Key Takeaways:

WLFI $USD1, a stablecoin tied to Trump’s camp, hit $1.25 billion in each day buying and selling quantityAlmost $991 million of the quantity was from simply 10 buying and selling pairs, totally on PancakeSwap V3Market observers level to its fast progress as a reputable risk to stablecoin giants like USDT

The crypto market simply witnessed an sudden breakout. WLFI $USD1, the dollar-pegged stablecoin sponsored by entities associated to former U.S. President Donald Trump, noticed a staggering 24-hour quantity whole of $1.25 billion. This spike did extra than simply elevate eyebrows — it has high stablecoins together with USDT on discover.

WLFI’s Meteoric Rise: From Quiet Launch to Market Disruptor

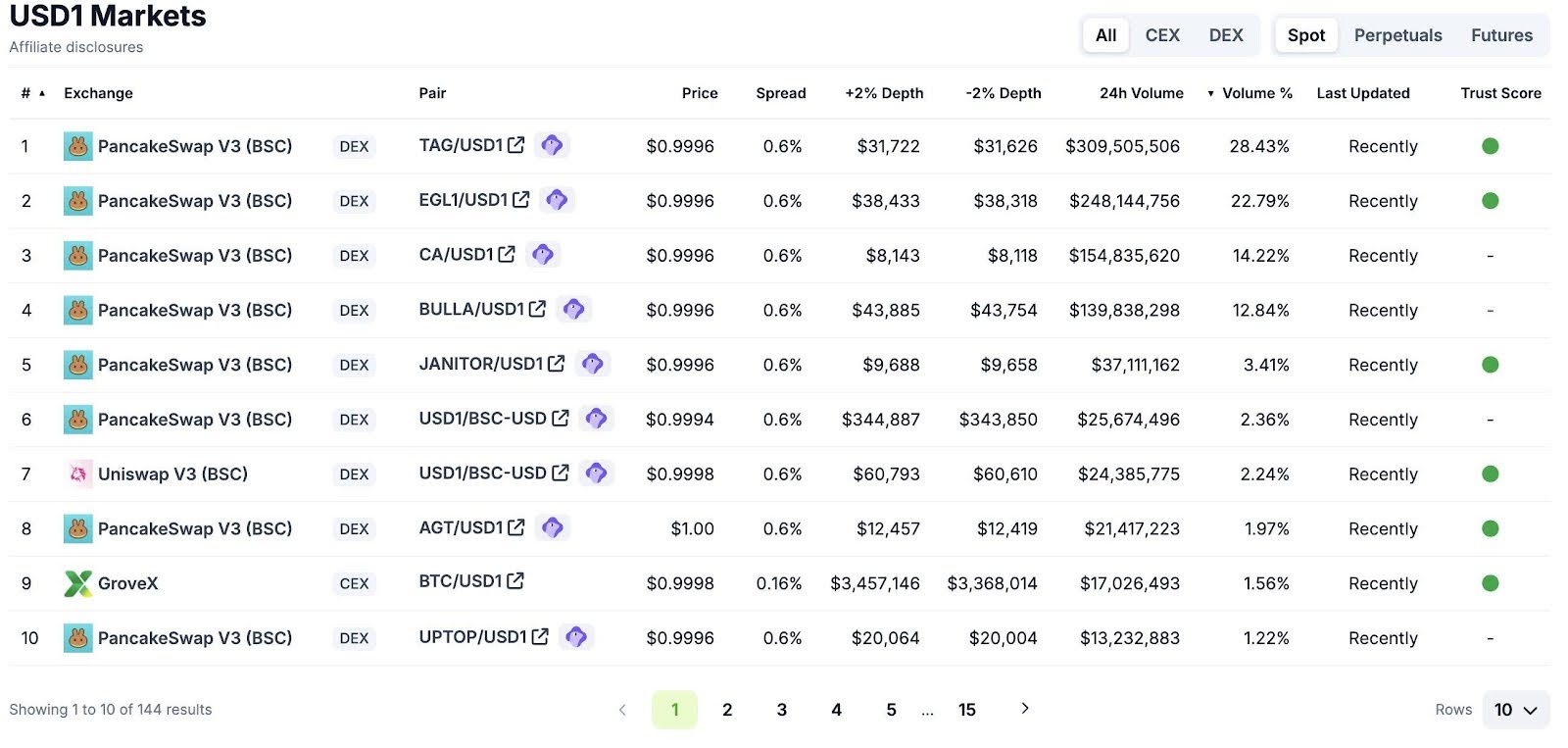

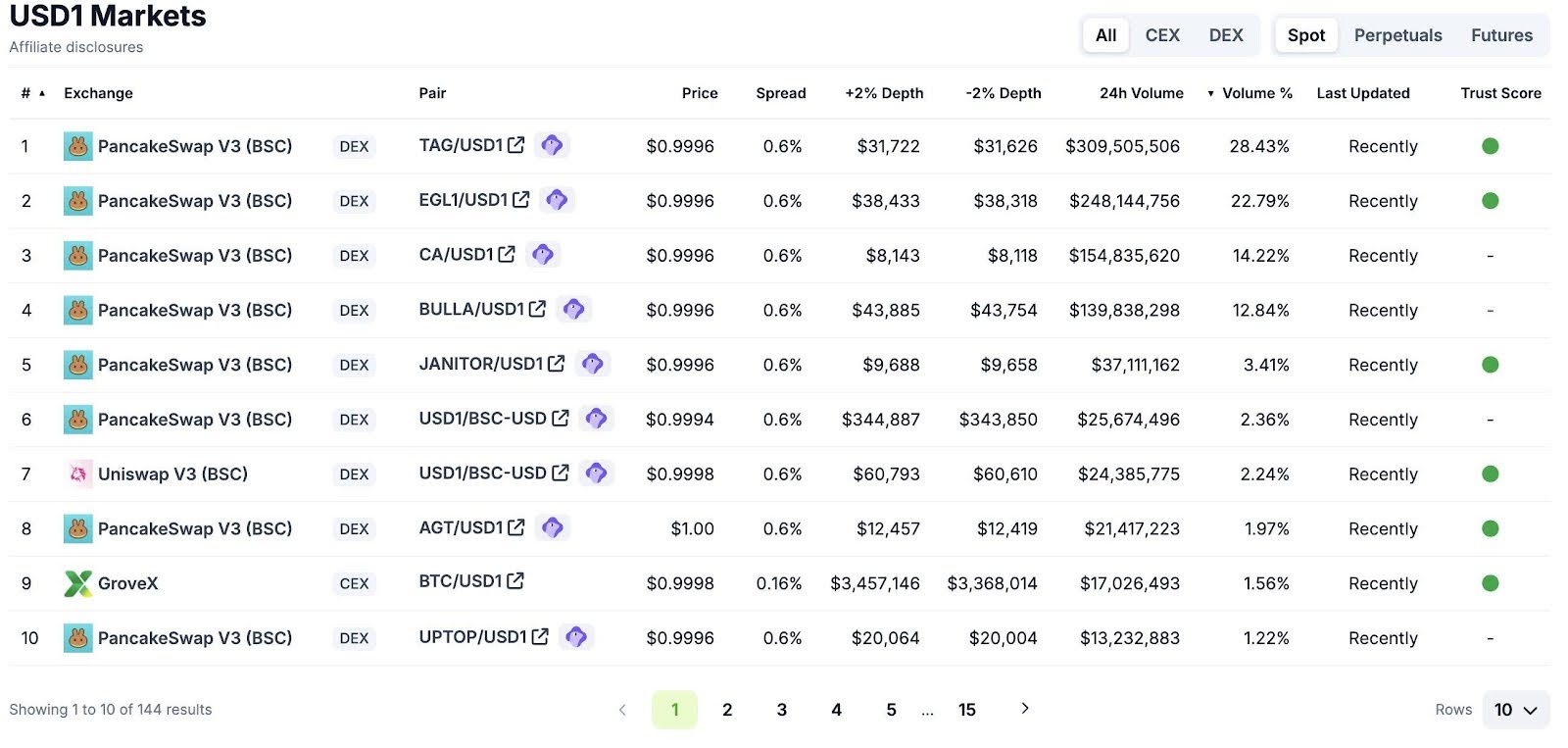

USD1 just isn’t a mean stablecoin. Launched with out a lot fanfare, it’s now the thing of intense curiosity due to what’s been taking place out there. Based mostly on on-chain knowledge, the token’s 24-hour quantity surged to $1.25 billion on June 29, 2025, with almost $991 million coming from its first 10 buying and selling pairs.

Nearly all of the liquidity was funnelled into PancakeSwap V3 on Binance Good Chain (BSC) which now serves as WLFI main ecosystem. Analysts consider this was a strategic play in a bid to make use of BSC’s low charges and deep liquidity to rapidly scale person participation.

What makes this much more noteworthy is the WLFI was in a position to attain this quantity with minimal publicity from CEX. Many of the quantity got here from DeFi functions, suggesting an elevated demand for stablecoins in decentralized finance and doubtlessly dissatisfaction with the way in which legacy gamers like USDT and USDC have been conducting themselves.

Learn Extra: World Liberty Monetary Invests $4M in AVAX and MNT Regardless of Portfolio Losses

A Trump-Backed Token? Unpacking the Political Affiliation

Although WLFI doesn’t explicitly come from Donald Trump or his marketing campaign, its model and backers are a direct throughline to his political base. Selling the stablecoin are some crypto influencers who’re related to supporting Trump’s run in 2024; WLFI is rumored to be backed by donors and supporters from inside Trump’s circle.

The seems to be marketed in direction of pink meat consuming retail buyers and politically lively merchants. That’s not too dissimilar from the humorous rise of so-called meme tokens like MAGA Coin or TrumpCoin, however in contrast to these extremely risky meme cash, WLFI is constructed to take care of a 1:1 peg to the U.S. greenback, theoretically giving it an edge in relation to perceived belief and utility.

Whereas the Trump affiliation is actually tacking on buzz, it’s WLFI’s liquidity and technical growth that has folks .

Learn Extra: World Liberty Monetary of Trump to Introduce USD1 Stablecoin Backed by U.S. Treasuries

Stablecoin Market Dynamics: WLFI vs. the Titans

Might WLFI Problem USDT’s Dominance?

Tether (USDT) and Circle’s USDC have lengthy been the stablecoin stars, with USDT main in DeFi quantity, and USDC being the selection for compliance and institutional use. However newcomers like WLFI are illuminating market demand for different choices.

WLFI’s $1.25 billion quantity day places it within the race for the highest spot within the non-centralized stablecoin market, a minimum of within the short-term. For comparability:

USDT usually data $50–70B in each day quantity, however that features a whole bunch of buying and selling pairs throughout dozens of exchangesWLFI achieved over 1.7% of USDT’s each day quantity in simply in the future, with out assist from main centralized exchanges like Binance or Coinbase

WLFI’s fast motion inside DeFi might point out that customers are experimenting with it as a high-liquidity substitution for swapping, yield farming and collateralization — use-cases traditionally dominated by USDT and USDC.

On-Chain Metrics Recommend Natural Development

On-chain knowledge signifies that WLFI’s liquidity swimming pools have garnered tens of 1000’s of distinctive pockets addresses, implying a real neighborhood of particular person customers as distinct from bots or wash-trading initiatives.

Key figures:

There have been greater than 17,000 lively wallets in WLFI Buying and selling pairs within the final 24 hours$350M of WLFI was locked in DeFi, unfold primarily throughout BSC and Ethereum bridgesThe stablecoin is preserving the true to the U.S. greenback inside ±0.1%, a strong efficiency metric for a brand new token

These statistics additionally improve WLFI’s credibility as a long-term operation. Although to a handful of skeptics the promotion trick may merely be inflicting the surge, the quantity, peg, and person interplay stay in standing for sustainable progress.

Regulatory Questions Loom

Regardless of its fast enlargement, WLFI’s authorized standing is unclear. And given it’s a dollar-pegged token that’s largely being utilized in DeFi, it might be a focus for U.S. regulators, particularly if its backers embrace political figures or main marketing campaign donors.

Regulators have lately ratcheted up their scrutiny of stablecoins, particularly people who develop rapidly and whose reserves aren’t absolutely disclosed, with the SEC and the U.S. Treasury growing their oversight. WLFI claims to be 100% hedged by money equal devices however as but we’ve got not seen any audited financials.

If WLFI plans to develop and doubtlessly facilitate transactions in centralized exchanges the regulators want to supply readability and transparency.

Amidst growing buying and selling quantity, media publicity, and DeFi momentum, WLFI has reached a pivotal inflection level.