Technique, beforehand known as MicroStrategy, has bought a further 6,556 Bitcoin in a $555.8 million acquisition. The agency acquired the Bitcoin between April 14 and April 20, spending a mean of $84,785 per coin. The newest transfer takes the corporate’s whole Bitcoin to 538,200 BTC.

Firm Now Has Over $36 Billion In Bitcoin

Primarily based on firm studies, Technique has paid round $36.47 billion shopping for its Bitcoin reserves at a mean of $67,766 per coin. The corporate continues to be the most important public firm to carry Bitcoins, manner forward of rivals equivalent to MARA Holdings.

That is the second straight week Technique has purchased Bitcoin. Two weeks in the past, the corporate acquired almost 3,460 BTC for over $280 million. The corporate has additionally posted a 12% Bitcoin return because the starting of the yr.

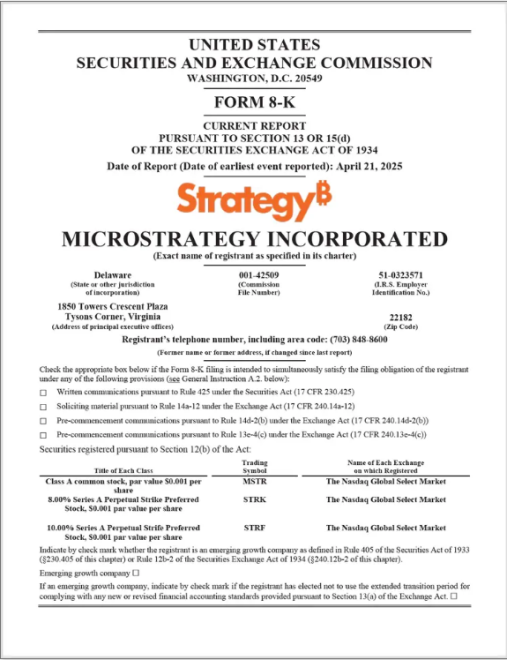

Ssource: Technique

Ssource: Technique

Technique Is Planning To Elevate $20 Billion For Extra Shopping for

The agency has no indication of decelerating its Bitcoin shopping for technique. Based on studies, Technique plans to lift over $20 billion from the sale of inventory to finance future Bitcoin buys. This aggressive shopping for persists whilst Bitcoin’s comparatively flat efficiency in current months.

Technique has acquired 6,556 BTC for $555.8 million at $84,785 per bitcoin and has achieved BTC Yield of 12.1% YTD 2025. As of 4/20/2025, it hodl 538,200 BTC acquired for $36.47 billion at $67,766 per bitcoin.https://t.co/x6LqCJClfP

— Wu Blockchain (@WuBlockchain) April 21, 2025

Technique will not be the one one taking a Bitcoin funding technique. Different institutional consumers are going the identical manner. Metaplanet simply acquired 330 BTC for a little bit over $28 million, growing its holding to 4,855 Bitcoin value near $500 million. Japanese retail firm ANAP has additionally jumped into the sport with a $70 million buy of Bitcoin.

Metaplanet has acquired 330 BTC for ~$28.2 million at ~$85,605 per bitcoin and has achieved BTC Yield of 119.3% YTD 2025. As of 4/21/2025, we maintain 4855 $BTC acquired for ~$414.5 million at ~$85,386 per bitcoin. pic.twitter.com/EUFSbUCOPW

— Simon Gerovich (@gerovich) April 21, 2025

Inventory Worth Surges After Saying Buy

The announcement of Technique’s new Bitcoin buy comes at a time when the corporate’s inventory has risen. Shares of MSTR rose almost 3% in prolonged buying and selling to about $325 from Friday’s shut at $317.

As of right now, the market cap of cryptocurrencies stood at $2.71 trillion. Chart: TradingView

This share efficiency appears linked to the current actions in Bitcoin’s costs. The cryptocurrency has surged to $87,600 as we converse. Observers have identified the excessive optimistic correlation between MSTR inventory and the costs of Bitcoin, which is comprehensible contemplating Technique’s enormous publicity to the digital forex.

A couple of analysts are nonetheless cautious of Bitcoin’s newest value surge. Crypto analyst Kevin Capital has cautioned that Bitcoin should transfer above $89,000 to validate a real uptrend. Till that occurs, he recommends market individuals to be cautious.

If Bitcoin retains going up within the subsequent few weeks, Technique’s inventory may additionally do the identical. Firm government chairman and co-founder Michael Saylor has already identified up to now that MicroStrategy has posted increased returns than different large belongings since implementing its Bitcoin technique.

The continuing institutional funding in Bitcoin by firms equivalent to Technique is indicative of accelerating mainstream acceptance of cryptocurrency as a legitimate asset class regardless of uncertainties surrounding long-term value stability and regulatory points.

Featured picture from The Star, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.