Disclosure: It is a sponsored submit. Readers ought to conduct additional analysis previous to taking any actions. Study extra ›

The results of the US election is an important issue affecting the method of rate of interest cuts and liquidity return. After Trump was assassinated however survived, the results of the US election appears to have been locked upfront, which implies that extra rate of interest cuts appear to be on the best way. On this case, most dangerous belongings will profit, and crypto belongings and commodities, as non-equity belongings with doubtlessly higher efficiency, might get extra shares in portfolios.

Extra Charge Cuts?

In comparison with June, buyers’ expectations for rate of interest cuts have turn into rather more optimistic in July. Even within the “strong” interbank market, merchants have anticipated the federal funds charge to fall under 3.6% in Oct 2025, and the variety of charge cuts this 12 months might even exceed two.

The newest CPI information is one cause that impacts merchants’ expectations. The US unadjusted CPI YoY recorded 3.0% in Jun, decrease than the market expectation of three.1%, marking the bottom degree since June final 12 months. The seasonally adjusted CPI MoM for Jun was -0.1%, the primary adverse worth since Might 2020.

The Fed has repeatedly emphasised over the previous 12 months that the brink for charge cuts will not be merely “inflation returning to 2%” however “the Fed being extra assured in inflation returning to 2%.” Following this inflation report, it may be stated that the Fed has virtually met the brink for charge cuts, suggesting {that a} international rate-cutting cycle is about to start.

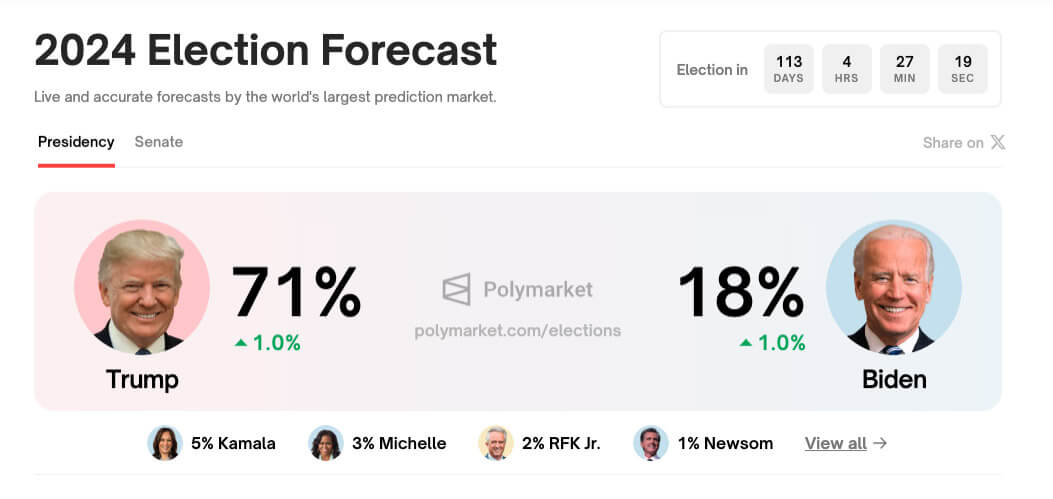

Though many buyers are involved in regards to the danger of re-inflation, as is the Fed, one other issue – the US election – is altering the load of re-inflation danger within the eyes of the Federal Reserve. After surviving final Sunday’s assassination, it’s virtually sure that Trump will win the 2024 election. In response to information from the prediction market web site Polymarket, Trump’s profitable charge has risen to 71%, which implies that the attainable influence of his future financial insurance policies must be taken under consideration early.

Contemplating that Trump is “very dissatisfied” with Powell’s present high-rate insurance policies and passive angle towards decreasing rates of interest and stimulating the financial system, the Fed might compromise on rate of interest coverage after Trump’s election, which implies that extra aggressive rate of interest insurance policies might emerge and convey a big launch of liquidity within the subsequent 1-2 years. Nonetheless, there isn’t any doubt that this can come at the price of attainable future inflation and recession.

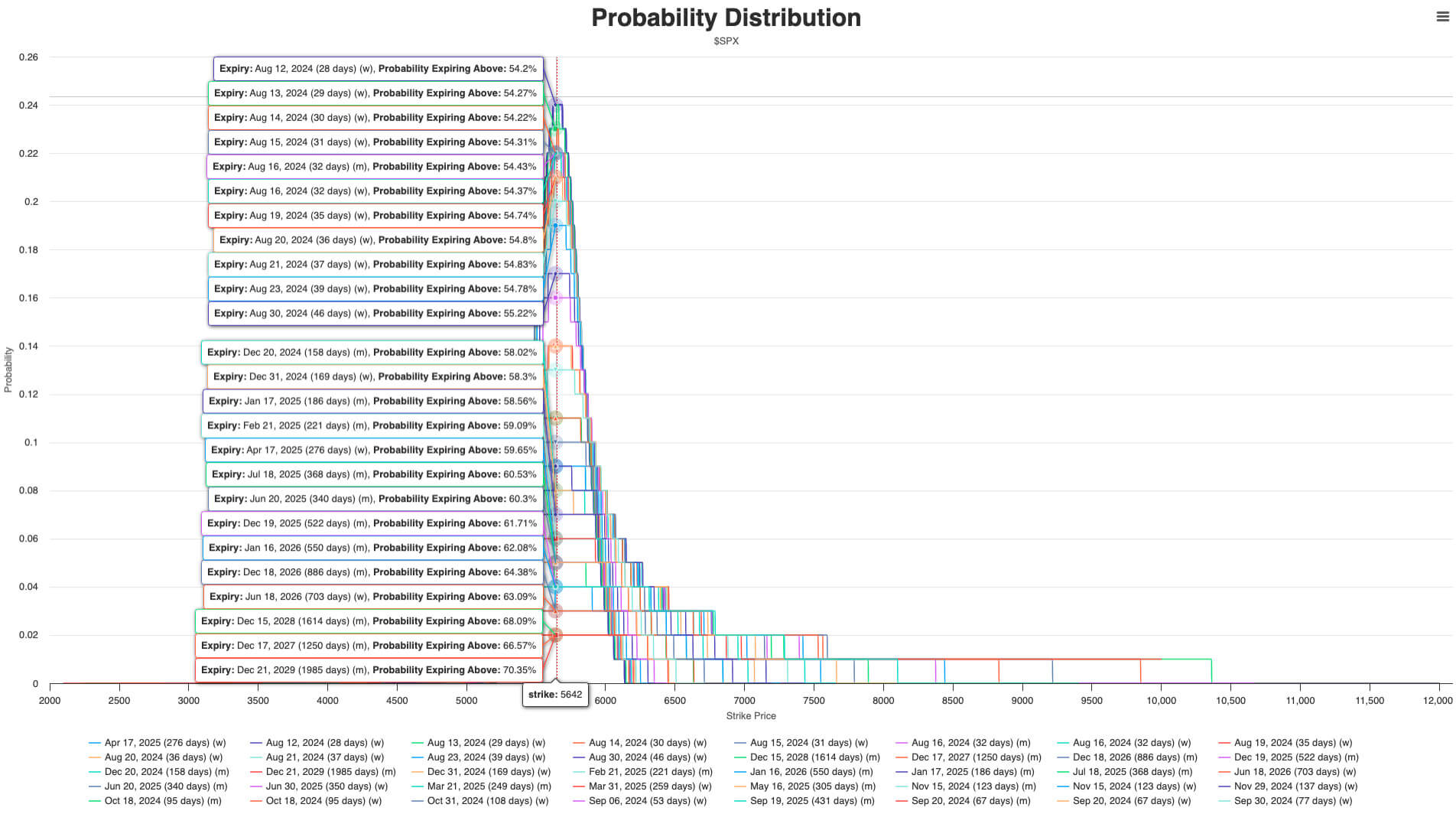

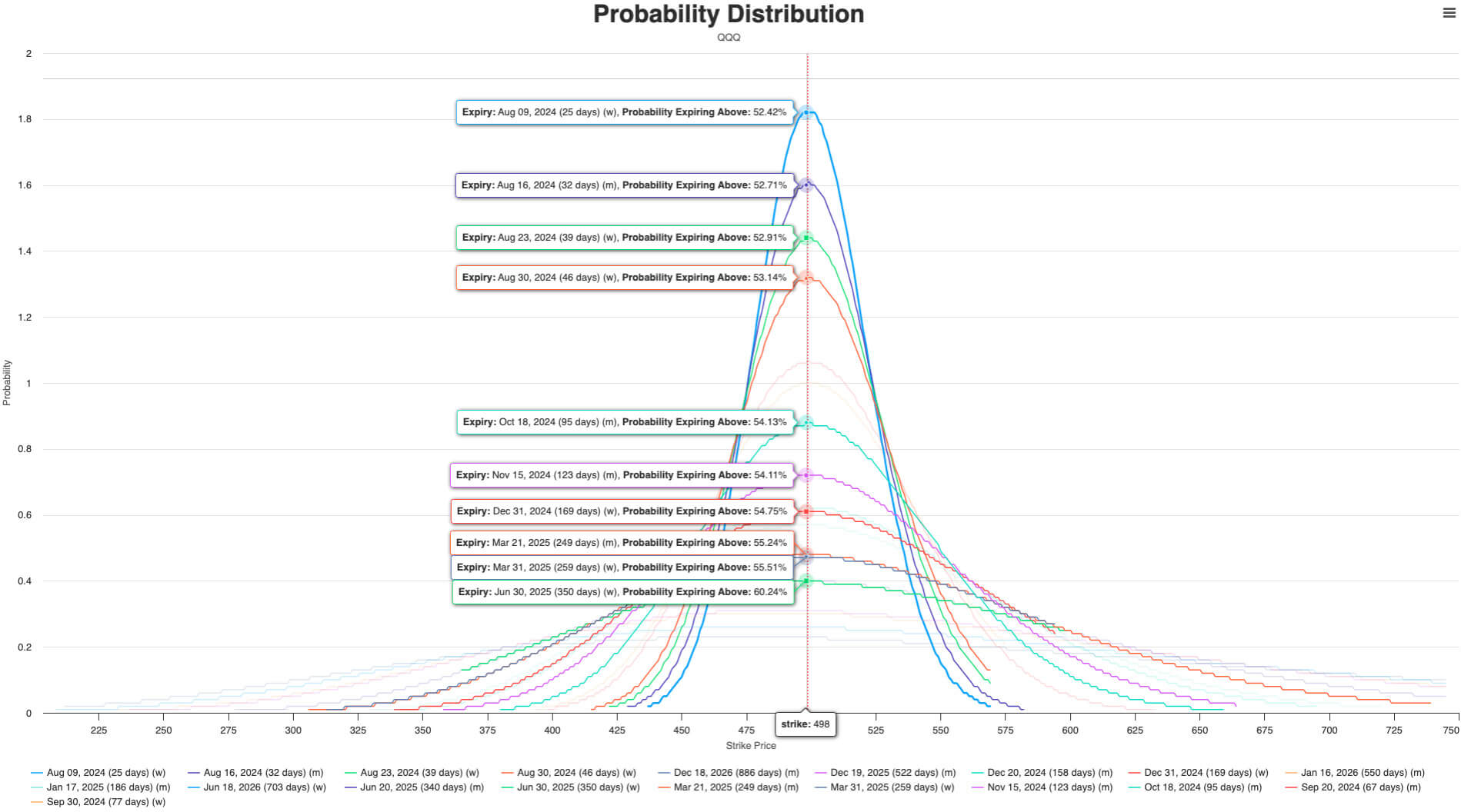

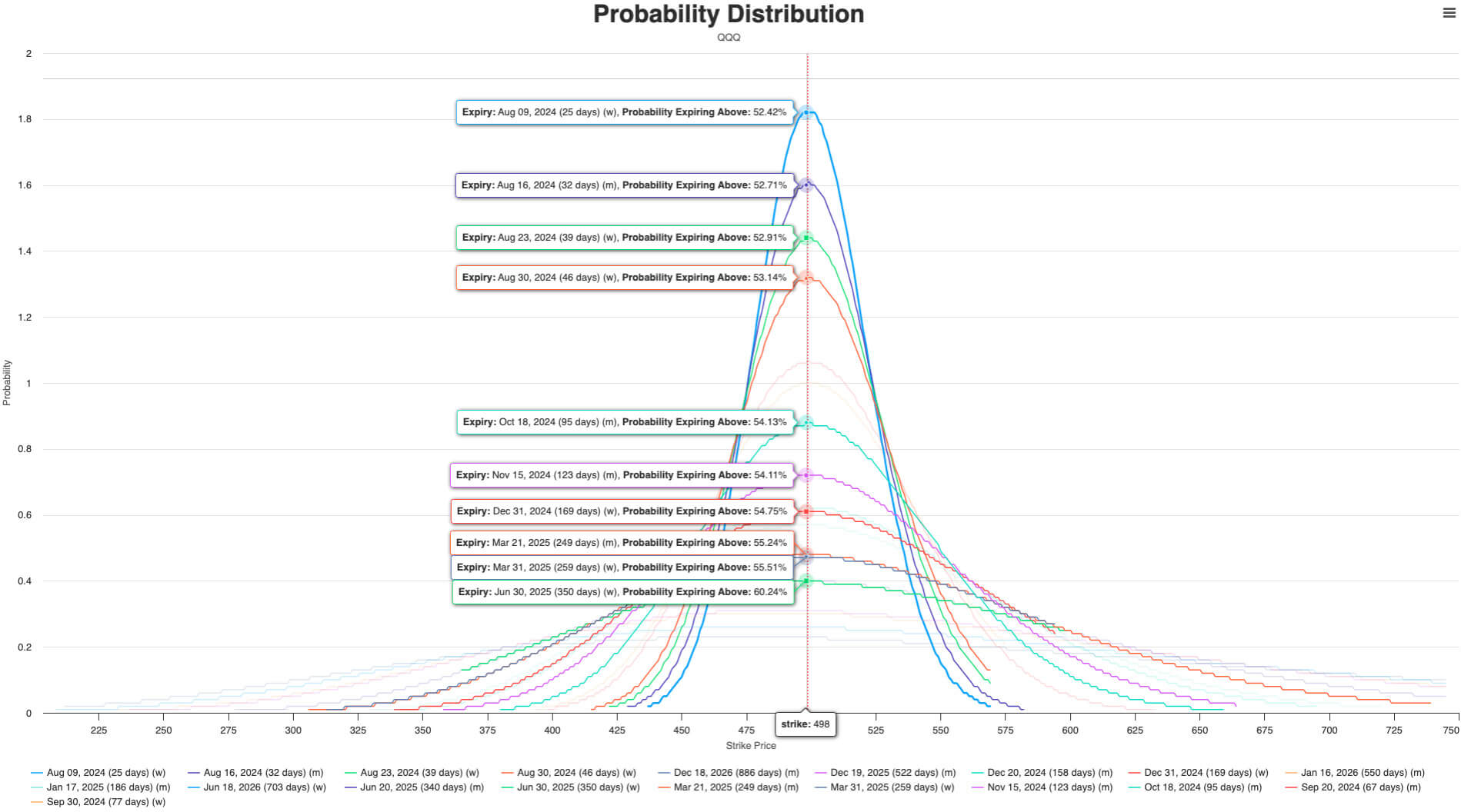

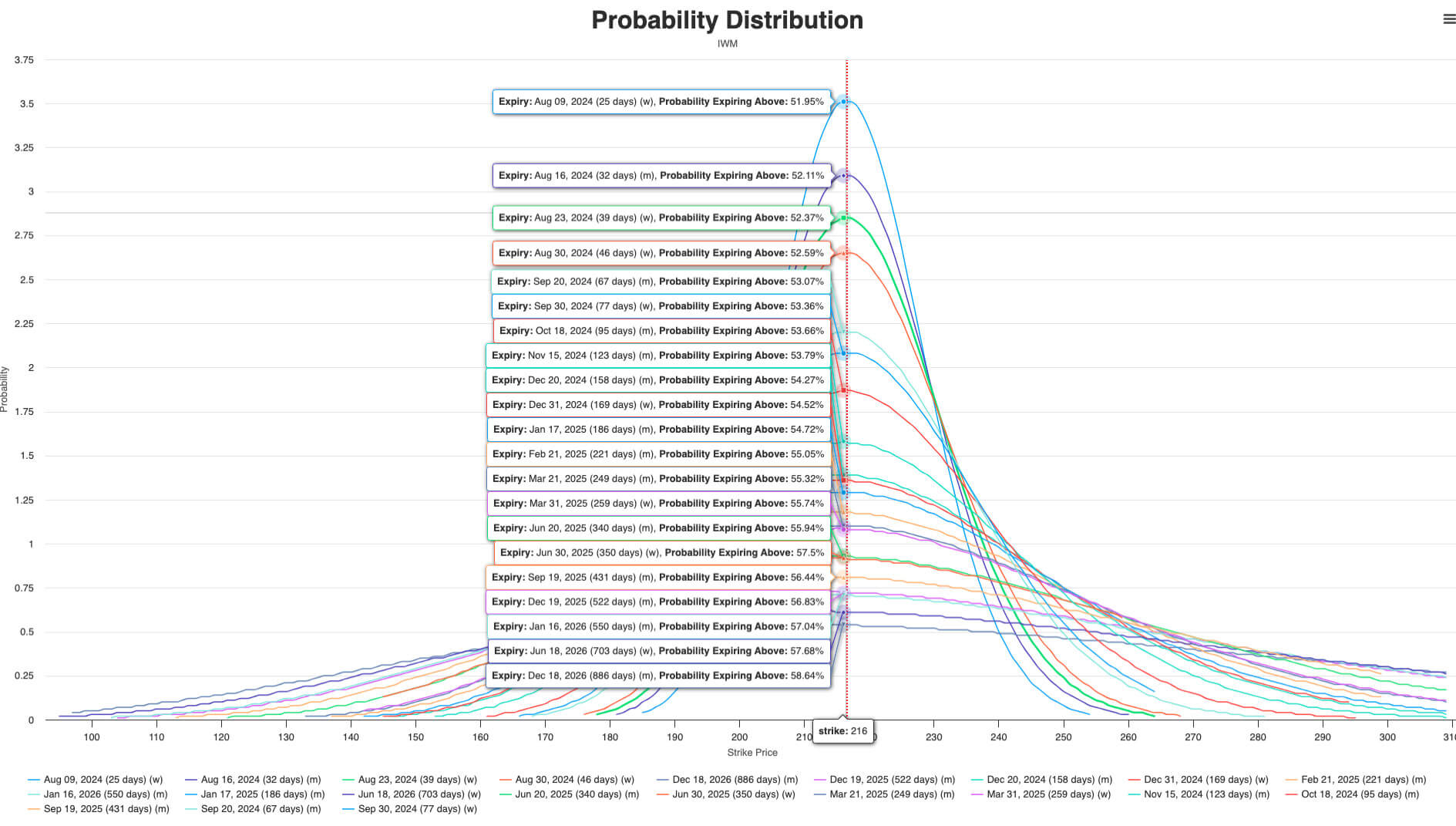

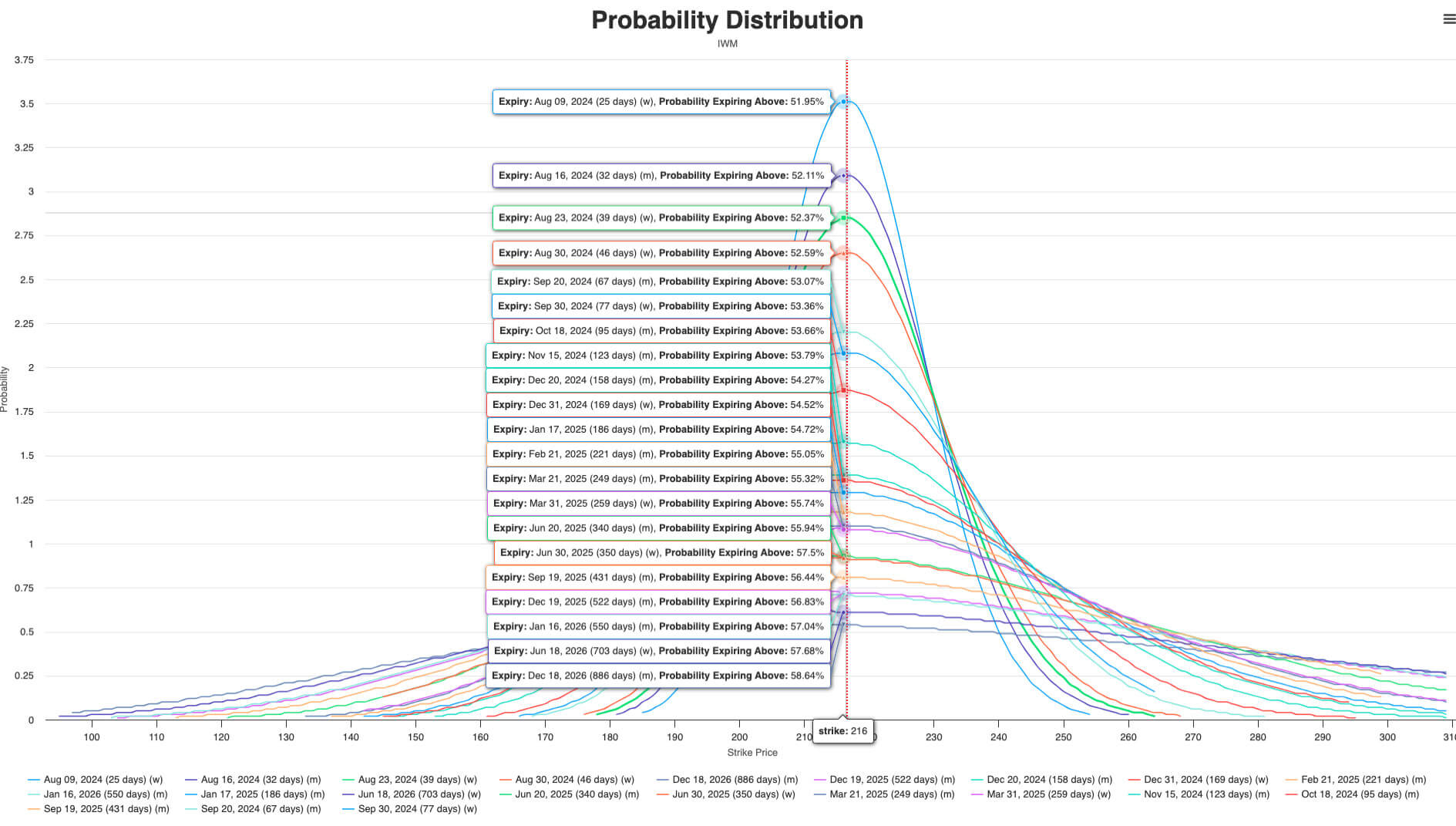

It should be admitted that the majority buyers don’t care about what occurs in 3-5 years. The expectation of rate of interest cuts is obvious in stimulating the chance asset market: the likelihood distribution implied by SPX choices is mostly biased in direction of bullish, and this bullish sentiment has even pervaded buyers’ expectations for the following 1-2 years. The above state of affairs implies that buyers anticipate conventional giant firms to profit from Trump’s financial insurance policies and obtain higher returns sooner or later.

Nonetheless, for small firms and tech firms, the potential influence of Trump’s tariff and immigration insurance policies on their operations is clear. In fact, that is additionally mirrored within the implied expectations of the market: whether or not it’s Nasdaq or Russell 2000, their implied return and implied improve are considerably decrease than these of the S&P 500.

General, extra rate of interest cuts are anticipated to be comparatively beneficial for the inventory market efficiency within the coming months. Nonetheless, contemplating attainable macro coverage modifications, holding solely inventory publicity doesn’t appear to be the only option. So, which asset exposures might deliver extra extra returns?

Commodities vs Cryptocurrency: King vs Queen

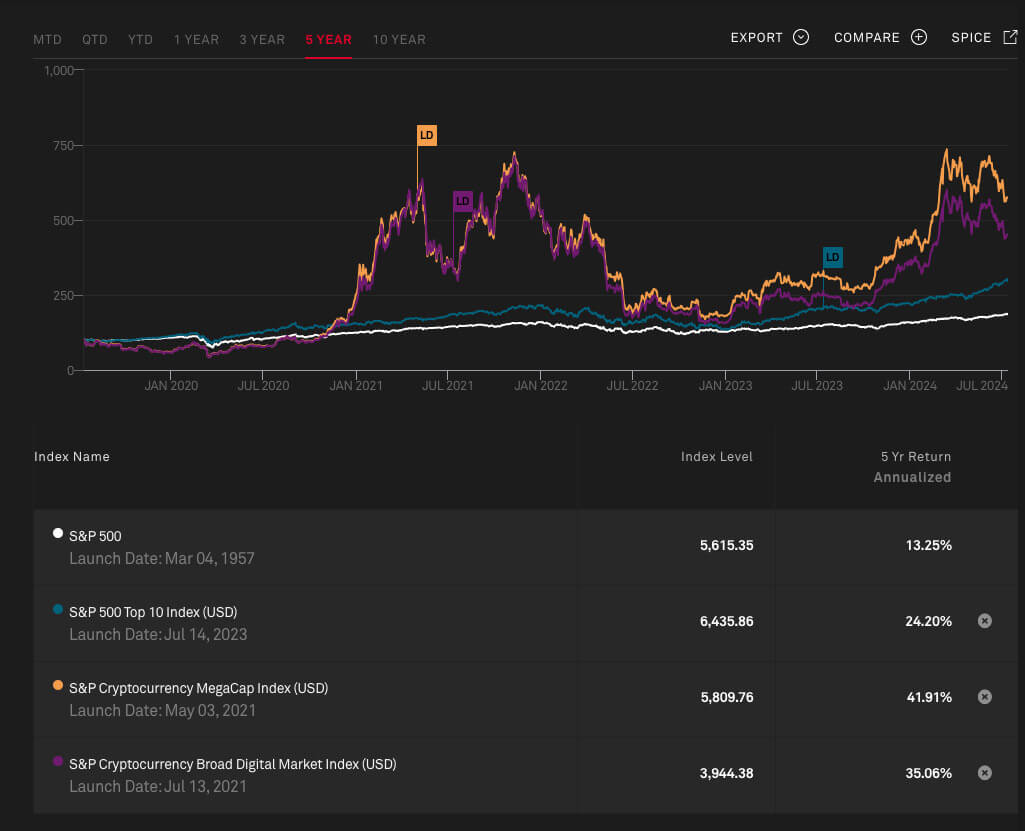

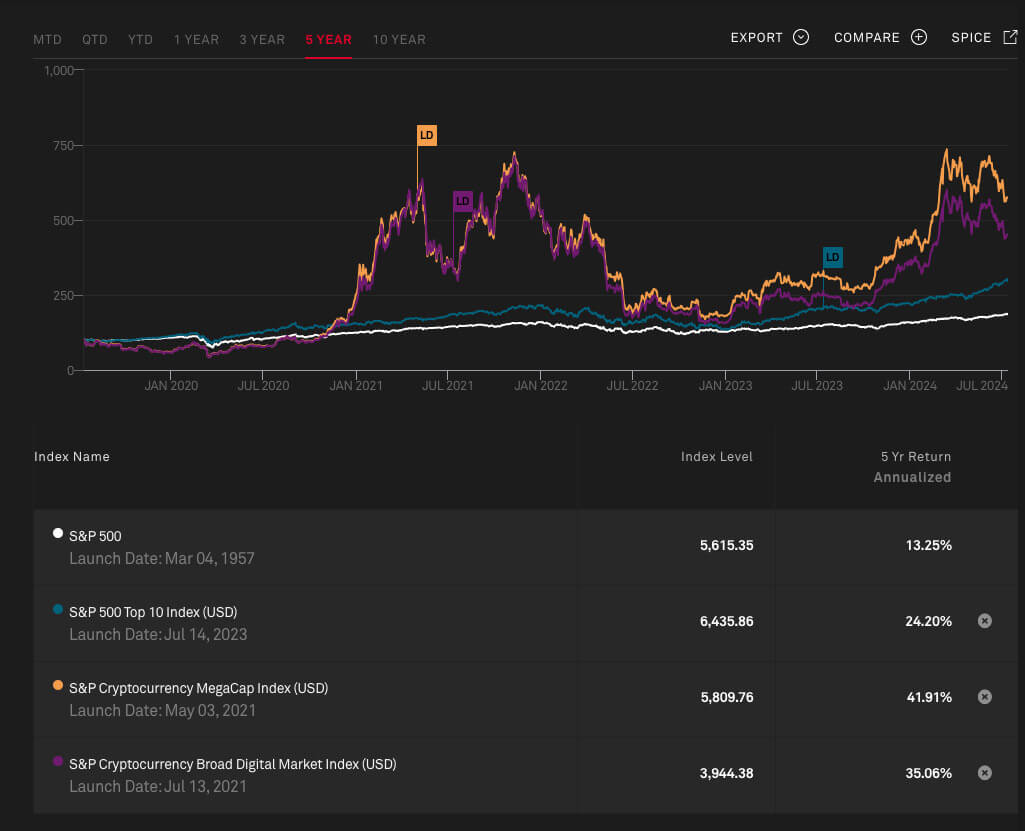

In comparison with shares, holding cryptocurrency publicity appears to have been confirmed to be a better option through the rate of interest lower cycle. Because the final spherical of the crypto bull market, the general efficiency of cryptos has considerably surpassed the efficiency of the S&P 500. Even when you select to carry mega shares, their efficiency has lagged significantly behind BTC and ETH.

That can also be why cryptocurrency-related publicity is quickly occupying the next proportion in funding portfolios: a small quantity of cryptocurrency publicity can enhance the portfolio’s total efficiency through the bull market. As well as, when macro danger occasions happen, mainstream crypto belongings similar to BTC can play a sure hedging function—whether or not it’s assassination or conflict.

Nonetheless, cryptos nonetheless face competitors from different non-equity belongings, similar to commodities. In contrast to cryptocurrency, commodities have maintained a comparatively sturdy efficiency through the rate of interest hike cycle. Extra onshore and offshore money liquidity is without doubt one of the core components sustaining commodities’ efficiency; resulting from earlier years’ QE and modifications in US financial insurance policies, each onshore and offshore markets have gathered a considerable amount of US greenback liquidity.

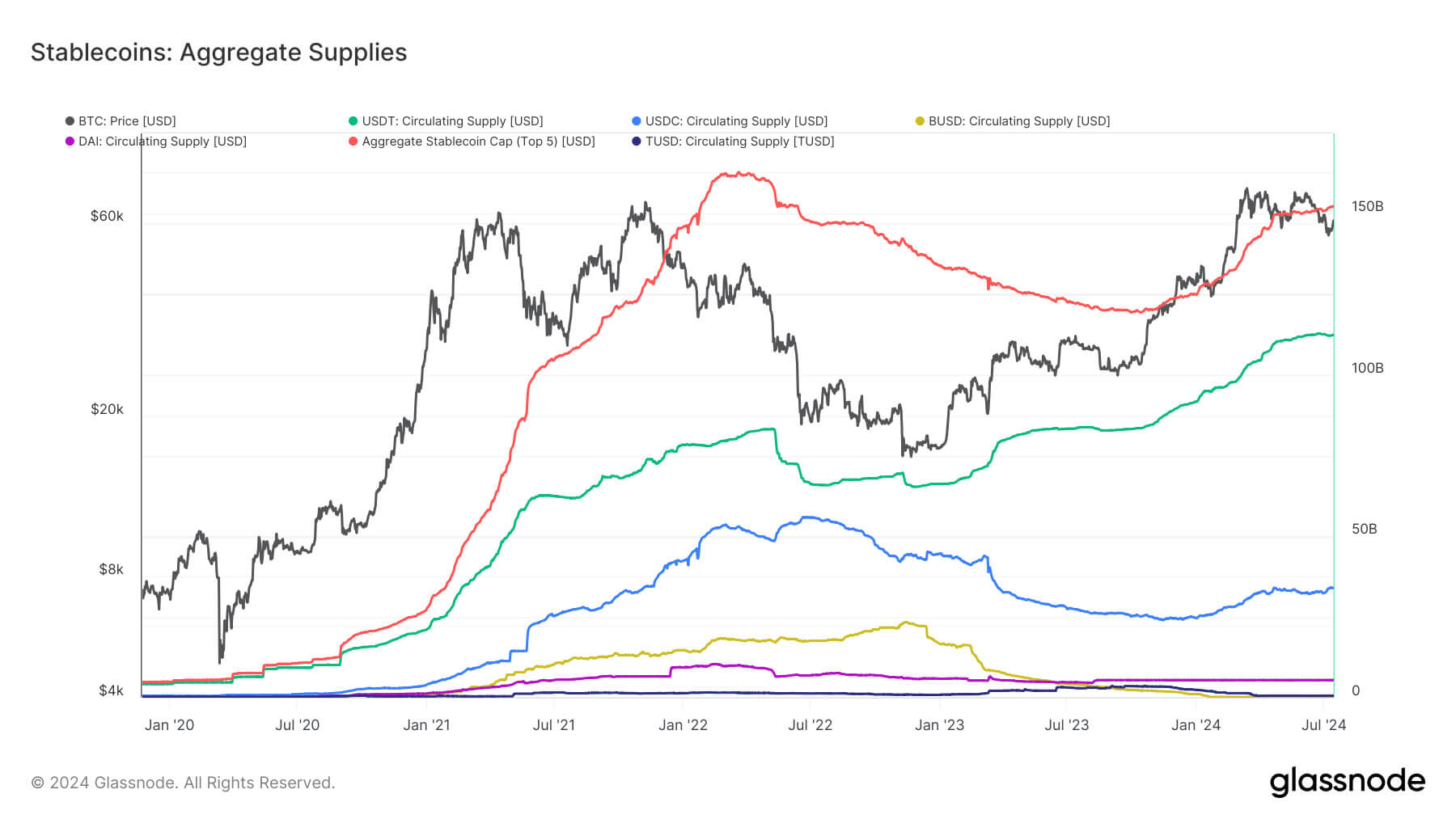

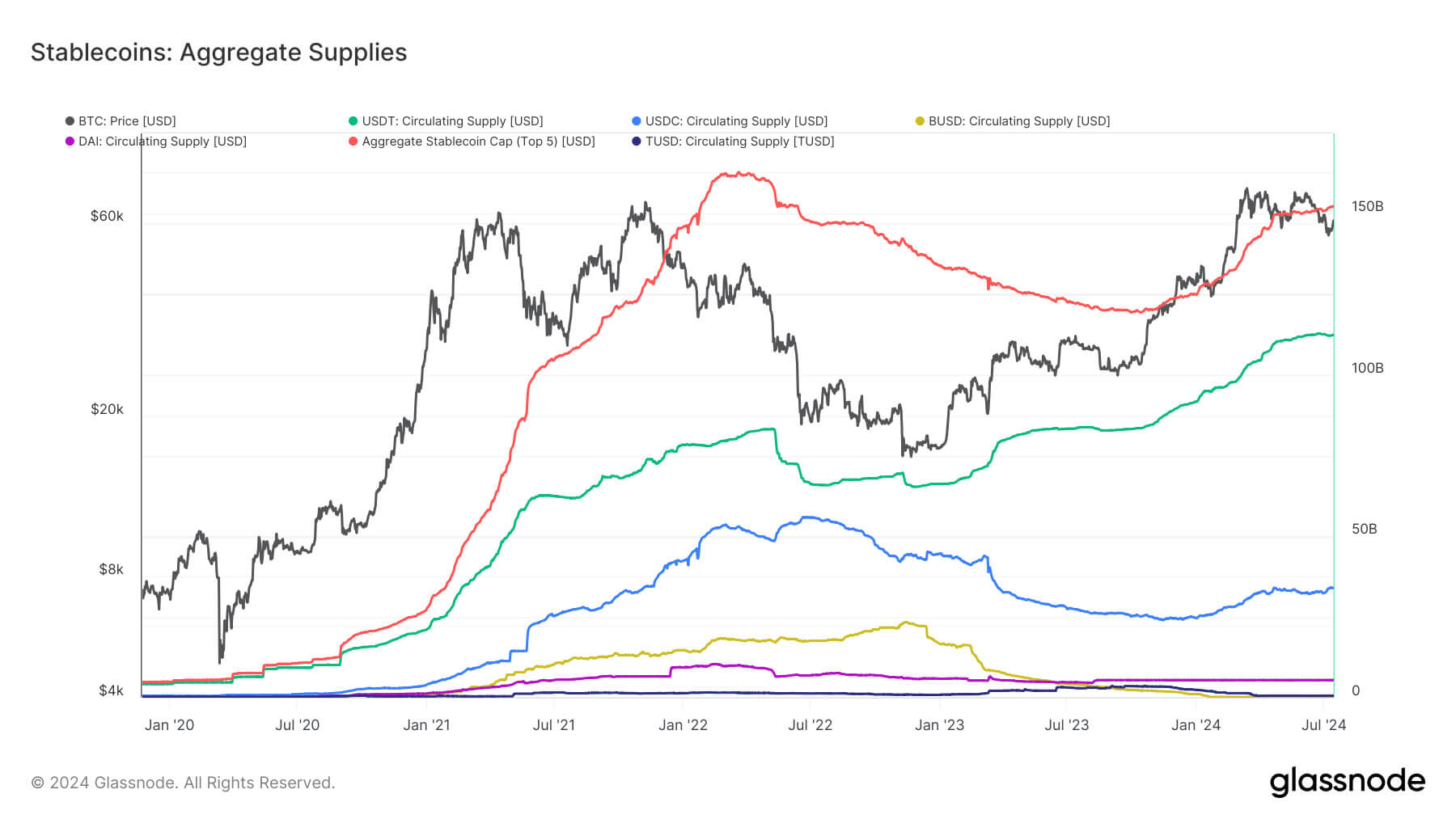

Within the cryptocurrency market alone, over $150 billion in money liquidity is already circulating within the type of stablecoins, and the size is anticipated to proceed to extend. Within the conventional market, the size of the Eurodollar used for commodity commerce is far bigger than that of the crypto market. Contemplating the influence of Trump’s future tariff insurance policies, the rise in commerce prices shall be mirrored within the costs of commodity futures, which can proceed the sturdy efficiency of commodities. It isn’t troublesome to watch that from 2021 to now, whether or not it’s rate of interest cuts or rate of interest hikes, the efficiency of commodities will not be inferior to cryptocurrency. Contemplating the dimensions and quantity of the commodity market, this can’t be ignored.

Let’s contemplate one thing extra profound: the speedy growth of the Eurodollar has led to the manufacturing and move of commodities regularly lagging behind the growth of liquidity scale, and rate of interest cuts will undoubtedly speed up the method of liquidity scale growth. Right now, commodity costs denominated in US {dollars} will stay steady at a excessive degree for a very long time.

Though commodity costs might expertise a short-term correction, from a medium to long-term perspective, the upward development of commodities is not going to present important modifications. As well as, comparatively scarce commodities similar to gold can even play the function of “laborious forex” and “liquidity container”; within the liquidity easing cycle, commodities might turn into sturdy rivals of cryptos.

In fact, the crypto market additionally has its distinctive benefits: greater macro sensitivity and better leverage. In contrast with commodities, crypto derivatives considerably influence the market, which brings comparatively greater volatility, thus bringing higher potential returns to buyers within the upward cycle. Nonetheless, greater leverage additionally means higher danger. In abstract, commodities and cryptocurrencies are “non-obligatory” apart from shares, and the share of the 2 within the portfolio relies upon extra on buyers’ danger preferences.

So, Again to the Crypto Market…

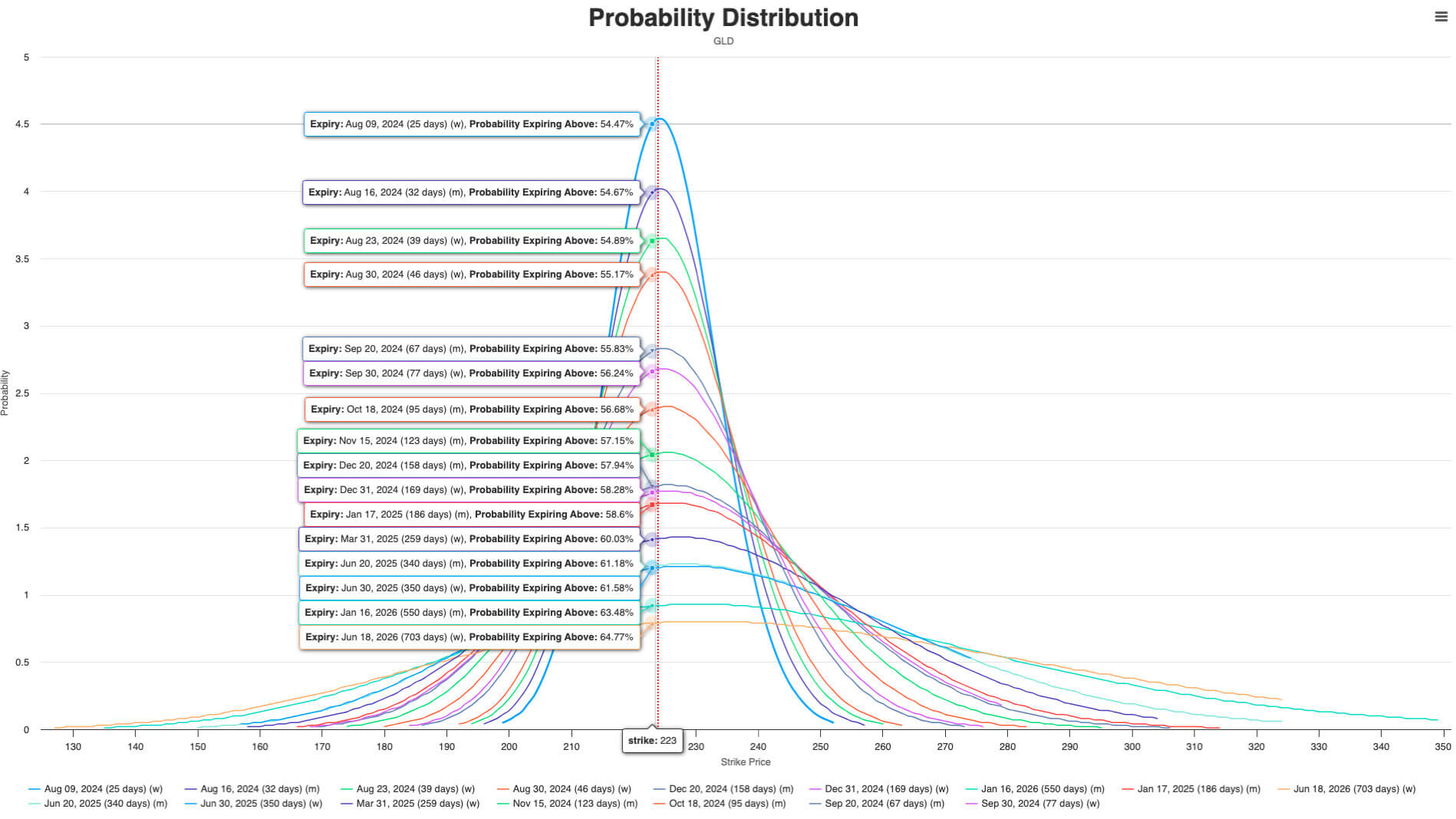

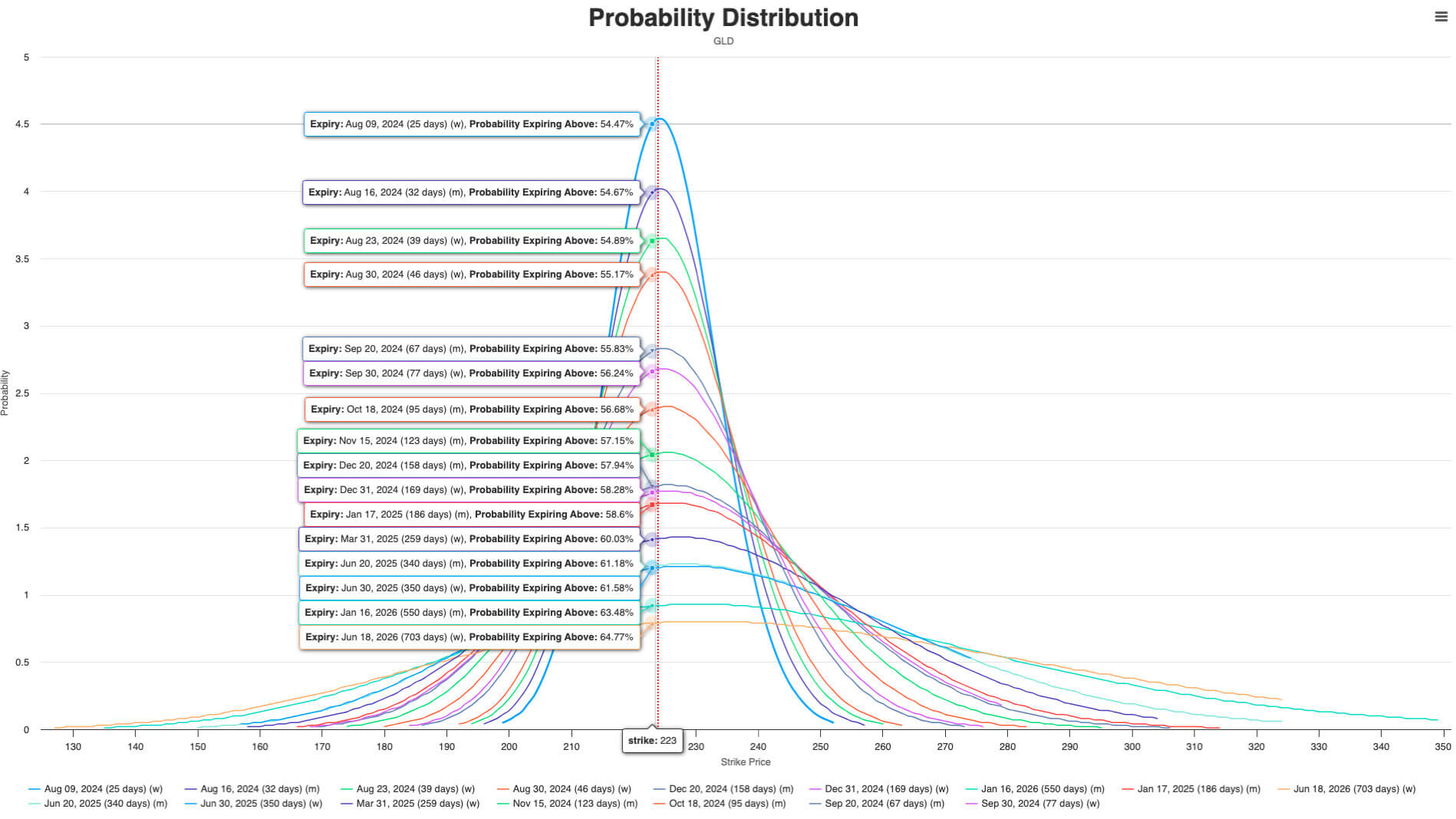

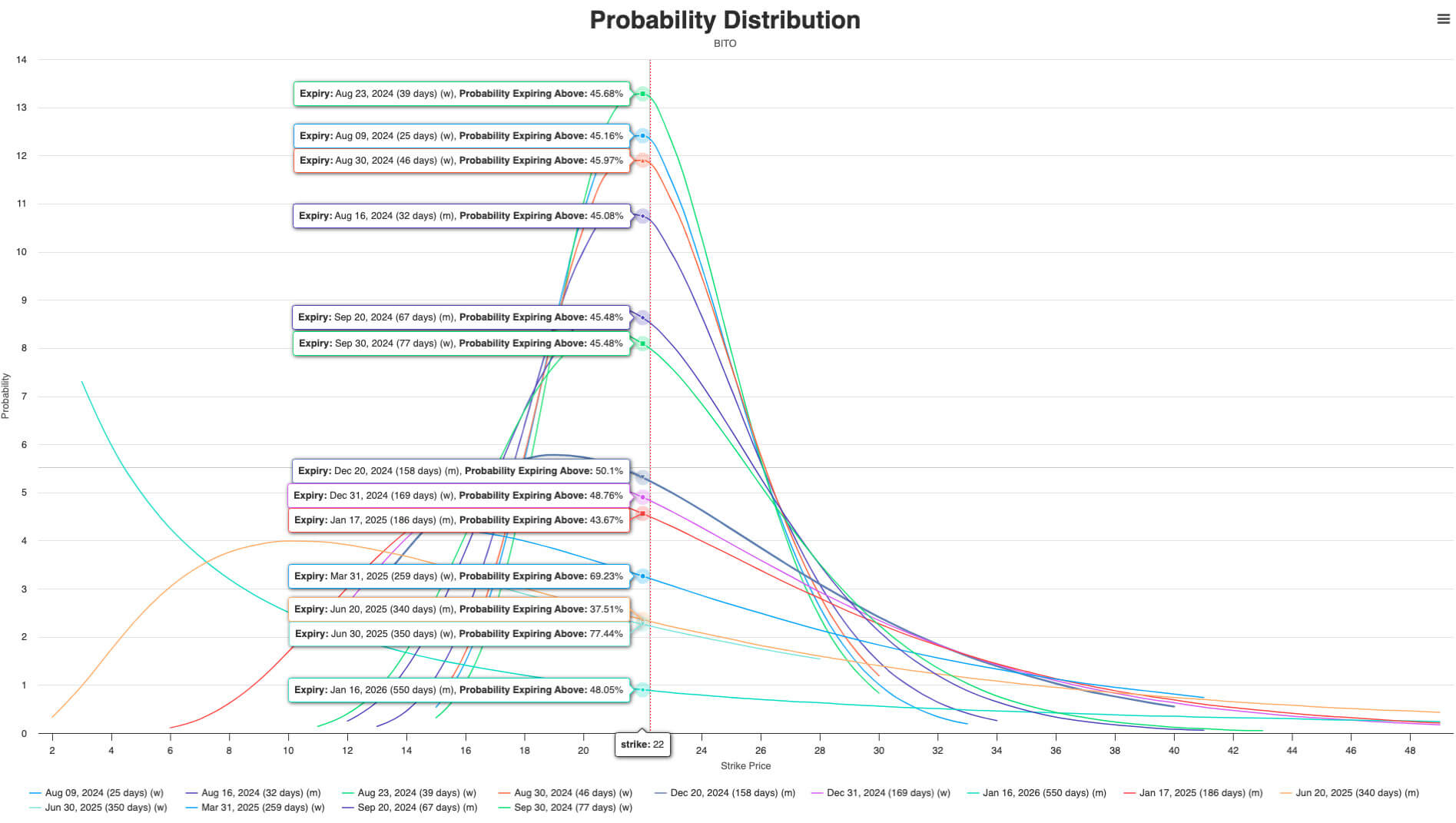

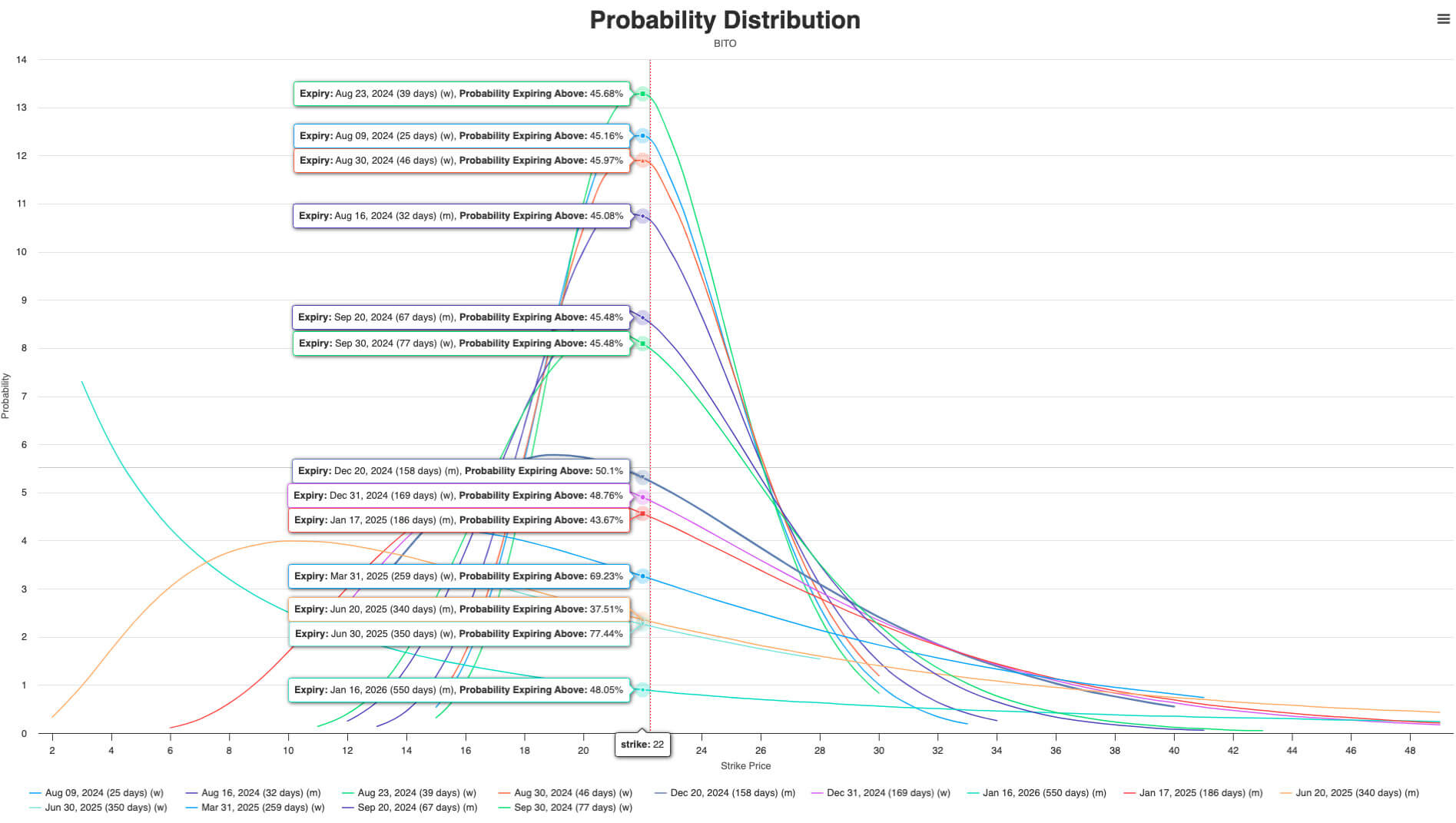

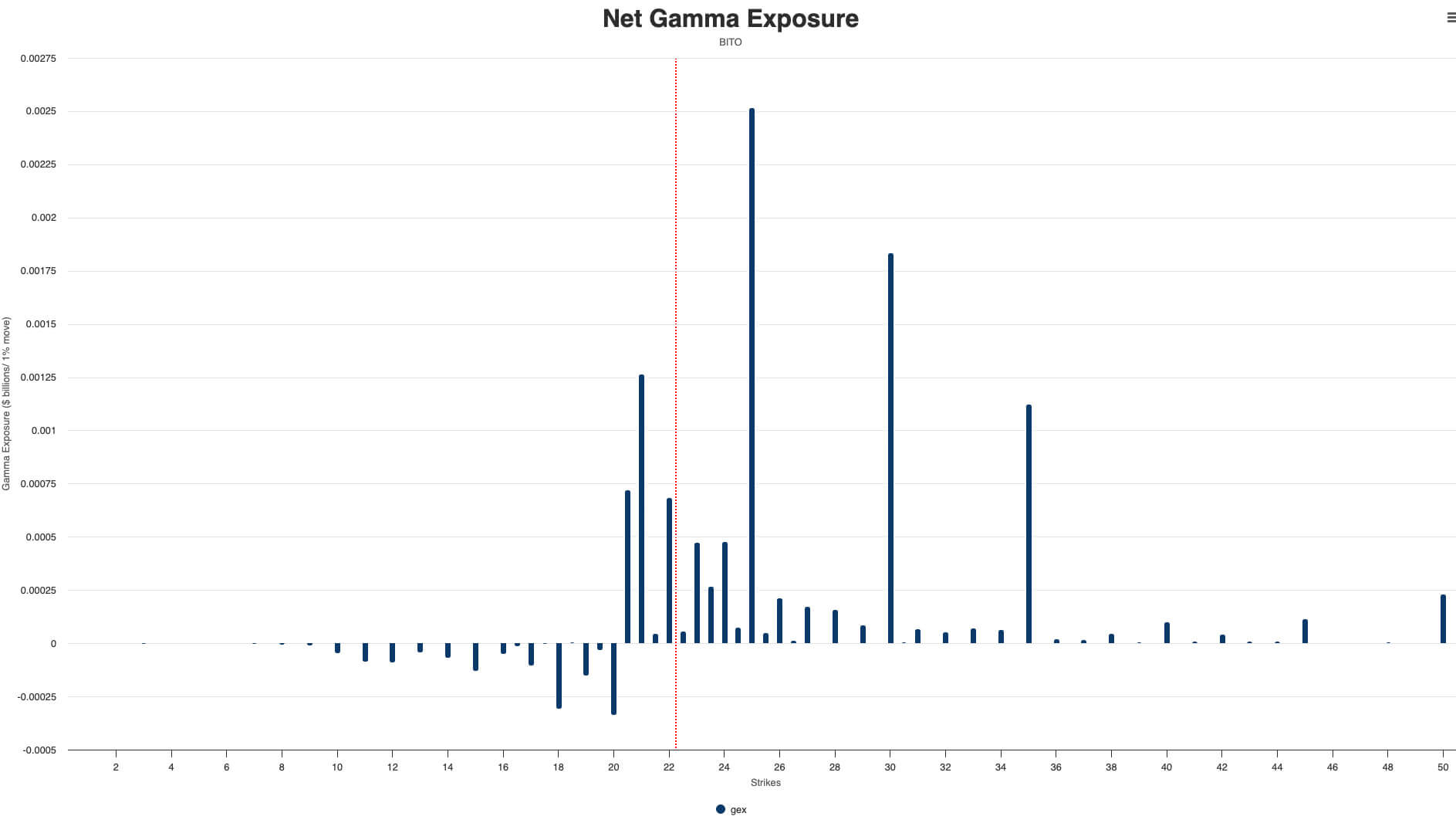

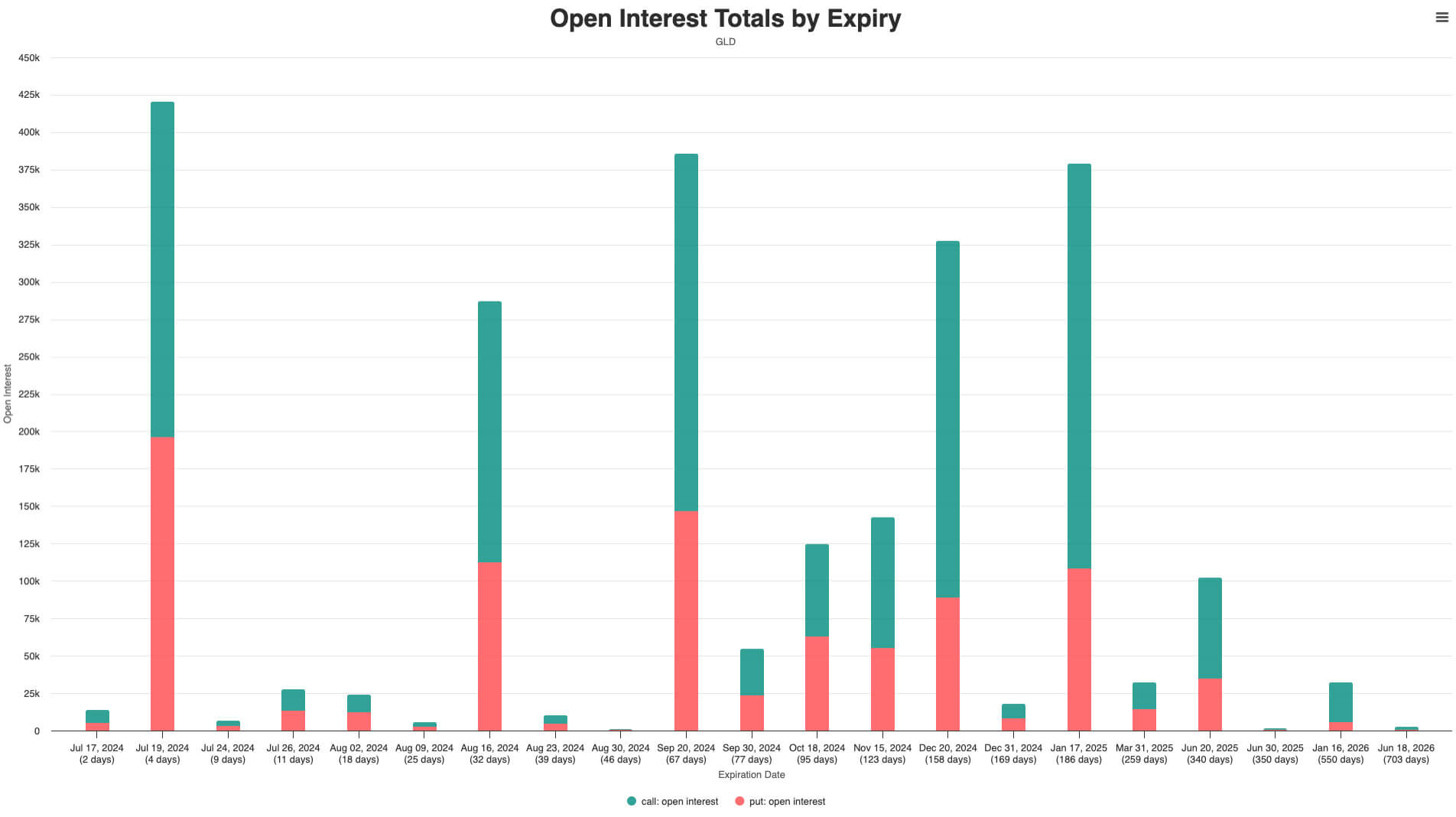

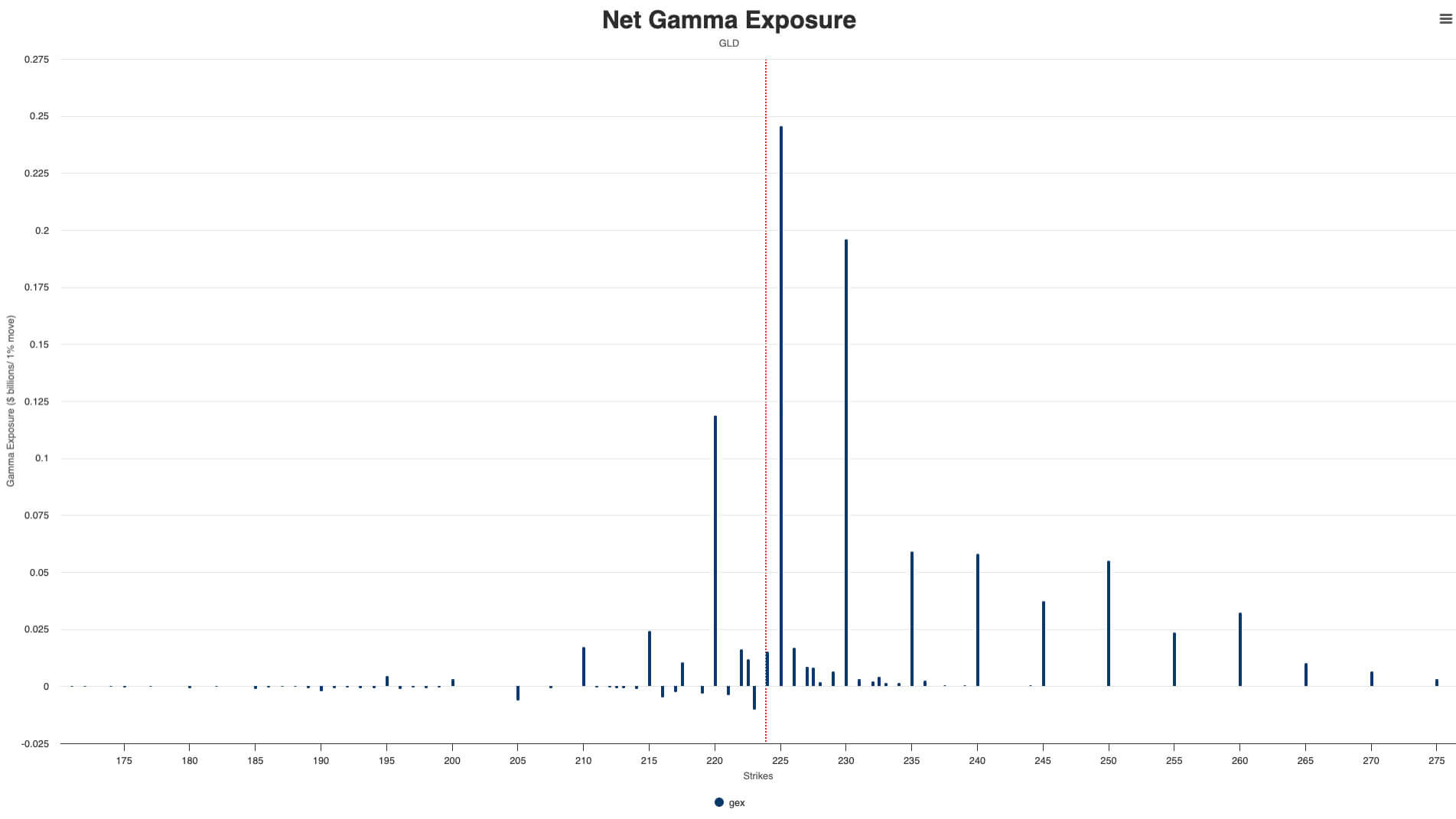

Is cryptocurrency higher than commodities within the subsequent 1-2 months? The reply is “undecided” – not less than for BTC. Buyers within the US inventory market and cryptocurrency market appear to have reached an implicit consensus: BTC is going through extra resistance from market makers hedging and buyers profit-taking on its additional upward path, decreasing buyers’ expectations for additional worth will increase in BTC. From the implied likelihood distribution perspective, the likelihood of BTC worth additional breaking by way of within the subsequent month has dropped to under 46%. As compared, gold nonetheless has a likelihood of over 54% to proceed to rise additional by way of new highs.

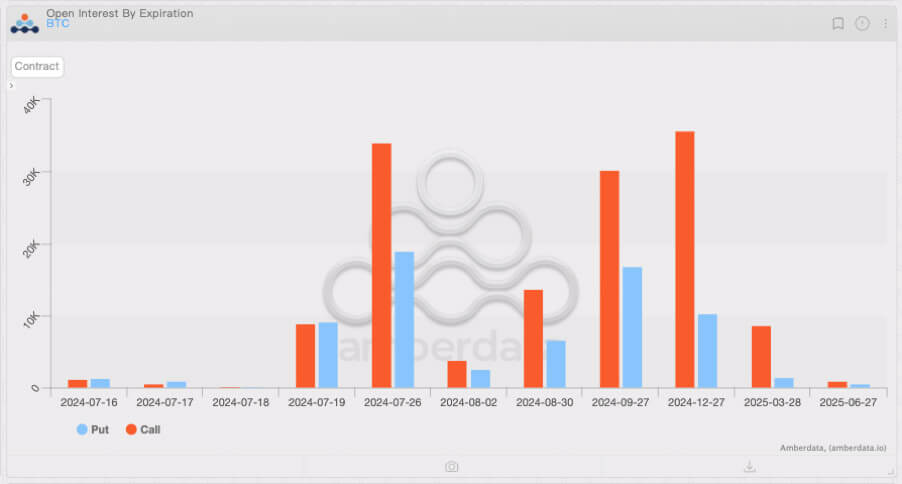

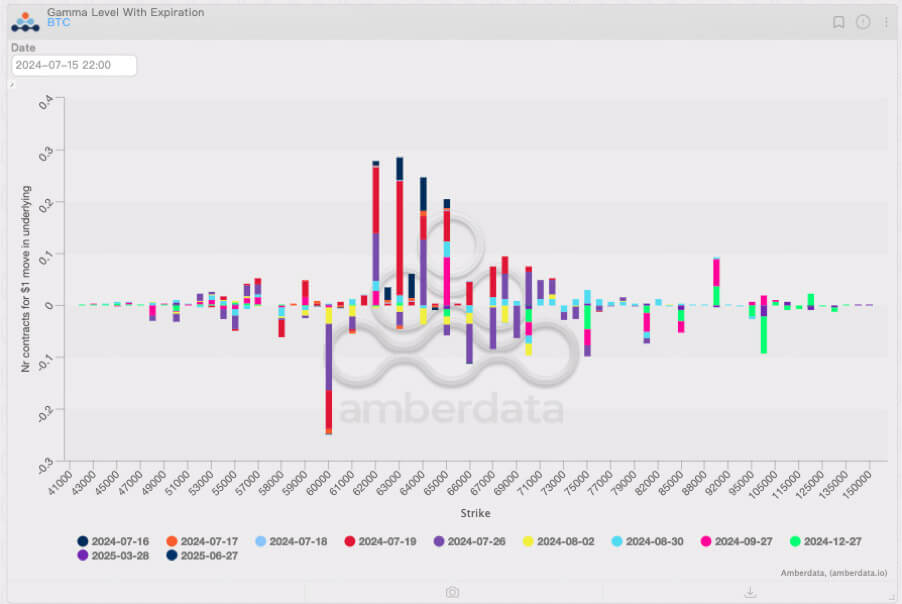

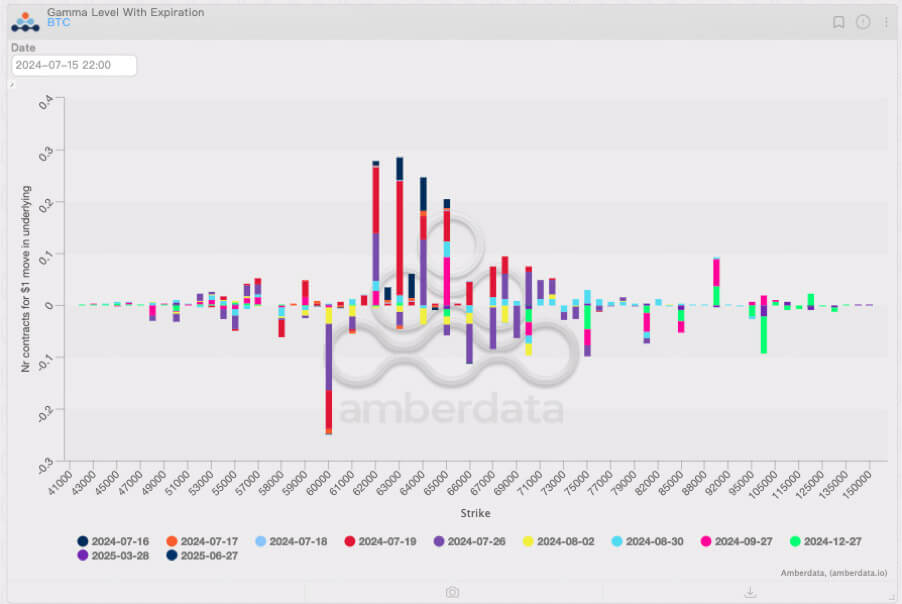

Certainly, the resistance on the upward path of gold can also be important. Nonetheless, evaluating the choice open curiosity distribution of GLD and BTC, it’s not troublesome to seek out that after July nineteenth, the upward resistance of gold costs largely comes from the far month moderately than the entrance month, which implies that gold costs will face comparatively small upward resistance within the subsequent few weeks. In distinction, the front-month resistance of BTC accounts for a bigger proportion, which implies that the potential for a breakthrough within the subsequent few weeks will additional lower. The worth breakthrough of BTC might happen in Aug, however not now.

Nonetheless, as soon as a breakthrough happens, the hedging impact of market makers will reverse and push the value of BTC to rise sharply. Though this can be a low-probability occasion, holding some lengthy positions within the far month continues to be a extra applicable selection; the short-term consolidation of BTC doesn’t have an effect on its long-term rise within the low rate of interest atmosphere sooner or later.

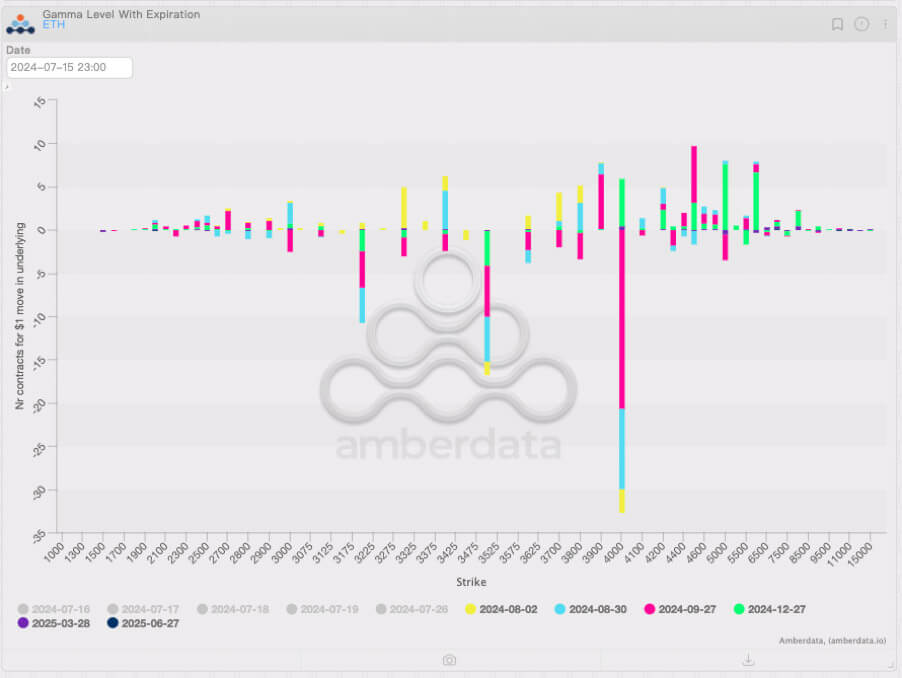

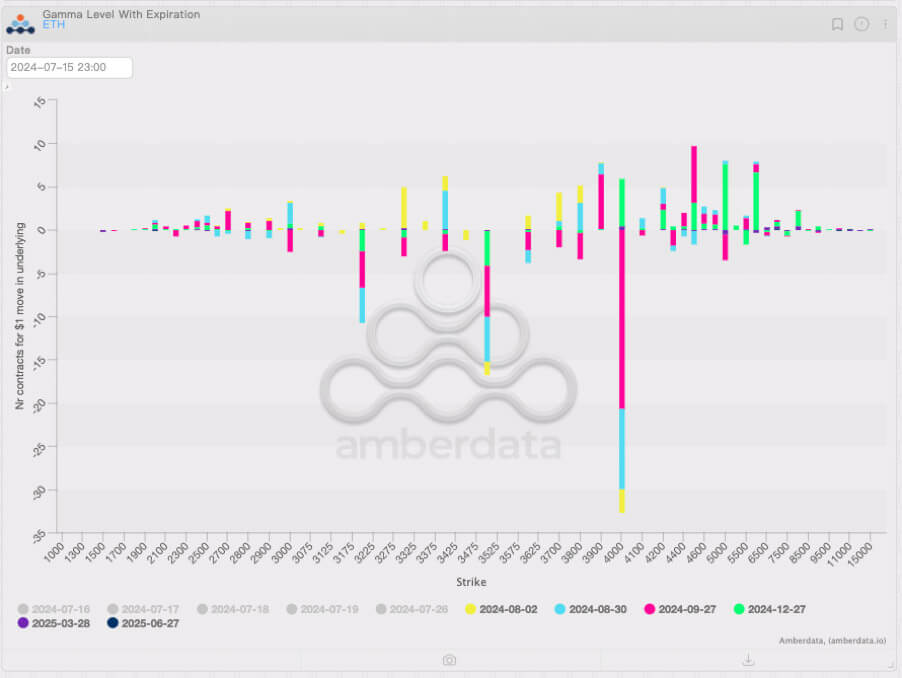

For ETH, we will anticipate it to carry out higher than BTC. On the one hand, ETH spot ETF could also be formally listed for buying and selling subsequent week; through the Asset Allocation interval, ETH might expertise the same rise to BTC in Quarter 1, which makes buyers have greater expectations for ETH’s efficiency. From the gamma distribution perspective, ETH’s resistance on the upward path could also be considerably lowered after the Jul choices’ expiration, which implies its worth breakthrough shall be extra sure.

In abstract, our asset allocation technique for Jul and Aug is able to set:

Inventory positions are dominated by SPX bulls.Bond positions rely upon private choice.For commodities, contemplate rising holdings of some gold bulls (achieved by way of GLD or CME’s gold futures).By way of cryptocurrency, maintain extra lengthy positions in ETH and reasonably lengthy positions in BTC.Improve the proportion of commodities and cryptocurrency within the funding portfolio appropriately (for risk-neutral buyers, 5% is a extra applicable selection; for risk-seekers, contemplate rising the proportion of commodities and cryptocurrency in positioning to 10%).

Let’s benefit from the appetizer earlier than the rate of interest cuts collectively; the feast is about to start. Are you prepared?

About BloFin Analysis

BloFin Analysis is the sub-brand of BloFin Academy‘s skilled content material. Based mostly on the crew’s wealthy expertise and mature methodology within the conventional and crypto markets, BloFin Analysis is dedicated to offering main & in-depth institution-level analysis content material for international crypto buyers. BloFin Analysis’s content material has been widely known, cited and reposted by high establishments and media within the international market, together with however not restricted to Coindesk, Forbes, Yahoo Finance, Deribit Insights, CryptoSlate, Amberdata, Optioncharts, and so forth.

BloFin Official Web site: https://www.blofin.comBloFin Twitter: https://x.com/Blofin_OfficialBloFin Academy: https://x.com/BloFin_Academy

Contact

Head of Advertising and Public RelationsAnnio Wu[email protected]

Talked about on this article