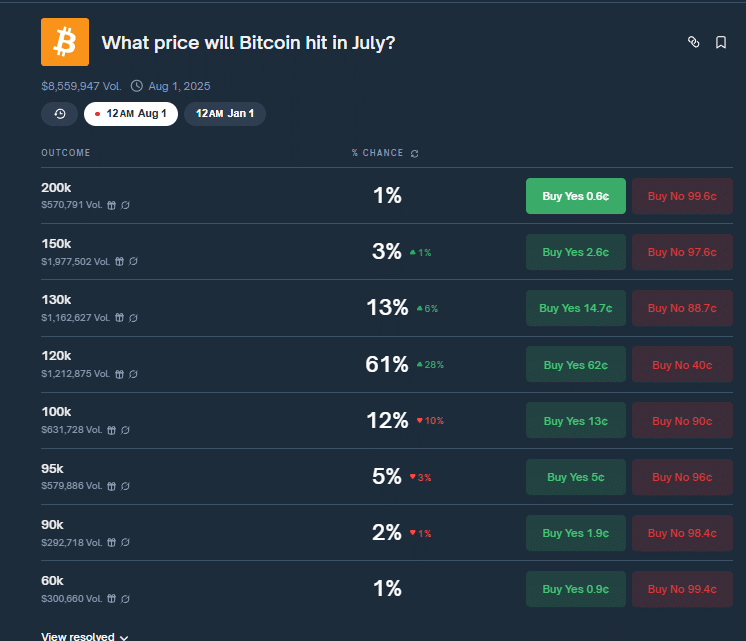

The truth is, Polymarket simply rewired its forecast, giving BTC a 61% likelihood of touching $120K earlier than the month closes. That’s a forecast that, till final week, was reserved for a far-off future. Right here’s what you need to know:

$180,000 Bitcoin is “Very A lot in Play”

Including gasoline to the hearth, VanEck’s head of digital asset analysis, Matthew Sigel, laid out what he referred to as the “excellent storm” forming for Bitcoin. In response to Sigel, Bitcoin’s upside is being pushed by:

“Persistent U.S. debt and deficit issues”

“A weakening greenback and demographic tailwinds”

“Charge minimize momentum and potential Fed management change”

BREAKING

President Trump simply EXPOSED the FED. It’s time to FIRE Jerome Powell instantly pic.twitter.com/V7tNWfhMGZ

— MAGA Voice (@MAGAVoice) July 8, 2025

Sigel isn’t alone. 99Bitcoin’s analysts throughout the house see financial easing, a rising urge for food for decentralized belongings, and world instability as creating the best backdrop for crypto to outperform.

VanEck has publicly acknowledged that $180,000 Bitcoin is “very a lot in play” in 2025.

The important thing shift is that company treasuries are shopping for Bitcoin, not retail buyers, as in 2021. Corporations are quietly accumulating BTC, signaling deeper institutional conviction. In the meantime, the U.S. Home is making ready for “Crypto Week,” and stablecoin regulation is predicted to be the primary actual shot at federal crypto laws.

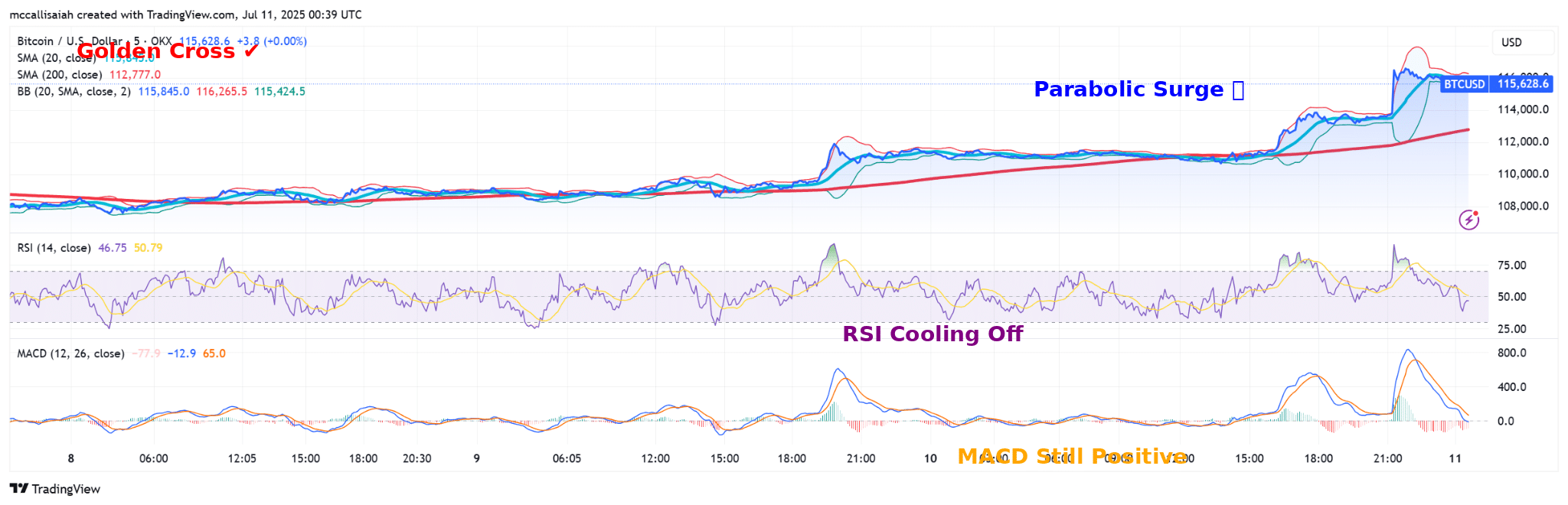

Technical Setup Factors to $150K If Bulls Maintain the Line

A textbook golden cross simply landed for BTC with the 20-period SMA over the 200, and that’s no small sign. That is usually a setup that always marks the beginning of bigger macro shifts.

After consolidating in a slim zone, the transfer as much as $116,000 was violent and volume-supported.

In the meantime, RSI pulled again from the sting of overbought. Look ahead to consolidation at these ranges.

In response to Cointelegraph and 10x Analysis’s Markus Thielen, BTC now has a 60% likelihood of gaining one other 20% over the following two months. That will push it previous $135,000. Others, like Kyle Reidhead of Milk Highway, see a transfer to $150,000 as the following logical goal.

The chart setup helps that concept. BTC just lately cleared resistance at $110,530, establishing for a possible breakout to the inverse head-and-shoulders sample goal of $150,000.

Polymarket Bets Huge on July Rally

Polymarket merchants are betting massive on the quick time period. Their forecast now sees a 61% likelihood of $120,000 BTC by finish of July, suggesting retail merchants are removed from taking earnings. That’s a significant shift in sentiment from simply weeks in the past.

Quantity on Polymarket has jumped considerably, displaying that contributors are keen to place actual capital behind this short-term bullish thesis. This may very well be a loopy summer time y’all.

EXPLORE: Tether CEO Paolo Ardoino Hopes For Internet Constructive From US Elections, Says Bitcoin Strategic Reserve Is A Nice Thought: 99Bitcoins Unique

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

Establishments, quant merchants, and crypto-native markets are all beginning to echo the identical name: Bitcoin 2025 worth to $150,000 and quick.

Polymarket merchants are betting massive on the quick time period. Their forecast now sees a 61% likelihood of $120,000 BTC by finish of July

All eyes are on Powell this month. As inflation lingers and labor metrics soften.

The publish Polymarket Provides Bitcoin 62% Odds of Hitting $120K by Month-Finish appeared first on 99Bitcoins.