The decentralized finance (DeFi) panorama is consistently evolving, with new Layer-1 blockchains vying for market share. These platforms promise enhanced scalability, safety, and consumer expertise. Sui, a permissionless blockchain, emerged as a promising entrant. Launched in Might 2023 by Mysten Labs, based by former Meta engineers, Sui rapidly carved out a major area of interest. It leverages a novel object-centric knowledge mannequin and the Transfer programming language. This positions Sui as a formidable participant within the DeFi house.

This text delves into Sui’s speedy ecosystem development. Particularly, it explores its growth inside Decentralized Finance (DeFi), gaming, and Non-Fungible Tokens (NFTs). This development is evidenced by vital Complete Worth Locked (TVL) and increasing consumer adoption. Moreover, the community’s strategic positioning is solidified by key partnerships with institutional gamers and a transparent roadmap for future growth.

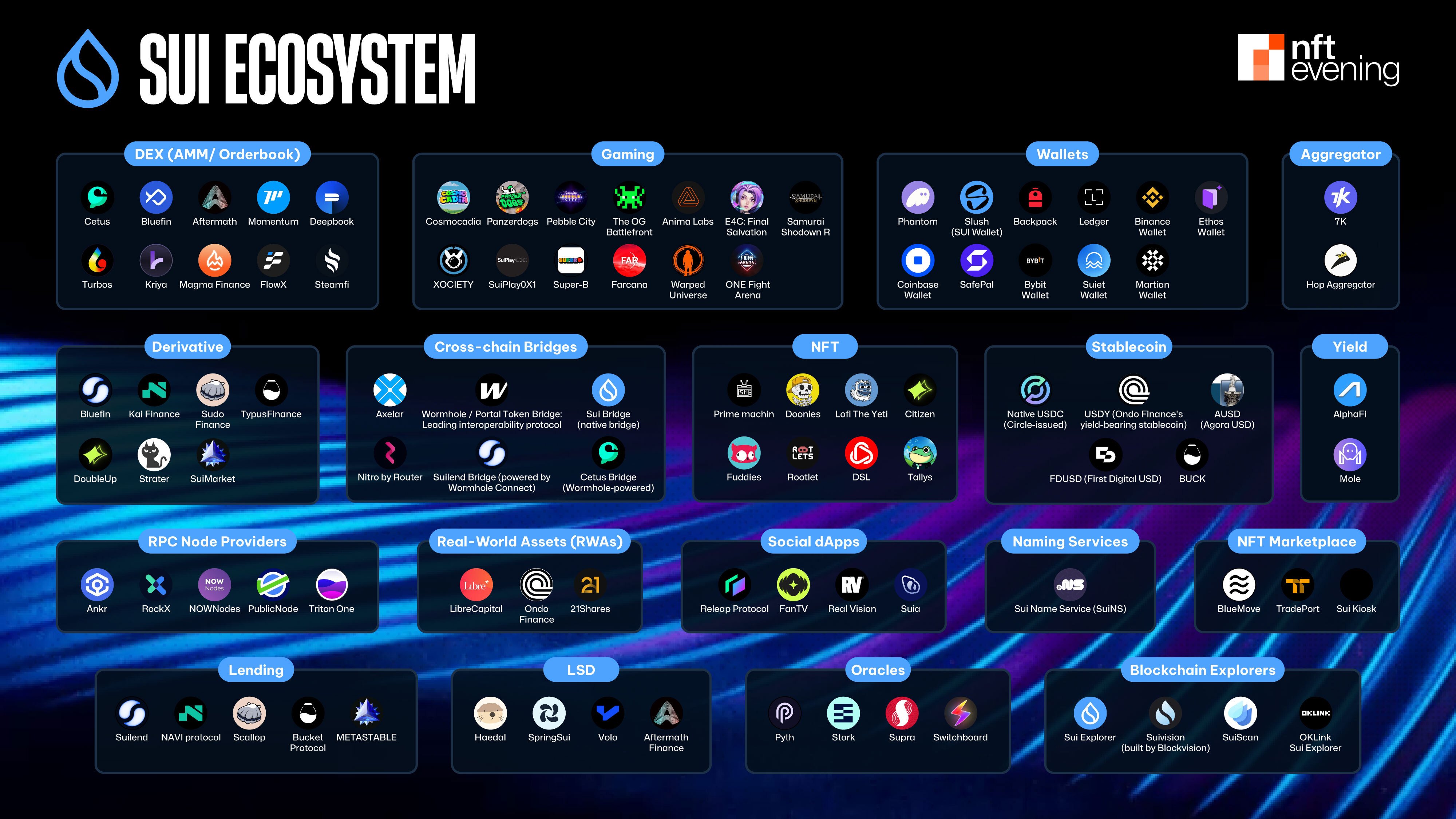

Sui – A Flourishing DeFi Ecosystem

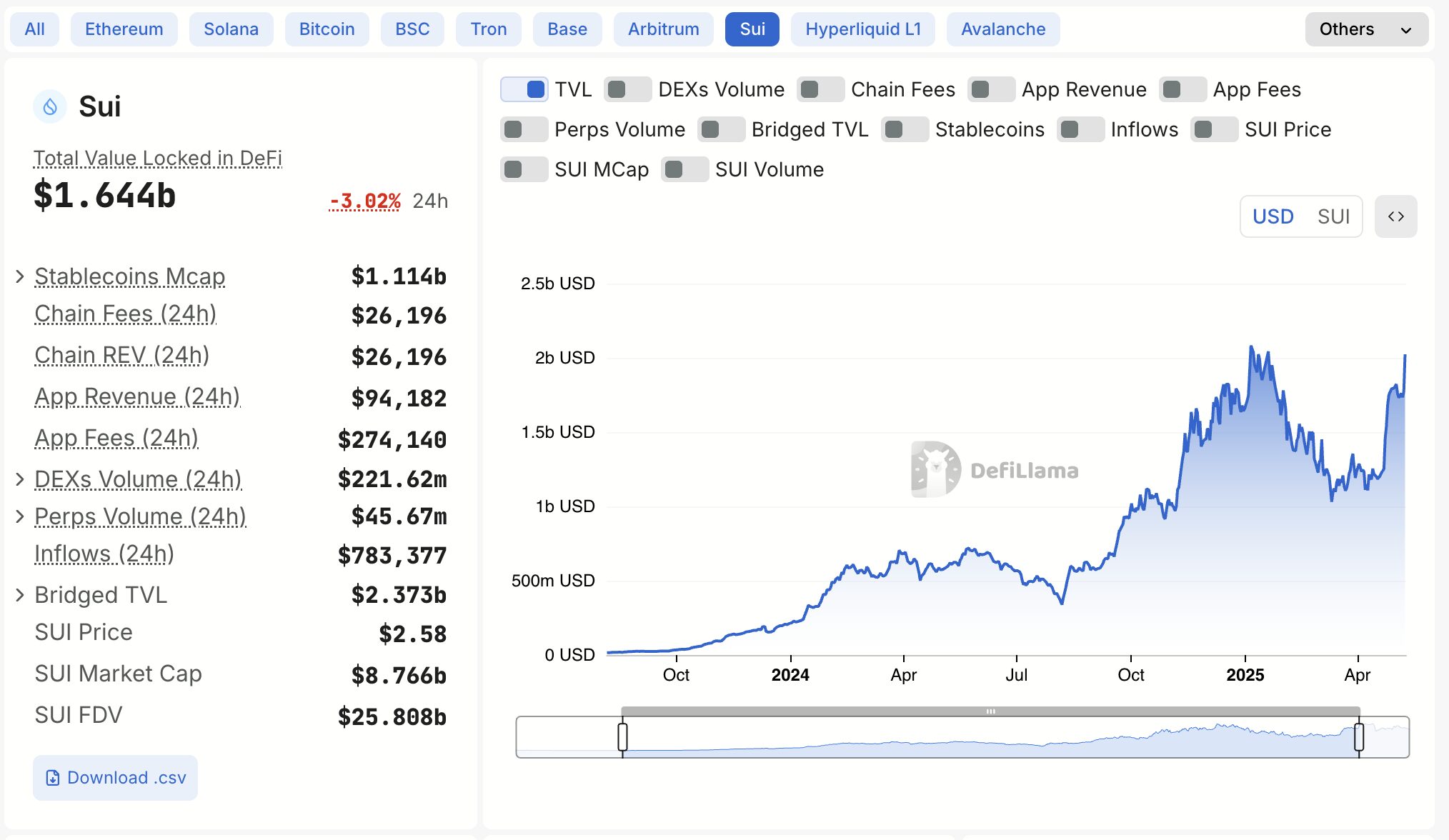

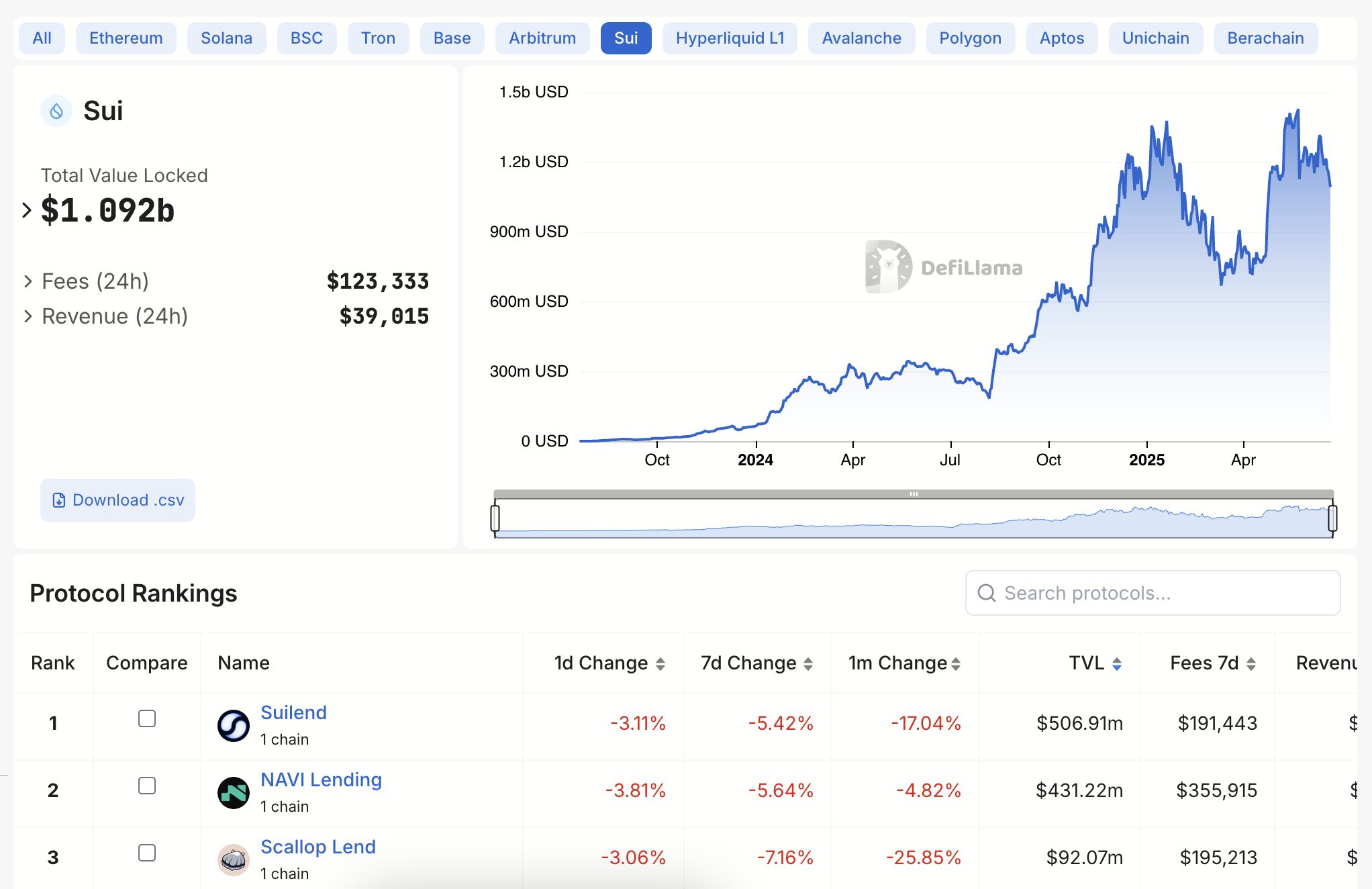

Sui‘s structure permits high-speed lending, buying and selling, and staking platforms. The community has demonstrated vital development in its DeFi sector, with Complete Worth Locked (TVL) surging from roughly $25 million at launch to over $2 billion by Might 2025, positioning Sui because the third-largest non-EVM chain by TVL.

Supply: DefiLlama

By June 2025, its DeFi TVL exceeded $1.7 billion, surpassing extra historic initiatives like Avalanche or Polygon. Stablecoin quantity on Sui has additionally seen explosive development, leaping from $400 million in January to just about $1.2 billion by Might 2025, with month-to-month stablecoin switch quantity exceeding $70 billion.

The cumulative complete DEX quantity on Sui has surpassed $110 billion, with a median 24-hour DEX quantity of roughly $250 million, indicating substantial buying and selling exercise.

Sui’s DeFi sector is powerful, characterised by high-speed transactions and capital effectivity, making it perfect for numerous monetary actions.

For extra: Sui Deep Dive: A Complete Evaluation

Supply: DefiLlama

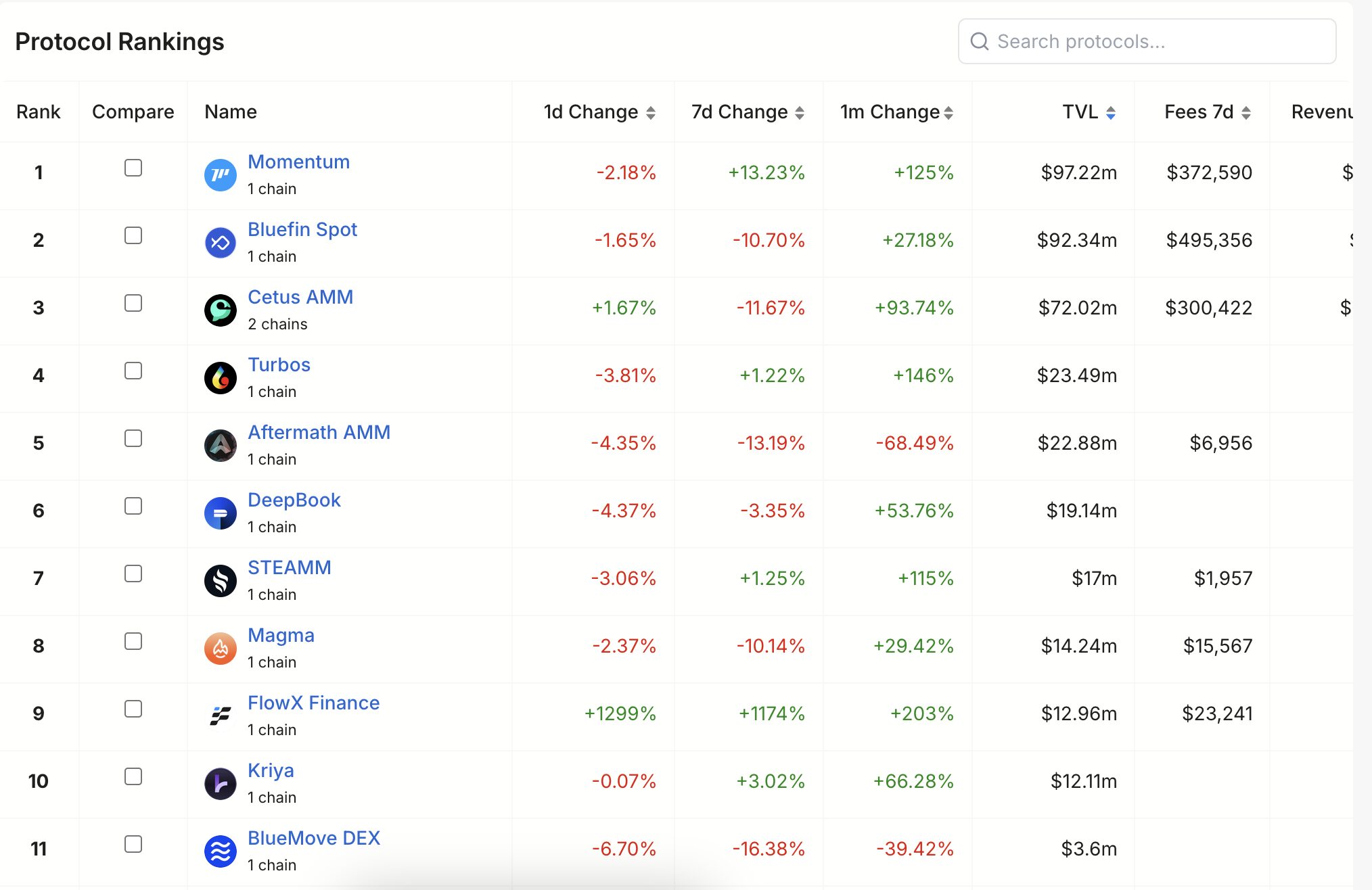

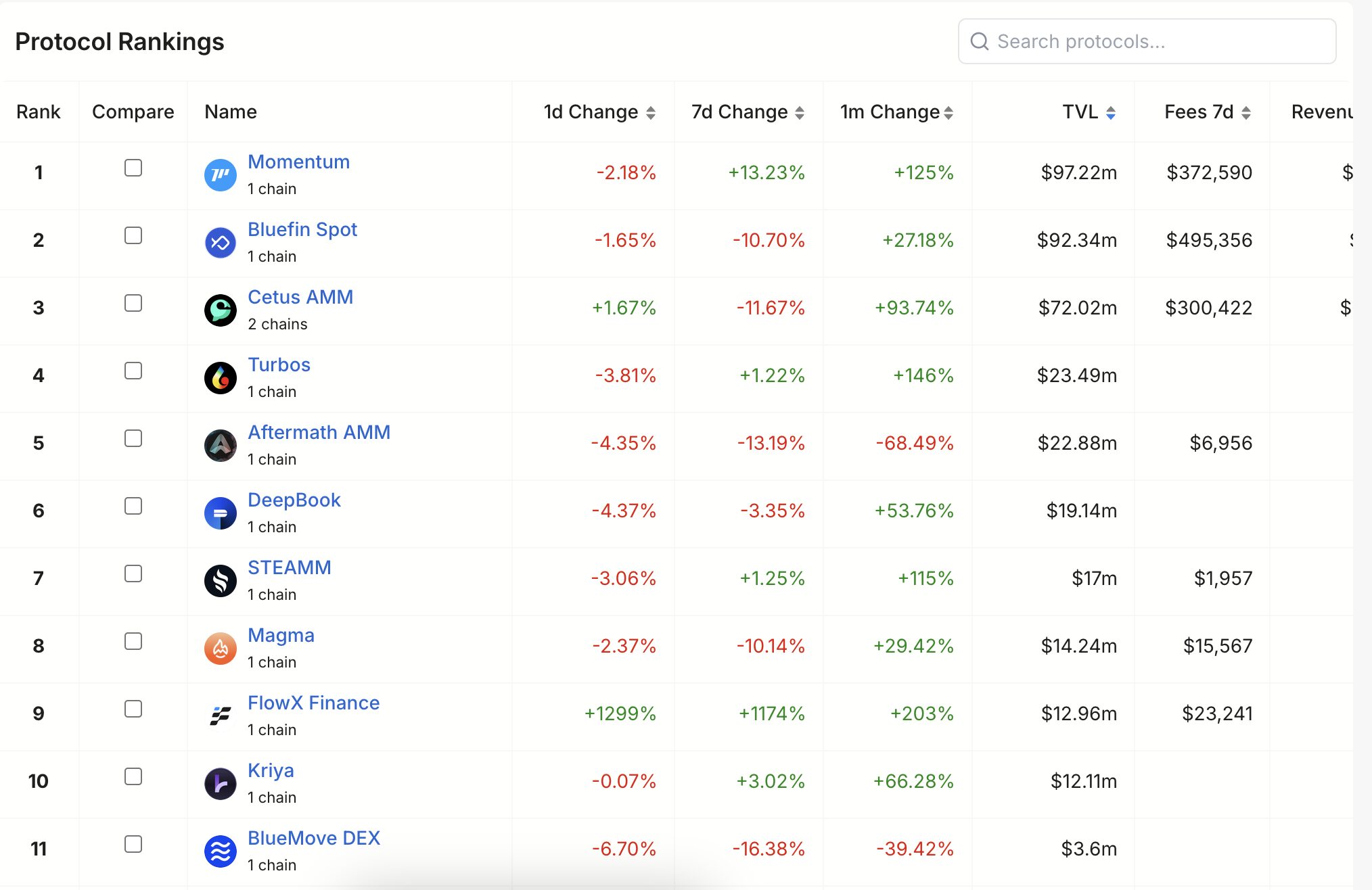

Decentralized Exchanges (DEXs)

Cetus Protocol (CETUS)

A number one DEX on Sui (and Aptos) using a Concentrated Liquidity Market Maker (CLMM) mannequin, much like Uniswap V3. This permits liquidity suppliers to allocate belongings inside particular value ranges, considerably enhancing capital effectivity and decreasing slippage for merchants. Cetus additionally includes a “Tremendous Aggregator” to supply the most effective costs throughout the Sui community and presents a developer SDK for straightforward integration.

Turbos Finance (TURBOS)

A distinguished DEX identified for its sturdy development and powerful assist for meme tokens inside the Sui ecosystem. Turbos emphasizes modern buying and selling mechanisms and complete listings, positioning itself as a key liquidity supplier and a catalyst for the meme coin market on Sui. It was notably unaffected by the Cetus exploit resulting from its unbiased and safe codebase.

Aftermath Finance (AF)

A decentralized buying and selling and DeFi platform aiming to offer a CEX-like consumer expertise absolutely on-chain. Aftermath presents multi-asset liquidity swimming pools, a smart-order router for environment friendly buying and selling, and liquid staking derivatives (afSUI). It integrates numerous DeFi merchandise like a DEX aggregator, yield farming, and even a cross-chain bridge, striving to be a “one-stop-shop” for Sui DeFi.

Momentum DEX (MMT)

The primary ve(3,3) decentralized change mixed with a token launch platform on Sui. Momentum’s ve(3,3) tokenomics mannequin goals to align incentives completely amongst liquidity suppliers, merchants, and protocols, with 100% of emissions, buying and selling charges, and rewards flowing on to customers. It additionally performs a key position in minting stablecoins on Sui, positioning itself as a essential infrastructure participant.

KriyaDEX (KDX)

A complete DeFi protocol providing a spread of functionalities together with AMM, restrict orders, leveraged perpetual contracts, and technique Vaults. Kriya focuses on offering quick, environment friendly, and low-cost transaction companies, supporting skilled merchants with options like as much as 20x leverage on perpetuals and on-chain dollar-cost averaging (DCA).

Supply: DefiLlama

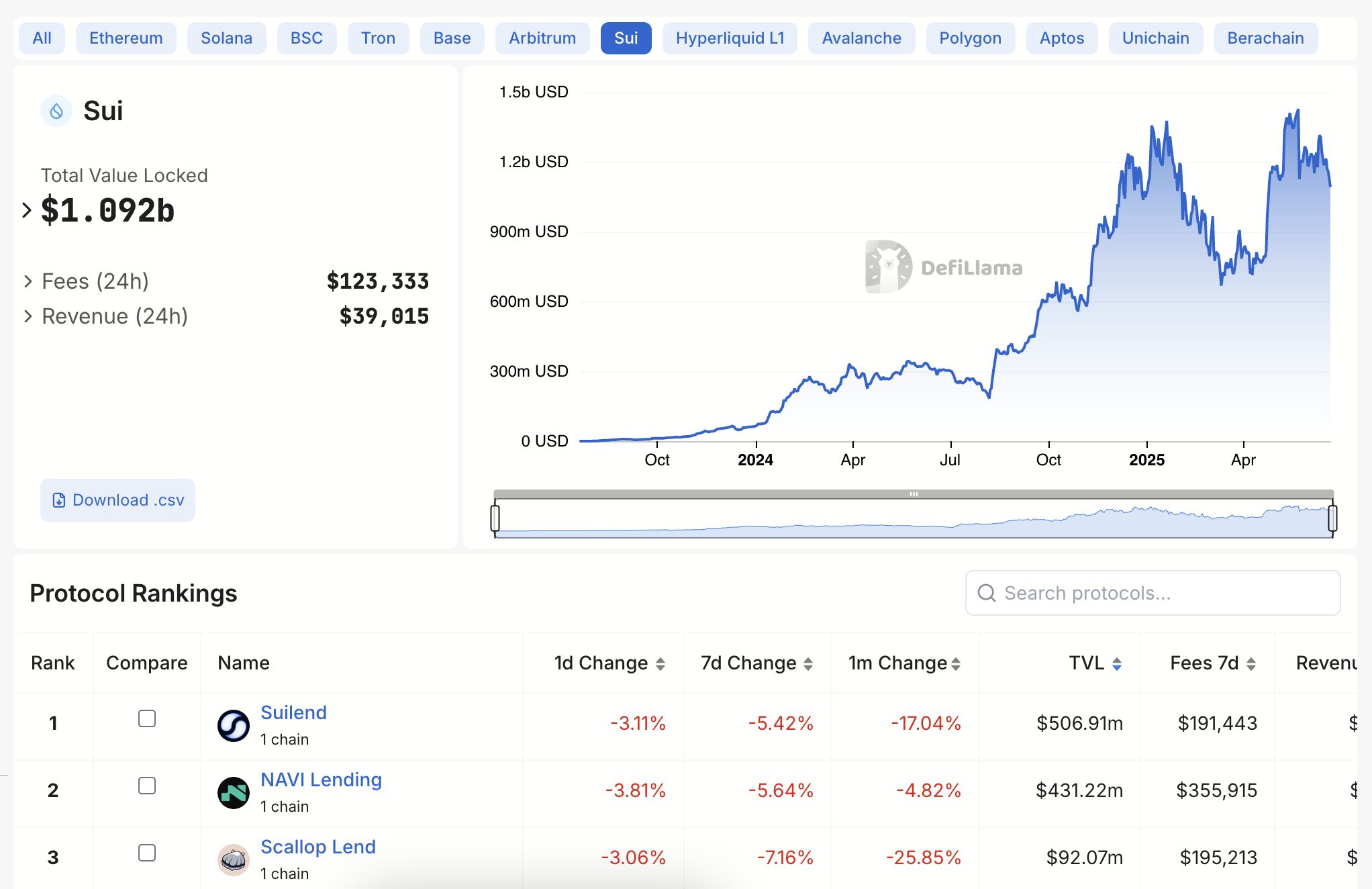

Lending & Borrowing Protocols

Suilend (SEND)

Suilend presents a unified platform integrating numerous important DeFi companies, making it a “one-stop-shop” for customers. This consists of:

Lending & Borrowing: Customers can deposit supported crypto belongings to earn curiosity or borrow towards their holdings with collateral, all powered by Sui’s high-speed, low-fee blockchain.Liquid Staking (SpringSui): This can be a key characteristic the place customers can stake their SUI tokens and obtain sSUI, a yield-bearing liquid staking token. sSUI can then be utilized in different DeFi actions, and SpringSui is especially notable for providing prompt unstaking, offering vital liquidity and security.Token Swapping (STEAMM): Suilend options its personal Superfluid AMM known as STEAMM, permitting customers to effectively swap tokens immediately inside the platform. This built-in swap performance helps scale back transaction charges and simplifies the consumer expertise.Cross-Chain Bridging: Powered by Wormhole, Suilend facilitates the seamless switch of belongings throughout main blockchains like Ethereum, Solana, and Polygon, enabling customers to carry belongings into the Sui ecosystem to be used inside the platform.

NAVI Protocol (NAVX)

The primary native liquidity protocol within the Sui ecosystem, providing a one-stop answer for lending, borrowing, and leveraged yield farming. NAVI helps numerous mainstream belongings (WBTC, WETH, SUI) and goals to be a user-friendly decentralized financial institution on Sui, identified for its capital-efficient and dynamic lending curiosity modes.

Scallop (SCA)

A number one decentralized finance (DeFi) protocol designed for peer-to-peer lending and borrowing. Scallop presents a complete cash market with high-interest lending and low-fee borrowing. It was the primary DeFi protocol to obtain an official grant from the Sui Basis, underscoring its institutional-grade high quality and safety. Scallop prioritizes institutional-grade safety and regulatory compliance.

Supply: DefiLlama

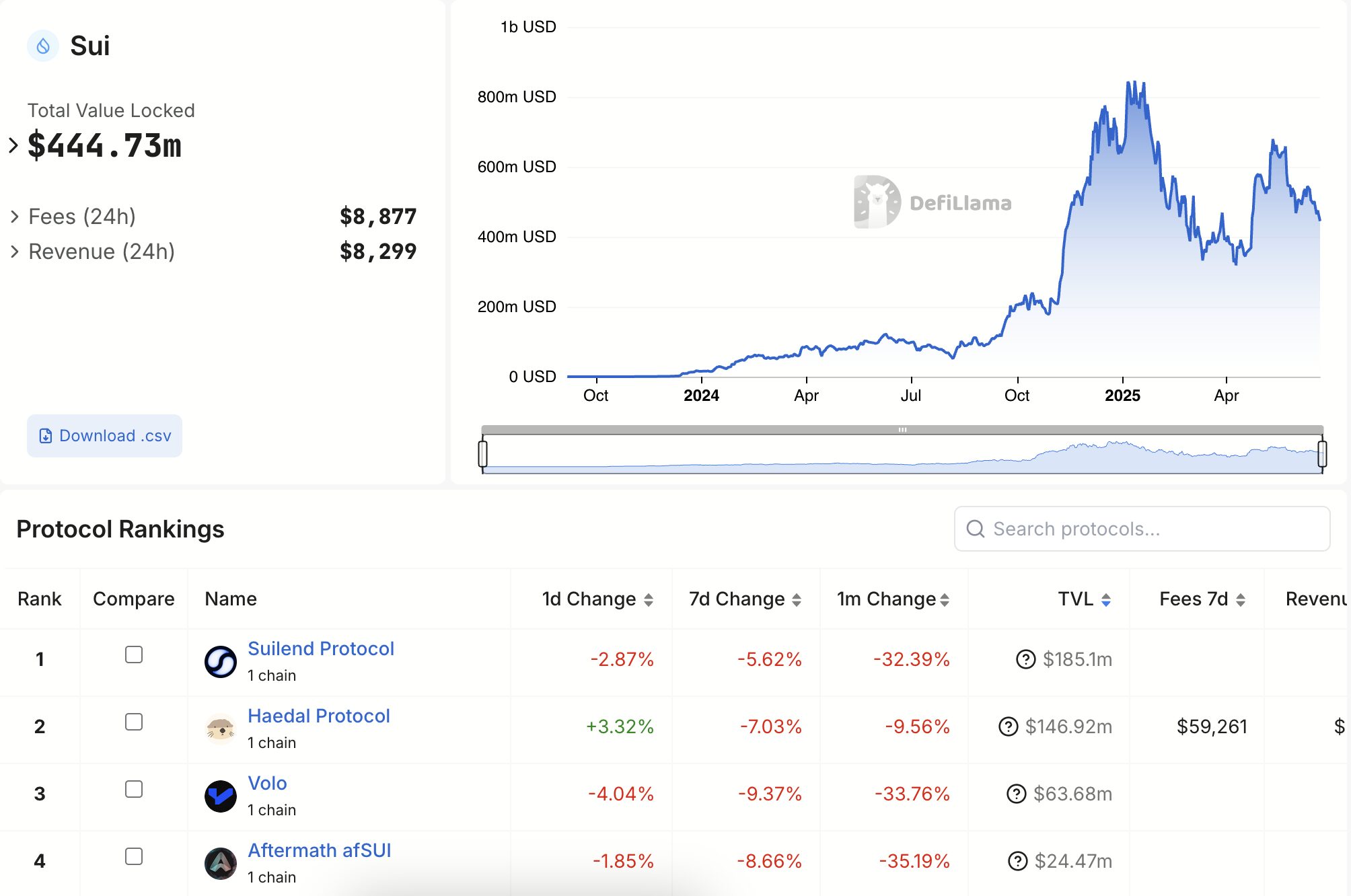

Liquid Staking Derivatives (LSDs)

A number of protocols are facilitating liquid staking on Sui:

SpringSui (by Suilend): Presents sSUI, notable for its prompt unstaking characteristic, offering vital liquidity and security by decreasing depegging threat.Aftermath Finance: Gives afSUI and integrates liquid staking into its broader DeFi platform.Volo: Presents vSUI as its liquid staking by-product.Haedal Protocol: The primary liquid staking answer constructed on Sui, offering haSUI and actively increasing its integration throughout main exchanges and DeFi platforms.

Supply: DefiLlama

Stablecoin Integration

Sui has a various and rising portfolio of stablecoins, together with native USDC, USDY (yield-bearing), AUSD, and FDUSD, which collectively signify a good portion of the community’s stablecoin market cap. This range enhances liquidity for DeFi and helps in-game economies.

Different Purposes and Infrastructure

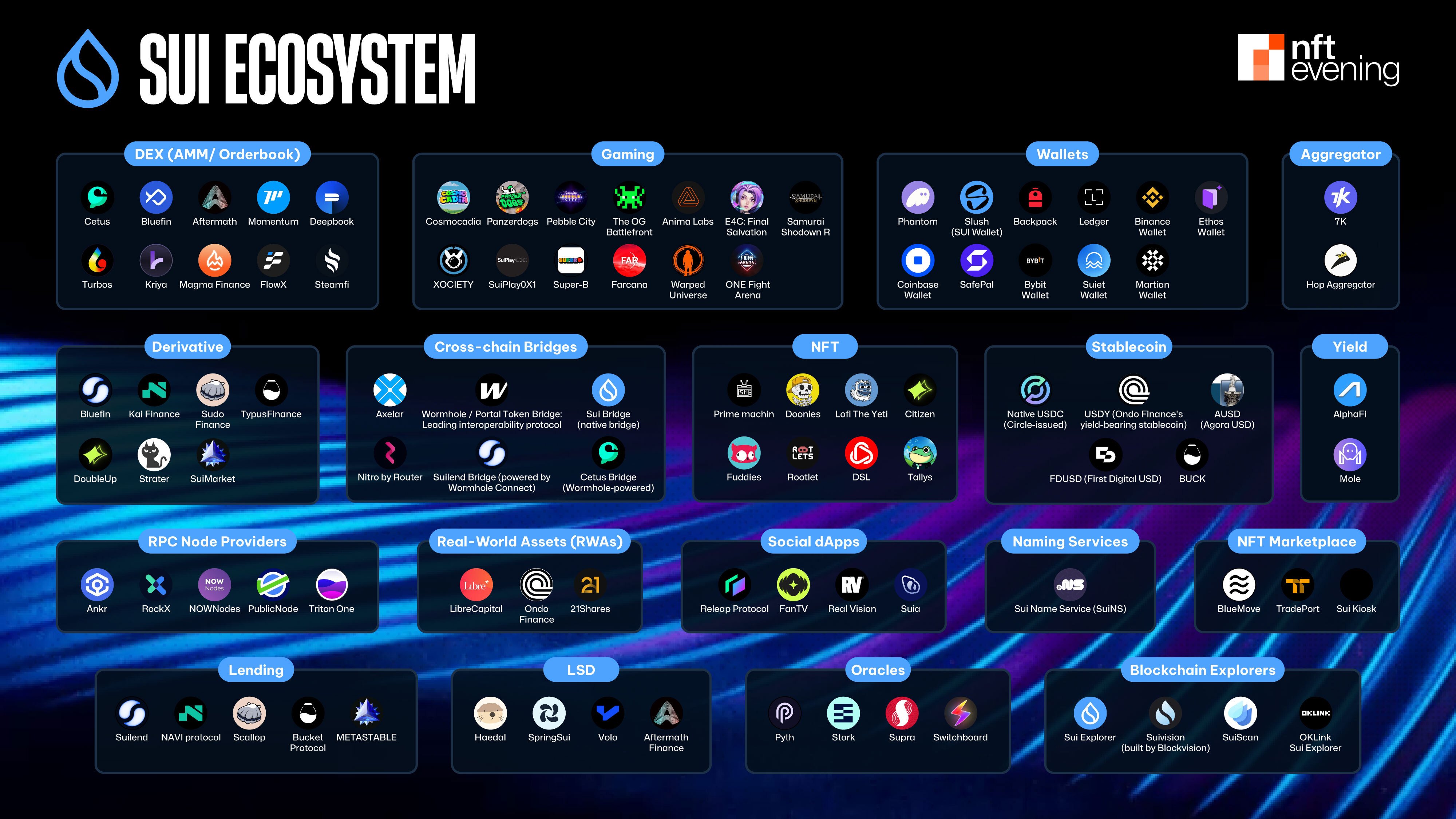

Sui’s versatile structure helps a wide selection of purposes past DeFi and gaming:

Social dApps: Tasks like Releap Protocol (a completely decentralized social graph), FanTV, and Actual Imaginative and prescient (integrating Sui for tokenized consumer rewards to foster interactive group engagement) exemplifies Sui’s attain into social purposes. Wallets: Quite a lot of wallets assist the Sui ecosystem, together with Phantom, Slush (SUI Pockets), Backpack, Ledger, Binance Pockets, Coinbase Pockets, SafePal, Bybit Pockets, Suiet Pockets, Martian Pockets, and Ethos Pockets. Cross-chain Bridges: Crucial for interoperability, Sui integrates with Axelar and Wormhole, a number one interoperability protocol facilitating worth and data switch throughout quite a few blockchains, together with Ethereum and Solana. Oracles: Providers connecting on-chain sensible contracts with off-chain knowledge, similar to Pyth, Stork, Supra, and Switchboard, can be found for the Sui community. RPC Node Suppliers: Infrastructure suppliers like Ankr, RockX, NOWNodes, PublicNode, and Triton One supply RPC companies for Sui, essential for dApp growth and operation. Developer Instruments and SDKs: Sui gives a complete developer-friendly setting, together with the Sui CLI, Sui VSCode extension, Sui JS (TypeScript SDK), intensive documentation, guides, tutorials, pattern code, a developer discussion board, weekly workplace hours, and a Telegram channel for assist. Blockchain Explorers: Instruments like Sui Explorer and Suivision (constructed by Blockvision) enable customers to view community exercise, monitor belongings, and debug sensible contracts. Sui Title Service (SuiNS): This decentralized naming protocol permits customers to register human-readable names (e.g., yourname.sui) that map to complicated pockets addresses and sensible contracts.

Strategic Development: Partnerships, UX, and Future Imaginative and prescient

Sui’s dedication to broad adoption and long-term sustainability is clear in its strategic strategy to partnerships, consumer expertise, and a transparent future roadmap.

Strategic Partnerships and Institutional Integration

Sui’s development is considerably fueled by strategic partnerships and institutional integrations, signaling robust confidence and a path for large-scale capital. These collaborations are essential for embedding Sui inside conventional finance (TradFi) and mainstream Web3 infrastructure.

Institutional Custody & Entry: Collaborations with Fireblocks improve institutional-grade custody and DeFi entry.RWA Tokenization: Partnerships like 21Shares (a number one crypto ETP supplier) intention to develop monetary merchandise, speed up Actual-World Asset (RWA) tokenization, and supply institutional and retail entry.Cross-Chain Liquidity: Integrations with Wormhole and OKX Pockets are essential for reinforcing cross-chain liquidity and consumer engagement.Safe Self-Custody: Ledger integration gives safe self-custody and staking choices for SUI.TradFi Bridges: Tasks like Ondo Finance are launching tokenized U.S. Treasuries on Sui, whereas ATHEX Trade explores on-chain fundraising by way of Sui, demonstrating a concerted effort to bridge TradFi with Web3. Notably, a current partnership with Microsoft additionally positions Sui for deeper blockchain integration inside enterprise purposes.

This concentrate on established gamers and interoperability de-risks the platform, attracting capital and legitimizing Sui’s place within the world digital asset panorama.

Person Expertise (UX) and Developer Enablement

Sui’s core design philosophy prioritizes a seamless consumer expertise (UX) and a developer-friendly setting to drive adoption past crypto natives.

Simplified Onboarding: Initiatives like ZK Login enable customers to entry dApps with acquainted internet credentials, considerably reducing the barrier to entry for mainstream audiences.Strong Developer Help: Sui presents complete instruments, libraries, tailor-made SDKs, and powerful group assist (workplace hours, boards, Telegram, hackathons like Sui Overflow, and developer grants). The “Transfer Accelerator” program additional helps builders in mastering the Transfer programming language.

This dedication reduces friction for each customers and builders, fostering a “virtuous cycle of development” important for mass adoption and positioning Sui as a platform for on a regular basis purposes.

Supply: Sui Ecosystem

Future Roadmap and Improvement Plans

Sui’s future roadmap emphasizes steady ecosystem growth and refinement. That is guided by a number of strategic priorities.

First, deepening DeFi is a key focus. Plans embrace exploring synthetics, Actual-World Property (RWAs), and secure yield alternatives. The Sui Basis’s multi-million greenback DeFi Ecosystem Development Fund goals to assist builders. Furthermore, it seeks to reinforce liquidity and drive long-term protocol adoption.

Second, scaling GameFi and creator platforms stays essential. The anticipated launch of the SuiPlay 0X1 gaming gadget is anticipated as a serious catalyst. Consequently, it’s going to create demand for brand new play-to-earn video games. This might additionally appeal to variations of well-liked blockchain video games to Sui.

For extra: The Development Potential of Sui?

Moreover, technical enhancements are underway. Plans embrace Layer 2 enhancements leveraging Zero-Information (ZK) expertise. This goals to allow sooner and cheaper transactions. Alongside this, ongoing enhancements to the core community, like Mysticeti v2, are deliberate.

Lastly, group and institutional focus continues. Efforts persist to draw institutional capital and enterprise options. Certainly, energetic group engagement by way of hackathons, instructional applications, and group hubs helps this.

Analysts usually anticipate SUI value will increase by 2029-2030. Some forecasts place it between $6 and $12, pushed by its pace, scalability, and low charges. General, the long-term outlook stays bullish. This positions Sui as a possible chief in rising AI-related niches. It may additionally problem established Layer-1s by the last decade’s finish.