Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a putting forecast, two educational researchers, Murray Rudd and Dennis Porter, have predicted that Bitcoin (BTC) might soar to an astonishing $4.3 million by 2036 if institutional shopping for tendencies proceed.

This prediction was highlighted by market professional Giovanni Incasa, who emphasised the importance of making use of rigorous supply-demand theories to Bitcoin’s distinctive financial construction.

Provide Shock Warning

Rudd and Porter have employed pure mathematical modeling to research Bitcoin’s market dynamics, warning that the approaching provide shock might result in value fluctuations ten occasions extra extreme than something seen so far.

Their findings recommend that the consequences of this provide shock will end in everlasting wealth redistribution, basically altering the panorama of digital property.

Associated Studying

In response to their conservative estimates, the Bitcoin value might attain $2.2 million per coin by 2036, a projection rooted in what they describe as “financial physics.”

The researchers word that the present liquid provide of Bitcoin stands at solely 11.2 million cash, with an estimated 4 million Bitcoin misplaced eternally attributable to misplaced keys and Satoshi Nakamoto’s unspent stash.

Their evaluation reveals that solely half of BTC’s complete provide is actively liquid, that means that even modest institutional purchases might result in important provide shortages.

Proof of this pattern may be seen within the each day shopping for habits of US exchange-traded funds (ETFs), which have averaged 285 Bitcoin per day since their launch, and the actions of Bitcoin treasury firms which might be eradicating hundreds of cash from circulation via debt financing.

Senator Cynthia Lummis has additionally proposed a strategic reserve of 1 million Bitcoin, which might contain an acquisition of roughly 550 cash per day over 5 years.

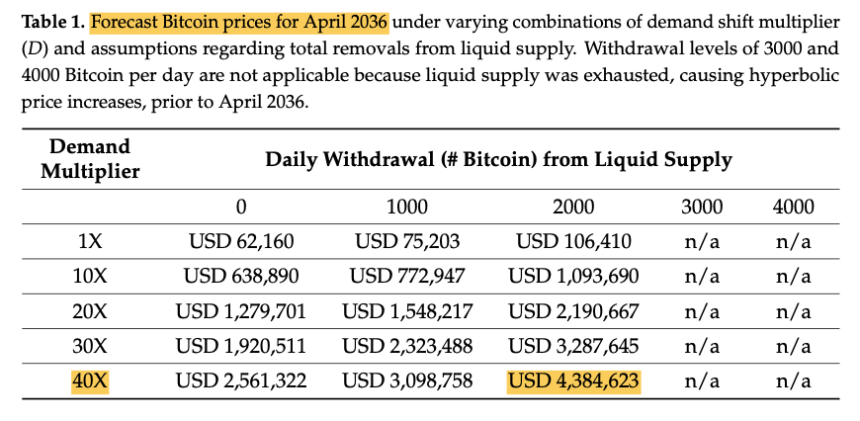

The researchers calculate that if 2,000 Bitcoin are faraway from circulation each day, the value might attain $106,000—a determine that’s already near immediately’s buying and selling value of $104,800, suggesting that their mathematical framework is holding true.

The crux of the researchers’ findings is that conventional provide curves should not relevant to BTC. Its completely inelastic provide creates important bottlenecks as demand rises, resulting in dramatic value will increase. They emphasize that establishments that delay their investments danger turning into completely priced out of the market.

Three Eventualities For Bitcoin

Rudd and Porter define three potential situations for Bitcoin’s future. In a conservative situation, with a 20-fold enhance in demand and continued institutional adoption resulting in 2,000 each day Bitcoin withdrawals, costs might attain $2.2 million by 2036.

Their bullish situation posits a 30-fold demand progress, the place Bitcoin might hit $5 million by early 2031. Probably the most excessive, hyperbolic situation anticipates a 40-fold demand enhance, with each day withdrawals escalating to 4,000 Bitcoin, probably driving costs to $4.3 million by 2036 and valuing Bitcoin at six occasions the present market cap of gold.

Associated Studying

The implications of Rudd and Porter’s analysis prolong past mere hypothesis. It highlights a transformative interval for BTC and the broader monetary panorama, the place strategic positioning and early adoption might imply the distinction between thriving and merely surviving within the digital financial system.

Featured picture from DALL-E, chart from TradingView.com