President Trump’s new retaliatory tariff coverage on imported gear from Asia has considerably elevated the price of Bitcoin mining within the U.S. Whereas mining companies wrestle with disrupted provide chains, some recommend that BTC costs may face short-term strain because of miner misery.

“Replay of China’s 2021 Bitcoin Mining Ban” from U.S.

In a transfer many within the business liken to a “replay of China’s 2021 Bitcoin mining ban,” President Donald Trump and the U.S. administration have imposed tariffs of as much as 145% on high-tech gear imported from China, together with Bitcoin mining rigs.

Not solely China, however a number of Asian nations concerned within the provide chain and meeting of mining machines will even face elevated tariffs.

Many U.S.-based Bitcoin mining corporations rushed to import gear earlier than the tariffs took impact, with some even chartering non-public planes to ship mining rigs – incurring prices between 2 million USD and three.5 million USD, two to 4 instances the same old fee, in line with Bloomberg.

Learn extra: Crypto Market Jumped Again After Trump’s Tariff Delay Bombshell

Nevertheless, this rush is just a short lived resolution. Beginning April 9, the worth of Bitcoin mining gear is anticipated to surge, particularly for rigs sourced from China, which nonetheless dominates the worldwide provide chain.

“Mixed with the strain from retaliatory tariffs, mining rig costs will rise additional, and miners’ revenue margins shall be more and more squeezed,” mentioned Csepcsar – CMO of Braiins.

Hashrate index – Supply: Thanh Nien Occasions

Bloomberg additionally reported that the 2 largest Bitcoin mining rig producers on the planet – Bitmain and MicroBT, have been compelled to regulate their provide chains, relocating a part of their meeting operations to nations similar to Malaysia or Japanese Europe.

In the meantime, main U.S. mining companies like Riot Platforms and Marathon Digital additionally noticed a slight decline of their inventory costs following the information of the brand new tariffs.

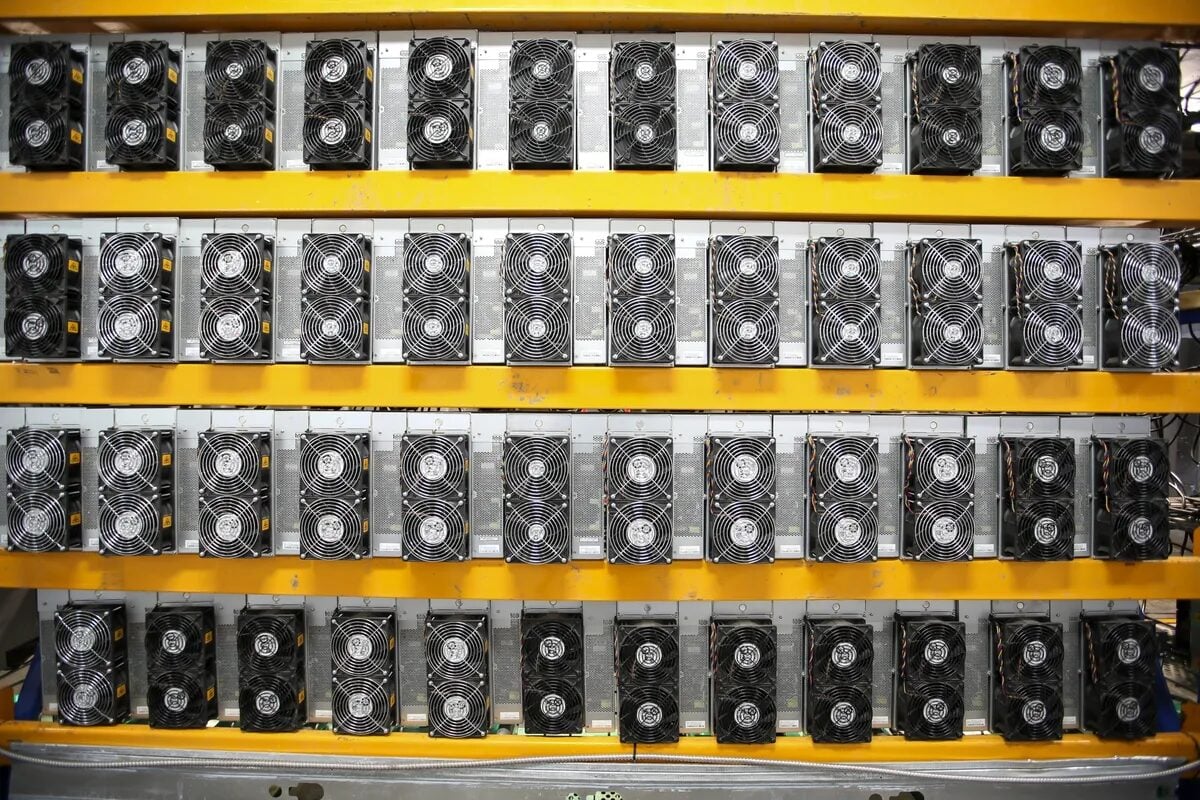

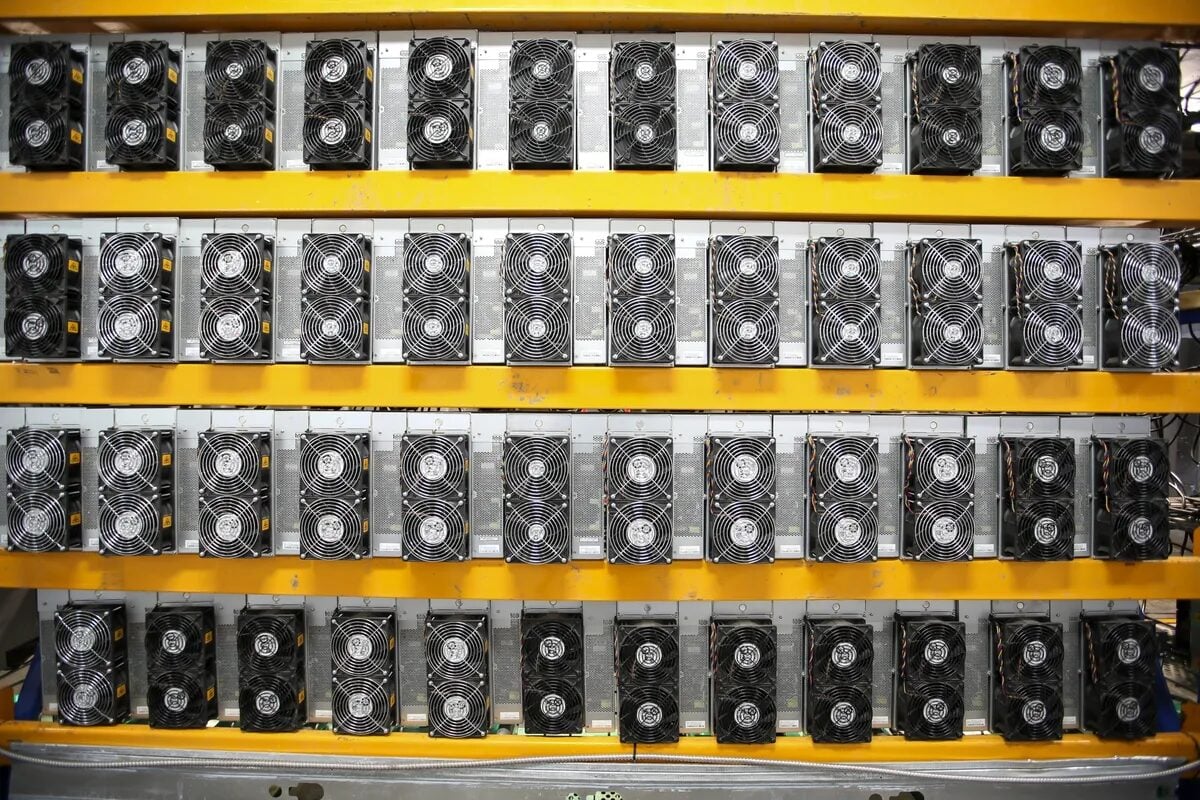

Bitcoin miners – Supply: Bloomberg

The U.S. Could No Longer Main the Hashrate Race

This raises the query: Is the U.S. presently accounts for almost 40% of the worldwide Bitcoin hashrate, pushing itself out of the main place?

When a rustic controls a big share of hashrate, it could actually:

Create jobs and contribute to GDP via infrastructure funding, electrical energy era, and auxiliary providers.Make the most of surplus electrical energy, turning mining right into a device for stabilizing the nationwide energy grid.Entice worldwide funding into sectors like know-how, AI, and renewable vitality.

Shedding this benefit couldn’t solely weaken the U.S. home mining business but additionally diminish the nation’s function within the world digital finance ecosystem. Opponents similar to Russia and Kazakhstan – each of which get pleasure from low cost electrical energy and favorable climates, could progressively reclaim market share.

“If the commerce struggle continues to escalate, areas with low tariffs and favorable situations may expertise a significant rise,” mentioned Csepcsar.

Jaran Mellerud from Luxor notes U.S. miners gained’t shut down quickly, since tariffs have an effect on solely new gear. As such, he believes the whole U.S. hashrate hasn’t declined, however its progress has slowed.

A couple of days in the past, Donald Trump launched large tariffs on the import of Bitcoin mining machines to the US 🇺🇸

This might have monumental implications for all the bitcoin mining business 🌍

Hold studying to study extra 🧵👇 pic.twitter.com/cbg37RNq7n

— Jaran Mellerud 🟧⛏️ (@JMellerud) April 8, 2025

Nonetheless, mounting tariff strain on Bitcoin miners may influence BTC’s worth within the brief time period.

Bitcoin, delicate to hashrate shifts, could drop if provide chains break or miners transfer to unstable areas. Slower {hardware} funding and unstable provide chains could put downward strain on BTC within the brief time period.

Observers warning that rising hashrate in Russia or Kazakhstan could increase dangers of coverage management and transparency points.

Conclusion

If the U.S. maintains its present hashrate and provide chains adapt easily, BTC may see a modest restoration. Conversely, if the hashrate shifts overseas, notably to areas with political danger, BTC may see a modest restoration. BTC’s worth could proceed to say no or change into extremely risky.

Extra broadly, the tariff tensions sign a rising geopolitical tug-of-war over who controls the computational spine of decentralized finance. Bitcoin hashrate now indicators digital sovereignty, not simply technical power. Mining dominance lets nations affect vitality, upgrades, and crypto coverage—impacts transcend simply worth strikes.

Learn extra: Simply In: Ethereum Precipitously Fell to the Lowest of 2024-2025