Geoff Kendrick, head of digital property analysis at Normal Chartered Financial institution, predicts Bitcoin might soar to $200,000 by the tip of 2025, probably reaching an all-time excessive. He ties this bullish outlook to rising issues in regards to the Federal Reserve’s independence and Bitcoin’s position as a hedge towards dangers within the conventional monetary system. As financial uncertainties loom, this forecast highlights Bitcoin’s rising attraction in risky markets.

A Hedge In opposition to Monetary Dangers

Kendrick emphasizes Bitcoin’s decentralized ledger as a defend towards vulnerabilities in centralized monetary programs. In contrast to conventional property, Bitcoin operates independently of presidency or institutional management, making it a secure haven throughout crises.

Based on Investing.com, the collapse of Silicon Valley Financial institution in March 2023 exemplified this, as Bitcoin rallied whereas TradFi property faltered. Traders more and more view Bitcoin as a buffer towards systemic dangers, significantly when belief in typical establishments wanes. This distinctive positioning underpins Normal Chartered’s optimism about Bitcoin’s value trajectory.

Fed Independence and Treasury Bond Dynamics

Latest issues in regards to the Federal Reserve’s autonomy have fueled Bitcoin’s attraction. Former President Donald Trump’s remarks about probably changing Fed Chair Jerome Powell, who has resisted aggressive charge cuts, have raised fears of political interference. Such uncertainties amplify Bitcoin’s worth as a decentralized asset.

Kendrick additionally factors to the U.S. Treasury time period premium, which hit a 12-year excessive in 2025, reflecting investor warning towards long-term Treasury bonds in comparison with short-term ones. Bitcoin has traditionally benefited from such yield disparities, as seen in its climb to a six-week excessive of $90,459, based on LSEG knowledge.

Normal Chartered’s Daring Forecast

Normal Chartered’s $200,000 prediction for 2025 displays confidence in Bitcoin’s long-term development. Kendrick initiatives a good loftier goal of $500,000 by 2028, pushed by persistent macroeconomic uncertainties and eroding belief in centralized monetary programs.

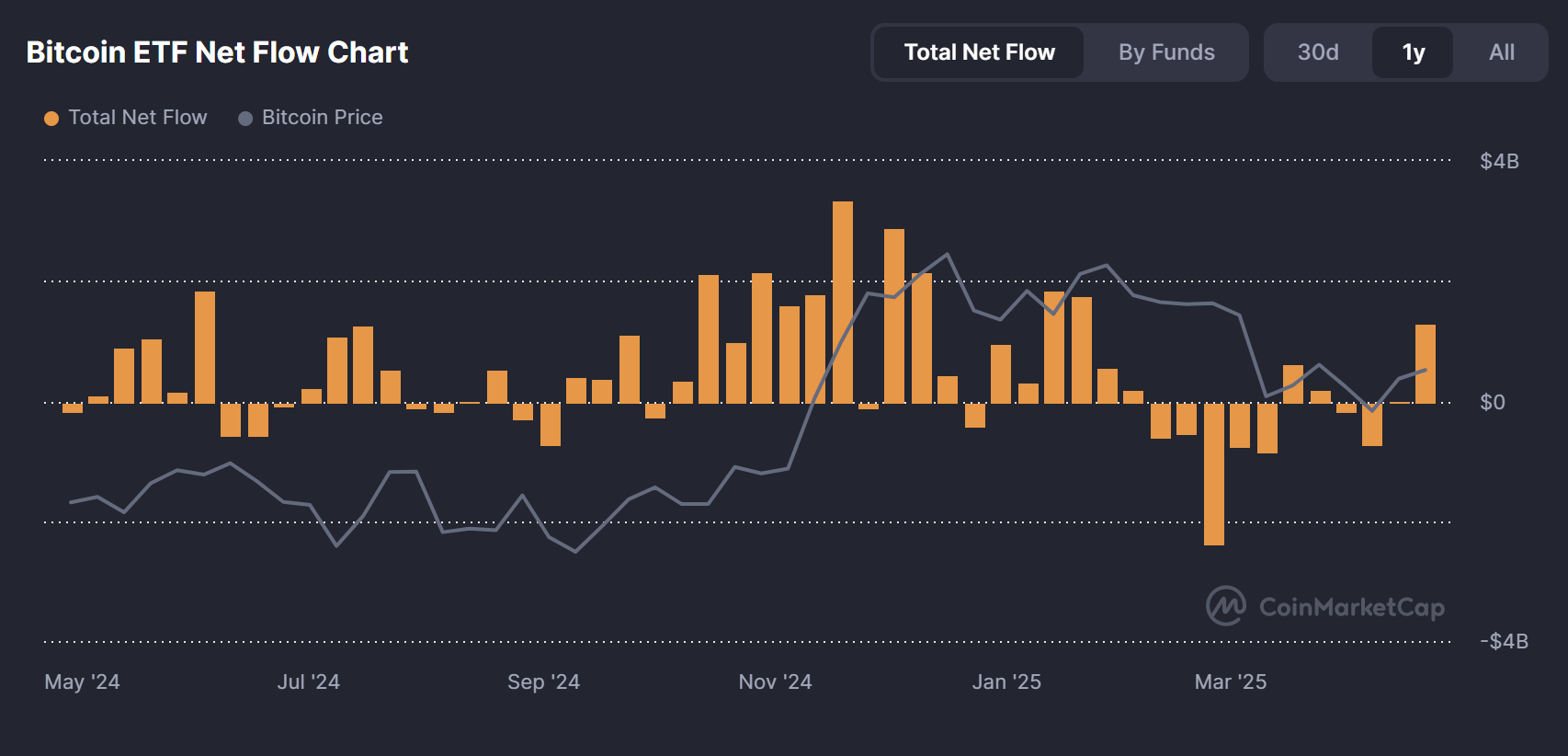

Market developments help this view with strong institutional demand and inflows into Bitcoin ETFs. As of April 22, 2025, the Bitcoin ETF web circulate recorded a major influx of $912.70 million, with historic values exhibiting $248.70 million during the last three months. Bitcoin has additionally surged to over $93,500, adopted by the restoration of the entire crypto market.

Supply: CoinMarketCap

These components sign rising mainstream adoption, which might propel Bitcoin’s value larger. Nonetheless, the trail to $200,000 hinges on sustained investor confidence and favorable financial circumstances.

Regardless of the optimism, Bitcoin’s volatility can’t be ignored. Value predictions are inherently speculative, and exterior components like regulatory crackdowns, shifts in financial coverage, or diminished institutional curiosity might derail Normal Chartered’s forecast. Traders should method such projections with warning, conducting thorough analysis earlier than making choices. Whereas Bitcoin’s decentralized nature gives resilience, its value stays delicate to world financial and political developments.