Everybody has heard the Chinese language proverb British misquote: “Might you reside in fascinating occasions,” and the way it’s imagined to be a curse. It sounds deep, like a quote for edgelords over 80.

However have you ever ever thought-about the choice? In keeping with the Anglo-Saxon Chronicle, there have been practically two centuries the place nothing a lot occurred. Vivian Mercier famously referred to as Ready for Godot “a play wherein nothing occurs, twice.” However nothing occurring 191 occasions? I’ll take fascinating occasions any day.

And that’s precisely what we’ve got now. Tether, with their stablecoin USDT, are coming to Lightning. We’ve been speaking rather a lot just lately about how Lightning is the widespread language of the bitcoin economic system and the way bitcoin is a medium of alternate (and it truly is; learn our report).

These two arguments now appear to be converging. Due to Lightning working as a standard language, it makes bitcoin interoperable with a variety of adjoining applied sciences, like USDT. And USDT goes to turbocharge bitcoin into new use instances, new markets, and new challenges on a scale that the Lightning ecosystem has but to expertise.

Given the selection, I’d fairly dive head first into the unknown than spend the afternoon on the sofa. All of the cool stuff is within the unknown. (Picture: pxhere)

Given the selection, I’d fairly dive head first into the unknown than spend the afternoon on the sofa. All of the cool stuff is within the unknown. (Picture: pxhere)

Given the selection, I’d fairly dive head first into the unknown than spend the afternoon on the sofa. All of the cool stuff is within the unknown. (Picture: pxhere)

USDT on Lightning is terra incognita. Attention-grabbing occasions certainly. So let’s take into consideration what it means for USDT to affix Lightning and for Lightning to maneuver USDT — the alternatives, the dangers, and the huge open questions.

Lightning was initially supposed to extend the throughput of the bitcoin blockchain, so bitcoin was to be its solely cargo. Taproot Belongings is a brand new protocol that enables fungible belongings (e.g. stablecoins) to be transmitted over Lightning as hashed metadata piggybacking on the identical infrastructure used to course of bitcoin funds.

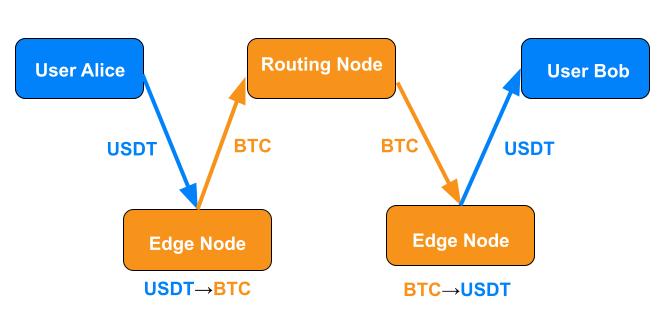

The way in which it really works is fairly easy for anybody who understands Lightning. The recipient generates an bill that pings edge nodes (i.e. the nodes connecting customers to the broader community) for alternate charges between bitcoin and the asset in query — USDT within the present case. As soon as the consumer accepts an edge node’s alternate fee, they generate an bill for the fee and ship it to the payer. The payer sends the asset to the sting node on their very own facet, the sting node converts every thing right into a normal-looking bitcoin fee, the fee proceeds via routing nodes alongside the community as regular, the sting node on the recipient’s finish converts the fee again into the unique asset (USDT) and forwards it to the recipient.

Taproot Belongings leverages the flexibility of Lightning and bitcoin to let customers switch new sorts of belongings over the community, utilizing bitcoin because the common medium of alternate. One corollary of all of the nodes talking Lightning is that any routing nodes between the sting nodes see solely BTC in transit. Lightning tells them easy methods to transfer BTC, and that’s all they’re doing so far as they know. Superior.

However there’s extra to it than simply technical specs. USDT is, in any case, an enormous medium of alternate. Tens of billions of USDT worth change palms day-after-day unfold throughout thousands and thousands of funds. Its every day buying and selling volumes are in the identical ballpark because the Brazilian actual and the Indian rupee. This can be a huge deal. So what does Lightning imply for USDT, and what does the addition of USDT imply for Lightning?

… for Bitcoin

Up to now, a lot of the technique to bitcoinizing commerce has targeted on orange pilling as many individuals as attainable and rising the round economic system one consumer at a time. This technique has maybe reached the boundaries of its scale. The circle has grown massively within the final decade and a half, but it surely’s nonetheless restricted, and we have to assume when it comes to thousands and thousands at a time.

Now that USDT and BTC are natively interoperable on Lightning, the circle has gained tangents. With USDT on Lightning, every social gathering to a fee — the payer and the recipient — can select whether or not to make use of BTC or USDT on their very own finish, and neither is determined by the opposite’s determination. A buyer pays in BTC, and the service provider can obtain USDT. Or the shopper pays in USDT, and the service provider can obtain BTC. Or they will each use the identical asset. It doesn’t matter. As soon as each belongings are native to Lightning, they turn into routinely, frictionlessly interchangeable. Everyone seems to be free to go for bitcoin’s benefits as a medium of alternate grown from the underside up by the customers or for USDT’s benefits as an asset whose worth is as steady as US financial coverage and Tether’s liquid reserves.

Lightning and, by extension, bitcoin stand to realize thousands and thousands of customers and billions of {dollars} price of spending energy. It’s a qualitative extension of bitcoin’s utility. The brand new use instances will do extra good for bitcoin than a boatload of orange drugs. It’s additionally probably a quantitative explosion for Lightning. Lots of these new customers may not even know that they’re utilizing Lightning because of its efficacy because the widespread language of the bitcoin economic system. However we ol’ college Lightning vets know. That is what we’ve been constructing in direction of.

And since we simply talked about how Lightning would make USDT simpler for American customers to entry, USDT may also make it simpler for them to make use of Lightning. American tax regulation treats BTC like an fairness, making every fee a probably advanced concatenation of tax occasions. But when US customers can entry Lightning with an asset that by no means incurs capital features, then they’ll have entry to lots of Lightning’s benefits with out one in all its specific regulatory drawbacks.

…for Tether

Tether usually points USDT on confirmed blockchains which have achieved important market traction, and so they have little interest in launching their very own. USDT is presently out there on Algorand, Celo, Cosmos, Ethereum, EOS, Liquid Community, Solana, Tezos, Ton, and Tron. Notice that these are all proof-of-stake (PoS) blockchains (besides Liquid, which makes use of a federation), so that they’re essentially extra centralized than bitcoin.

These blockchains additionally face completely different tradeoffs. Ethereum is comparatively decentralized for a PoS blockchain, however its transaction charges are notoriously excessive. Tron is cheaper. Maybe that’s why, in response to one estimate, practically 7x extra month-to-month lively retail USDT customers go for Tron over Ethereum and ship 8x extra retail quantity over Tron. However Tron is notoriously centralized, making it a choke level for USDT. If Tron have been to fail, Tether would lose one thing like half of its whole capability throughout all blockchains. Ouch. By permitting USDT to be transacted over Lightning, which is inherently decentralized, Tether mitigates their dependency on low cost, centralized blockchains.

Additional, Lightning might make USDT way more handy to make use of within the US market. US exchanges generally restrict USDT transactions to sure blockchains. For instance, Coinbase says “Coinbase solely helps USDT on the Ethereum blockchain (ERC-20). Don’t ship USDT on another blockchain to Coinbase.” Lightning offers huge exchanges like Binance, Coinbase, and Kraken (which already assist Lightning immediately) a decentralized various for USDT funds to supply their customers.

The brand new American administration has mooted onshoring your entire stablecoin trade and instructed that regulating it’s their “first precedence.” In different phrases, they’ll be paying very shut consideration to each growth. So long as stablecoins like USDT are pegged to the greenback, those that management the greenback and revenue from it would wish to management the stablecoins too.

Regulators assume they will even enhance on freedom by regulating it. They will’t assist it. It’s of their nature. Nevertheless it follows that, as USDT features utility on Lightning and Lightning features utility as a way to maneuver USDT, we’re all going to be attracting higher scrutiny from regulators. It’s laborious to say how a lot they’ll really be capable to do or what they’re going to strive, but it surely gained’t be any enjoyable. Regulation is at all times friction.

One space that’s prone to appeal to regulatory scrutiny is the sting nodes. Typical centralized exchanges are typically topic to KYC/AML guidelines in lots of jurisdictions. If the sting nodes shall be routinely exchanging USDT and BTC and forwarding funds, they could additionally look rather a lot like typical exchanges to regulators, who have a tendency to not like decentralization. 🙄

What’s It Price? What’s It Value?

Whereas Lightning does provide customers and USDT some important advantages, it’s not clearly the perfect all-around answer for each fee involving USDT. Lightning customers anticipate low charges. So do USDT customers who use centralized blockchains and custodial exchanges. However including a second asset to Lightning provides some monetary issues that everybody — routing nodes, customers, and particularly edge nodes — should reckon with.

First, the sting nodes are offering the standard duties of LSPs — holding customers related to the community with sufficient channels and sufficient liquidity to maintain these funds transferring — along with changing between belongings. That conversion is a priceless service that deserves compensation, and it can be dangerous (see under).

Second, USDT is prone to improve transaction quantity significantly, which signifies that LSPs and routing nodes should hold extra liquidity on the community to ahead these funds. They don’t take the identical shortcut as custodial exchanges, which simply should replace their inner ledgers. The economics of liquidity allocation nonetheless apply, solely extra so.

Will Lightning be capable to compete with centralized exchanges like Tron for USDT funds? The reply will in all probability resemble the reply to most questions on matching applied sciences with use instances: every expertise may have sure strengths and weaknesses that advocate it for sure use instances and never others. As regular, the market will determine it out. Nonetheless, because the expertise wasn’t tailor-made to this specific use case, worth discovery shall be a technique of trial and error, which takes time.

Free Name Choices? Uh oh.

Edge nodes face the danger of the “free-call-option drawback,” which is fascinating sufficient to advantage its personal dialogue right here. This can be a new threat, and it’s inherent to any scenario involving two belongings in a single Lightning fee.

Lightning funds must be accomplished inside a sure time as a way to be settled, or the bill cancels routinely. That point is the “T” in HTLCs — hashed, time-locked contracts.

When the sting nodes bid with their alternate charges for a USDT↔BTC fee, they calculate their bids primarily based on parameters like their present liquidity scenario and the spot worth. However the customers have a window between accepting the sting node’s bid and the expiration of the HTLC wherein to settle the fee. Costs can transfer in that window. If I provoke a USDT fee at one fee, then I can wait till the speed strikes in my favor earlier than I launch the preimage to settle it. If the speed strikes towards me, I merely don’t launch the preimage. In that case, the sting node would possibly provoke a channel closure to redeem their funds, however that’s a gradual (and due to this fact expensive) course of. If it strikes in my favor, the sting node is on the hook for the distinction. Heads, I lose nothing. Tails, I fleece the sting node.

Funds involving any mixture of belongings on Lightning give the consumer a name choice. Conventional monetary establishments handle their draw back threat in promoting name choices by including the danger to the worth. These choices can get very costly for unprepared edge nodes. Simply ask Kilian and Michael at Boltz, who initially introduced this entire concern to my consideration and had the category to explain it for all of us within the ecosystem. The choice is for the sting nodes to cost the decision choice into their quotes, similar to conventional monetary establishments. Intertemporal arbitrage is nice work if you may get it.

Customers aren’t the one supply of concern for edge nodes both. If a routing node fails to ahead the preimage — whether or not via intent or malfunction — the sting node might nonetheless be on the hook. A minimum of with routing nodes, it is perhaps attainable to implement some type of repute system to assist select the route. Nonetheless, a repute system for finish customers may not be possible as new customers shall be continuously becoming a member of the community.

The free name choices have by no means been an issue for Lightning till now as a result of the community has solely handled a single asset: bitcoin. If the free-option drawback grew to become severe sufficient, one might think about a number of parallel, single-currency Lightning Networks rising. One for bitcoin. One for USDT. One other for … If bitcoin will get lower out of the loop, we’ll lose the good thing about bitcoin interoperability. We would even wind up regretting bringing USDT onto Lightning within the first place.

Bitcoin was at all times meant to be revolutionary. Disrupting damaged fiat is the entire level and at all times has been. We’re in it for the revolution. We all know that change and disruption was by no means going to be a easy course of.

However change is an effective factor. Progress is only a form of change that individuals welcome. We welcome USDT on Lightning as a result of we see the chance. It may well signify progress for USDT customers, for Lightning, and for bitcoin.

Like several change, although, it’s going to require cautious thought, preparation, sharp instincts, and fast reactions. You don’t go into uncharted territory with out the precise gear and some abilities. Anybody within the Lightning liquidity enterprise goes to face some new challenges, but in addition stands to make some huge features.

Tether stands to realize a cost-effective, decentralized distribution community and higher entry to the very important US market. Lightning stands to realize an enormous infusion of liquidity and customers. Bitcoin shall be natively interoperable with USDT. That’s why there’s a lot pleasure.

However regulators are watching. And edge nodes will solely provide the indispensable conversion providers if doing so is worthwhile, not ruinous. So let’s method this alteration as we do all new developments in Lightning: by considering laborious, designing rigorously, hardening our code, getting ready the market, and by no means shedding sight of our final purpose, which is to understand the common bitcoin economic system.

This can be a visitor put up by Roy Sheinfeld. Opinions expressed are totally their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.