Ever want you can set your investments on autopilot? eToro’s new Recurring Investments function allows you to just do that. By automating your investing, you’ll be able to construct steadily in direction of your objectives, cut back volatility, and cease worrying about timing the market.

Right here’s every thing it’s essential to find out about this highly effective instrument — together with the right way to set it up, and why automation may very well be your secret weapon for long-term progress.

What’s recurring funding?

Recurring funding (RI), also called recurring orders, means that you can set a hard and fast amount of cash to speculate month-to-month in your favorite belongings. A recurring funding plan is:

Straightforward to arrange: Select from 1000’s of shares, ETFs, and crypto on your recurring plans. You determine which quantity and date per 30 days works greatest for you.

Value-effective: Begin investing from $25, plus get pleasure from lowered FX charges and decrease fee on recurring investments of shares and ETFs.

Constant: With an automatic plan, you’ll be able to persist with your technique and make investments with consistency, irrespective of how busy you might be.

Much less nerve-racking: Free your self from timing the market and worrying about lacking alternatives.

Versatile: No lock-in interval means you’ll be able to modify your plan or cease anytime — it’s fully as much as you.

Why take into account recurring investments?

Construct a long-term technique with consistency. By constantly investing as a part of your common funds, your portfolio has potential to develop over time. Recurring investments additionally aid you leverage the compounding impact, turning constant small contributions into greater outcomes.

Keep disciplined, even when life will get busy. Automation ensures you’re at all times contributing to your portfolio, even throughout hectic durations. This consistency is a key technique to reaching monetary objectives.

Scale back danger with dollar-cost averaging. Investing smaller fastened quantities frequently, no matter market situations, permits buyers to realize publicity at a median of various buy costs — averaging out the price over time and serving to to handle volatility.

Timing the market vs. time available in the market

Let’s take a better have a look at what dollar-cost averaging can do.

Staying invested long run (often called “time available in the market”) can usually be extra essential than making an attempt to foretell the most effective occasions to purchase or promote (“timing the market”). You need to use “persistently investing a set quantity every month” with a recurring funding plan as a dollar-cost averaging (DCA) buying and selling technique.

For instance, the chart beneath illustrates how DCA outperformed timing the market on the SPDR S&P 500 (SPY) ETF, an exchange-traded fund which tracks the S&P 500 Index.

Hypothetical $1000 funding in SPDR S&P 500 (SPY) ETF (2007-2024)

Information as of December 1, 2024. For illustrative functions solely. Previous efficiency shouldn’t be a sign of future outcomes.

Supply: Yahoo Finance, Galaxy Asset Administration.

If an funding was made at any time when the index dropped by greater than 5% (“shopping for the dip”), this is able to have resulted in 16 investments, in comparison with 210 months of constant DCA — with DCA performing 1.25x higher.

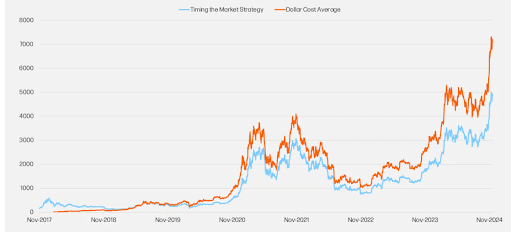

DCA’s benefit may be much more pronounced with risky belongings akin to cryptocurrencies.

The charts beneath illustrate how shopping for Bitcoin (BTC) utilizing a DCA technique carried out higher than an ideal market-timing technique over the identical time interval.

Throughout the time-frame from 2017 to 2024, DCA delivered 1.46x greater returns:

Hypothetical $1000 funding in Bitcoin (2017-2024)

Information as of December 1, 2024. For illustrative functions solely. Previous efficiency shouldn’t be a sign of future outcomes.

Supply: CCData, Galaxy Asset Administration.

You’ll be able to learn extra about dollar-cost averaging right here.

Which belongings can I spend money on with recurring investments?

eToro presents a variety of belongings for recurring investments, permitting you to diversify and cut back dangers:

Shares: Personal shares in your favorite firms with no fee charges.

ETFs: Put money into diversified funds designed to trace particular sectors or markets.

Crypto: Reap the benefits of the rising potential of digital currencies.

By diversifying throughout these asset sorts, you’ll be able to create a well-balanced portfolio that aligns along with your monetary objectives.

The right way to arrange recurring investments on eToro

Log in to your eToro account. (Don’t have an account but? Get one right here.)

Select your asset. Head to the precise inventory, ETF, or crypto for which you wish to arrange an RI, or click on right here to find prime belongings.

Click on “Make investments.”

Choose “Recurring Funding” and enter the quantity and date every month that works for you.

Verify your settings. That’s it — your portfolio is about for recurring funds.

What to think about earlier than beginning recurring investments

Earlier than establishing your RI, it’s value interested by a couple of key components:

Your funds: Begin with an quantity that matches your monetary consolation zone.

Frequency: Resolve how usually you wish to make investments (e.g., weekly or month-to-month).

Your objectives: Are you saving for retirement, constructing wealth, or experimenting with crypto? Your technique will rely in your goals.

Market developments: Whereas RI may also help to mitigate market timing dangers, you’ll wish to keep knowledgeable about main market actions with a view to make the most effective funding choices.

Begin constructing your future at present

With Recurring Investments on eToro, you’ll be able to create a disciplined, constant technique to assist develop your portfolio whereas having fun with:

Low fee charges on shares and ETFs

Low $25 minimal funding to get began

Full flexibility with no lock-in durations

Whether or not you’re simply beginning out in your funding journey, or in search of a easy approach to assist develop your current portfolio, Recurring Investments may very well be the answer you’ve been ready for.

Set a Recurring Funding

eToro is a multi-asset funding platform. The worth of your investments could go up or down. Your capital is in danger.

For crypto: Don’t make investments until you’re ready to lose the entire cash you make investments. This can be a high-risk funding and you shouldn’t anticipate to be protected if one thing goes flawed. Take 2 minutes to be taught extra