Conventional finance (TradFi) is beginning to take the lead on tokenizing real-world property (RWA), says blockchain knowledge tracker Kaiko Analytics.

In line with a brand new Kaiko Analysis publish, TradFi giants like Constancy, JPMorgan, and BlackRock are main the brand new wave of RWA tokenization utilizing crypto.

“Final week, Constancy Worldwide introduced its participation in JPMorgan’s tokenized community, turning into the most recent institutional participant to hitch the quickly rising tokenization development. In parallel, BlackRock’s BUIDL, its tokenized liquidity fund, continues to develop and has now amassed over $460 million.

Since its launch in March, BlackRock’s BUIDL has outpaced a number of crypto-native corporations, together with Maple Finance’s Money Administration Fund, which focuses on short-term money devices. Though Maple has been lively within the house for years and recovered from the 2022 crypto lending providers collapse, its Money Administration Fund has solely amassed round $16 million in property, paling compared to BUIDL.”

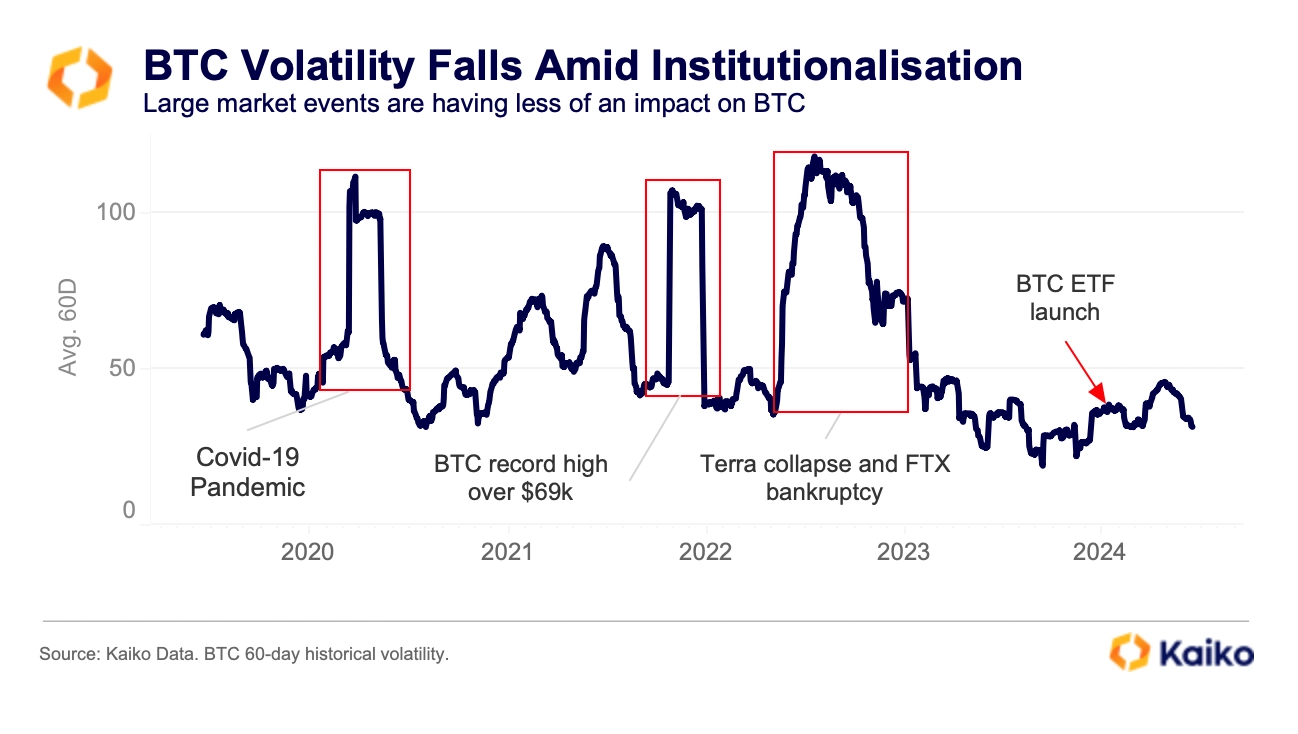

Trying on the flagship crypto Bitcoin (BTC), Kaiko means that BTC’s decreased volatility is an indication of the asset’s maturation.

“Though BTC might need been on a rollercoaster experience pushed by macro information final week, it’s clear that the digital gold has reached a brand new stage of maturity in 2024. This may be noticed in its declining volatility, with BTC’s 60-day historic volatility remaining beneath 50% because the starting of 2023. This stands in stark distinction to the numerous fluctuations of 2022, when volatility exceeded 100%.”

BTC is value $64,527 at time of writing.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Worth Motion

Observe us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any losses it’s possible you’ll incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney