For years, Bitcoin fans have been anticipating a major change within the worth as a result of involvement of institutional traders. The idea was easy: as corporations and huge monetary entities spend money on Bitcoin, the market would expertise explosive development and a sustained interval of rising costs. Nonetheless, the precise end result has been extra advanced. Though establishments have certainly invested substantial capital in Bitcoin, the anticipated ‘supercycle’ has not unfolded as predicted.

Institutional Accumulation

Institutional participation in Bitcoin has considerably elevated lately, marked by substantial purchases from giant corporations and the introduction of Bitcoin Change-Traded Funds (ETFs) earlier this yr.

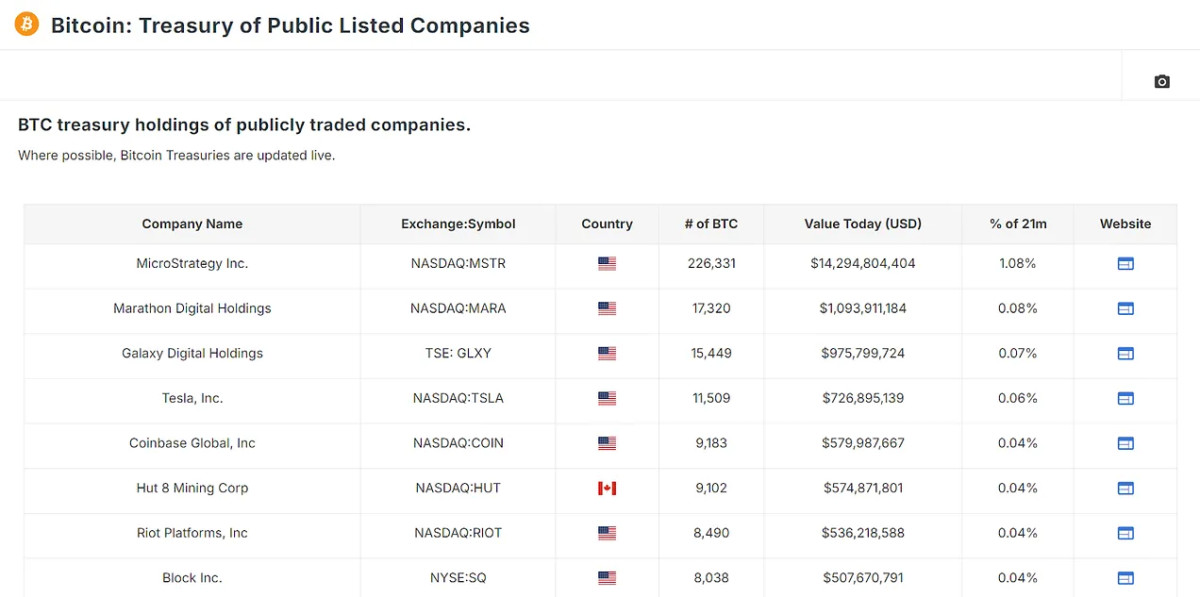

Main this motion is MicroStrategy, which alone holds over 1% of the whole Bitcoin provide. Following MicroStrategy, different distinguished gamers embrace Marathon Digital, Galaxy Digital, and even Tesla, with important holdings additionally present in Canadian corporations comparable to Hut 8 and Hive, in addition to worldwide corporations like Nexon in Japan and Phoenix Digital Property within the UK; all of which might be tracked by way of the brand new Treasury knowledge charts obtainable on website.

In whole, these corporations maintain over 340,000 bitcoin. Nonetheless, the actual game-changer has been the introduction of Bitcoin ETFs. Since their inception, these monetary devices have attracted billions of {dollars} in investments, ensuing within the accumulation of over 91,000 bitcoin in only a few months. Collectively, non-public corporations and ETFs management round 1.24 million bitcoin, representing about 6.29% of all circulating bitcoin.

A Have a look at Bitcoin’s Current Worth Actions

To grasp the potential future impression of institutional funding, we will take a look at current Bitcoin value actions for the reason that approval of Bitcoin ETFs in January. On the time, Bitcoin was buying and selling at round $46,000. Though the value dipped shortly after, a basic “purchase the rumor, promote the information” situation, the market shortly recovered, and inside two months, Bitcoin’s value had surged by roughly 60%.

This enhance correlates with institutional traders’ accumulation of Bitcoin by way of ETFs. If this sample continues and establishments preserve shopping for on the present or elevated tempo, we may witness a sustained bullish momentum in Bitcoin costs. The important thing issue right here is the idea that these institutional gamers are long-term holders, unlikely to unload their belongings anytime quickly. This ongoing accumulation would cut back the liquid provide of Bitcoin, requiring much less capital influx to drive costs even greater.

The Cash Multiplier Impact: Amplifying the Impression

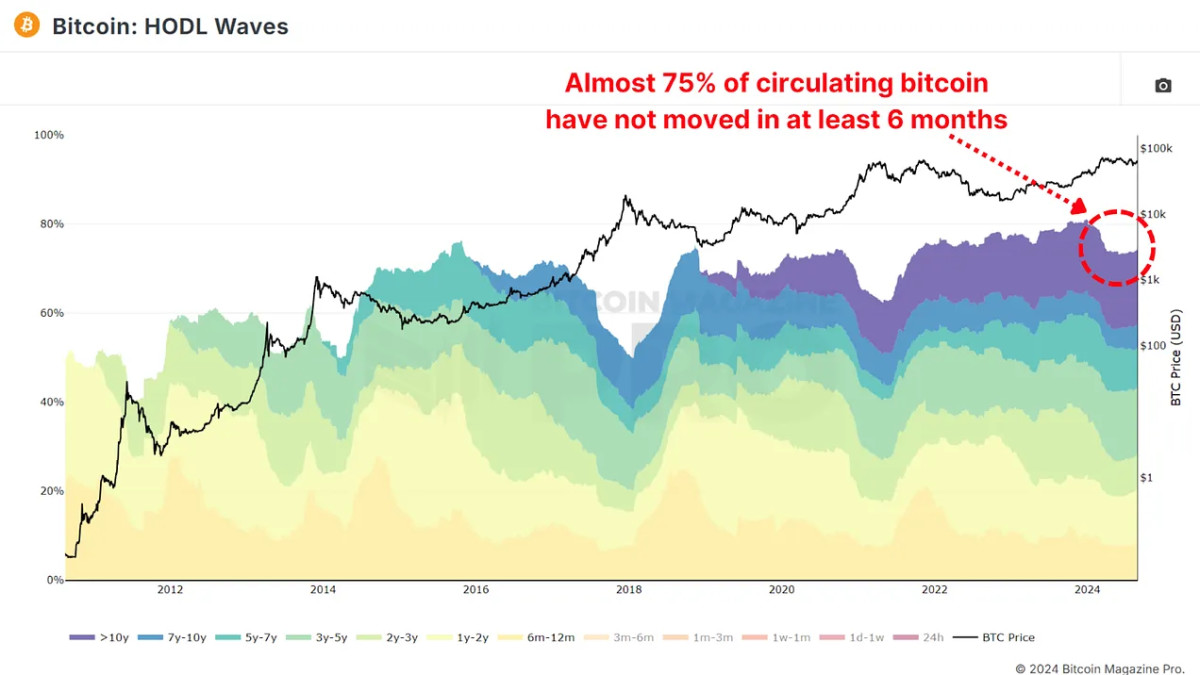

The buildup of belongings by institutional gamers is important. Its potential impression available on the market is much more profound when you think about the cash multiplier impact. The precept is simple: when a big portion of an asset’s provide is faraway from energetic circulation, such because the practically 75% of provide that hasn’t moved in at the least six months as outlined by the HODL Waves, the value of the remaining circulating provide might be extra unstable. Every greenback invested has a magnified impression on the general market cap.

For Bitcoin, with roughly 25% of its provide being liquid and actively traded, the cash multiplier impact might be significantly potent. If we assume this illiquidity leads to a $1 market influx enhance available in the market cap by $4 (4x cash multiplier), institutional possession of 6.29% of all bitcoin may successfully affect round 25% of the circulating provide.

If establishments had been to start offloading their holdings, the market would possible expertise a major downturn. Particularly as this may possible set off retail holders to start offloading their bitcoin too. Conversely, if these establishments proceed to purchase, the BTC value may surge dramatically, significantly in the event that they keep their positions as long-term holders. This dynamic underscores the double-edged nature of institutional involvement in Bitcoin, because it slowly then out of the blue possesses a better affect on the asset.

Conclusion

Institutional funding in Bitcoin has each optimistic and detrimental points. It brings legitimacy and capital that might drive Bitcoin costs to new heights, particularly if these entities are dedicated long run. Nonetheless, the focus of Bitcoin within the fingers of some establishments may result in heightened volatility and important draw back threat if these gamers determine to exit their positions.

For a extra in-depth look into this matter, take a look at a current YouTube video right here: