Analyst Weekly, June 23, 2025

Oil’s Threat Premium Has Arrived

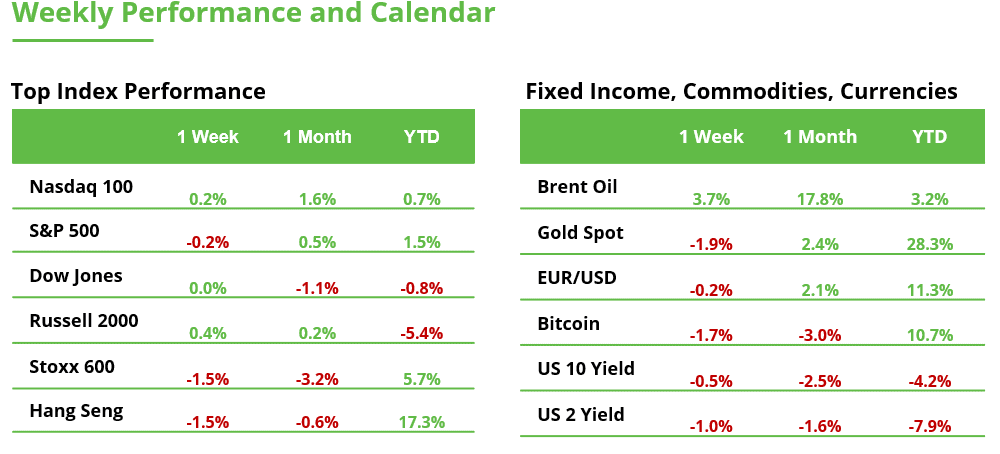

Selecting up from final week’s commentary on potential oil market disruption, this week buyers are turning their focus to the broader macroeconomic implications of rising geopolitical tensions within the Center East. By June 22, Brent crude had climbed almost 18% from early-month ranges, reaching a five-month excessive close to $79. The transfer displays rising concern over the potential disruption of key commerce routes, notably the Strait of Hormuz, which handles almost 30% of worldwide seaborne oil flows. Betting markets now put the chances of a closure at round 60% over the following 12 months.

Whereas a lot of the early market response has centered on Western power safety and central financial institution coverage, China could also be one of the vital strategically uncovered economies on this state of affairs. Because the world’s largest power shopper in 2024, China stays closely reliant on imported fossil fuels, notably from the Center East. Official knowledge present that six of its prime 10 oil suppliers are primarily based in or close to the Persian Gulf, with further volumes flowing, usually at discounted charges, by way of transshipment hubs like Malaysia. This leaves a big share of China’s power provide weak to disruption. The consequence could possibly be a resurgence of cost-push inflation throughout China’s manufacturing sector, introducing new macro headwinds for each home development and international provide chains.

Funding Takeaway: Buyers at the moment are positioning for a extra unstable macro surroundings. Count on heightened demand for inflation hedges, comparable to power equities, actual property, and gold, and a rising concentrate on resilience in international provide chains. Areas and sectors extra uncovered to power prices and commerce flows in Asia and Europe could face near-term headwinds, whereas commodity exporters and defensive sectors may benefit.

Fed Chair Jerome Powell has emphasised that non permanent oil worth spikes alone are usually not sufficient to shift policy- they have to be sustained and feed into broader inflation expectations to change the trail of cuts. This nuance reinforces investor demand for high quality, liquidity, and suppleness, and will push portfolio building towards extra balanced, all-weather methods.

Greenback Drifts, Gold Beneficial properties: A Reserve Shift in Movement

The US greenback is below pressure- DXY has touched under its post-Liberation Day low, earlier than current geopolitical tensions have generated sporadic safe-haven demand. A number of short-term catalysts have been driving the downward pattern: 1. over $500 billion in liquidity has entered the market since late April (because the US is paying its short-term obligations post-reaching the debt restrict), 2. new tariff dangers are clouding the commerce outlook, 3. financial knowledge has softened, 4. Part 899 of the US tax invoice has raised issues about overseas capital flows, 5. the deficit continues to widen, and, 6. markets are more and more pricing in Fed fee cuts.

However past the same old macro noise, a extra structural shift could also be brewing. Traditionally, when the greenback weakens, overseas central banks step in to purchase Treasuries as a method to stabilize their very own currencies. That sample seems to be breaking. Regardless of the greenback’s slide, overseas central banks have continued promoting Treasuries, elevating the likelihood they’re regularly diversifying away from US-denominated property.

We’ve famous refined indicators of diversification away from the greenback in current quarters, however now it’s changing into extra express. A current World Gold Council survey discovered that 73% of central banks anticipate greenback reserves to say no over the following 5 years, whereas 95% anticipate to extend their gold holdings. Geopolitical dangers, sanctions publicity, and rising commerce tensions are more and more shaping reserve administration choices.

If this shift persists, it could mark a structural change in international capital flows, a transfer away from greenback dominance that might increase long-term US borrowing prices, weaken Treasury demand, and reshape how the world manages monetary threat. What seems like a short-term greenback selloff could, the truth is, be the opening act of a broader reserve realignment.

Supply: World Gold Council, June 2025.

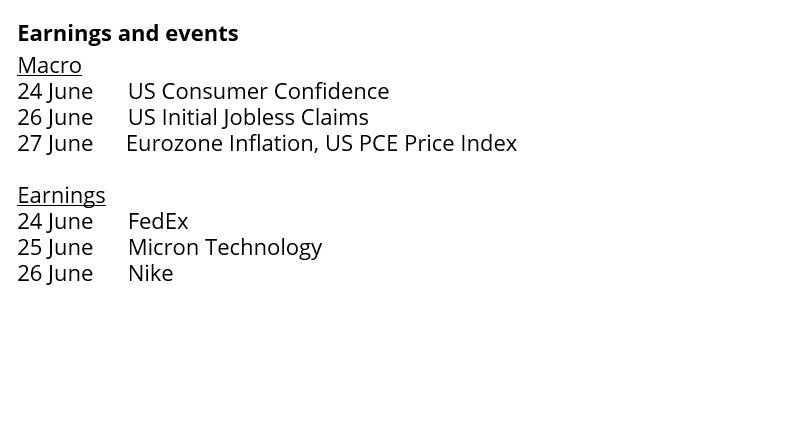

FedEx earnings on Tuesday: How a lot is international commerce actually struggling?

FedEx is delivering extra than simply a normal quarterly replace this week. After months of commerce conflicts, geopolitical tensions and financial uncertainty, these numbers may lastly present concrete insights into how considerably all these components have impacted international commerce.

Stress check for logistics stocksThe US has enacted a collection of tariff will increase and threats. Tariffs introduced on April 2 specifically despatched shockwaves by the monetary markets, from which many shares have but to totally recuperate, together with names within the logistics sector.

Actuality checkFedEx will report its earnings for March by Might on Tuesday after U.S. market shut. This era coincides with elevated strain on international items flows resulting from U.S. commerce coverage. Earnings per share are anticipated to rise 9.8% to $5.94, whereas income is forecast to say no 1.9% to $21.7 billion.

This means improved effectivity or constant price management regardless of declining revenues. Nonetheless, such a sample, rising earnings on falling gross sales, shouldn’t be sustainable long-term. Administration will present steerage throughout the earnings name. Buyers ought to pay shut consideration to any indicators concerning provide chains, demand, and commerce dangers.

Technical evaluation and outlookSince breaking its uptrend line in February, FedEx inventory has been in a broader downtrend. The 17% enhance from the April low to $226 is to be seen as a technical rebound throughout the ongoing pattern. A sustained breakout above resistance at $245 could possibly be the primary signal of a pattern reversal. Till that occurs, the restoration stays a counter-trend transfer.

FedEx within the weekly chart. Supply: eToro

Extra than simply FedExFedEx is a key financial indicator, however not the one one. In occasions of geopolitical pressure, tariff uncertainty, provide chain disruptions, and shifting commerce agreements, a broad view of transportation and logistics knowledge is important.

Different key metrics embrace container throughput indices (e.g., RWI/ISL), air cargo knowledge, the Baltic Dry Index, and commerce figures from main economies. Outcomes from different logistics firms like UPS, Maersk, and DHL additionally full the image.

BottomlineInvestors ought to concentrate on the place international commerce is definitely organized and executed. Modifications to tariffs or commerce restrictions impression transport demand virtually instantly, usually inside weeks. Extremely globalized firms with versatile logistics are particularly affected. Tuesday’s outcomes will check investor confidence not simply in FedEx, however within the broader resilience of worldwide commerce.

Technical Evaluation: Oracle

Oracle has damaged to new all-time-highs this week after smashing by the earlier excessive from December final yr. It will likely be essential for the bulls to defend any retest of the $200 deal with and that in principle ought to act as a ground now to a continued transfer larger. After breaking the uptrend again in March, buyers would have rightly been apprehensive, however since discovering a backside it has now rallied over 80%.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any explicit recipient’s funding goals or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.