As we enter This autumn, a interval traditionally recognized for sturdy Bitcoin efficiency, the newest version of The Bitcoin Report from Bitcoin Journal Professional delivers important insights into the evolving market dynamics of Bitcoin. With a mix of quantitative on-chain knowledge, technical evaluation, and macroeconomic views, this report affords a complete take a look at Bitcoin’s positioning, highlighting important alternatives and challenges for each buyers and market individuals.

Key Highlights from the Report:

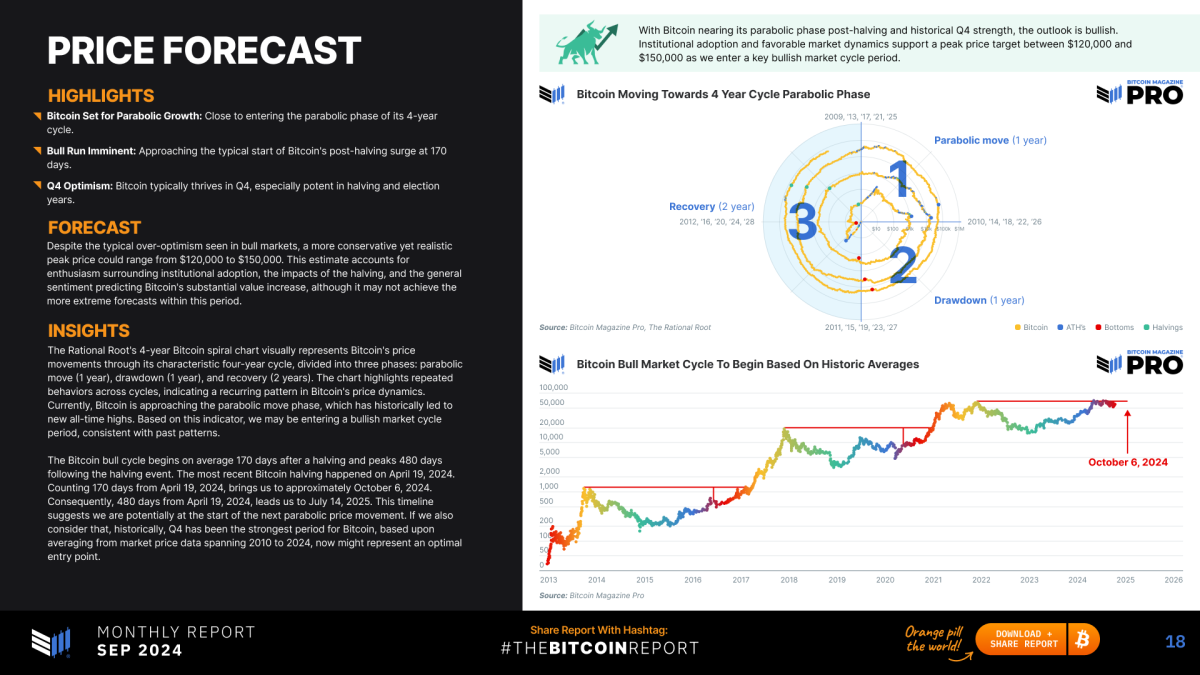

Historic This autumn Efficiency: Bitcoin has averaged a 23.3% return in This autumn, exhibiting a powerful seasonal development towards bullish efficiency.Breaking Important Resistance: Current technical evaluation factors to Bitcoin breaking by way of key resistance ranges, doubtlessly setting the stage for parabolic progress.Derivatives Market Momentum: The derivatives market exhibits renewed momentum, with rising open curiosity and diminished leverage throughout main exchanges.Mining Profitability Restoration: Mining profitability has rebounded, with hash value reaching a two-month excessive, signaling a strengthening of Bitcoin’s underlying fundamentals.Institutional Accumulation: In September, U.S. Bitcoin ETFs bought 17,941 Bitcoins—32.9% greater than the 13,500 new Bitcoins mined throughout the identical interval, indicating vital institutional demand.

This 21-page report is constructed on a stable basis of on-chain metrics, technical evaluation, and macroeconomic components. It gives an in-depth examination of Bitcoin’s latest market developments, together with traits like institutional accumulation and mining profitability restoration. With This autumn traditionally delivering sturdy returns for Bitcoin, the report highlights how macroeconomic components—comparable to potential Federal Reserve fee cuts and liquidity injections from the Individuals’s Financial institution of China—may act as catalysts for Bitcoin’s continued progress. In a low-leverage setting inside derivatives markets, these financial insurance policies might spark a brand new Bitcoin rally.

Knowledgeable Evaluation and Insights

That includes unique commentary and insights from main trade figures like Lyn Alden, The Rational Root, and Julian Liniger, this second month-to-month version of The Bitcoin Report is a must-read for each buyers and fanatics.

The analytical rigor offered on this version is additional enriched by the views of thought leaders comparable to Philip Swift, Pete Rizzo, Dr. Michael Tabone, Dr. Demelza Hays, Patrick Heusser, Lucas Betschart, Lukas Pfeiffer, Pascal Hugli, and Joël Kai Lenz. Their insights cowl a spectrum of points together with macroeconomic coverage implications, sector-specific developments, and technical indicators. By leveraging the collective experience of main analysts, The Bitcoin Report delivers an unparalleled breadth of study, from micro-level on-chain behaviors to macro-level geopolitical and financial drivers influencing Bitcoin’s adoption curve.

Share, Talk about, and Have interaction

We invite you to learn and obtain the September version, full of insights that may preserve you forward on this fast-evolving market. Whether or not you’re managing portfolios, in search of long-term Bitcoin publicity, or just staying knowledgeable, The Bitcoin Report gives the information you’ll want to keep on prime of the development.

Be happy to share the report’s content material, take screenshots, and publish on social media utilizing the hashtag #TheBitcoinReport. By monitoring these conversations, we will enhance future editions and proceed delivering high-value content material to the Bitcoin neighborhood.

Alternatives for Sponsorship and Collaboration

All in favour of sponsoring future editions of The Bitcoin Report or exploring joint-publication alternatives? Accomplice with us to achieve publicity within the fast-growing Bitcoin area.

For extra data, attain out to Mark Mason at mark.mason@btcmedia.org to debate how your model will be a part of this thrilling initiative.