Crypto indicators on Telegram are actionable suggestions advising merchants to purchase or promote a specific cryptocurrency. For newbie merchants or these missing time to research charts, indicators simplify decision-making, these cryptocurrency indicators can save time, allow you to make knowledgeable buying and selling selections, and cut back the possibilities of shedding capital as a result of a foul name.

Most crypto indicators suppliers use Telegram to share crypto indicators with their neighborhood due to how briskly messages are delivered and the way straightforward it’s to comply with updates. You get alerts in actual time and an in depth evaluation supporting every advice.

On this article, we are going to cowl what crypto indicators are intimately, how crypto indicators work, the favored varieties of cryptocurrency buying and selling indicators, and the advantages and dangers of crypto indicators on Telegram. Moreover, you’ll learn to learn crypto buying and selling indicators and the way to decide on a crypto indicators Telegram group to comply with.

What Are Crypto Indicators on Telegram?

The crypto indicators on Telegram are buying and selling directions that recommend when to purchase or promote a cryptocurrency. Every sign consists of clear entry and exit factors or costs, which comprise a cease loss to handle threat and a take-profit goal to safe beneficial properties. Telegram crypto sign teams usually advise promoting a proportion of the place based mostly on market circumstances.

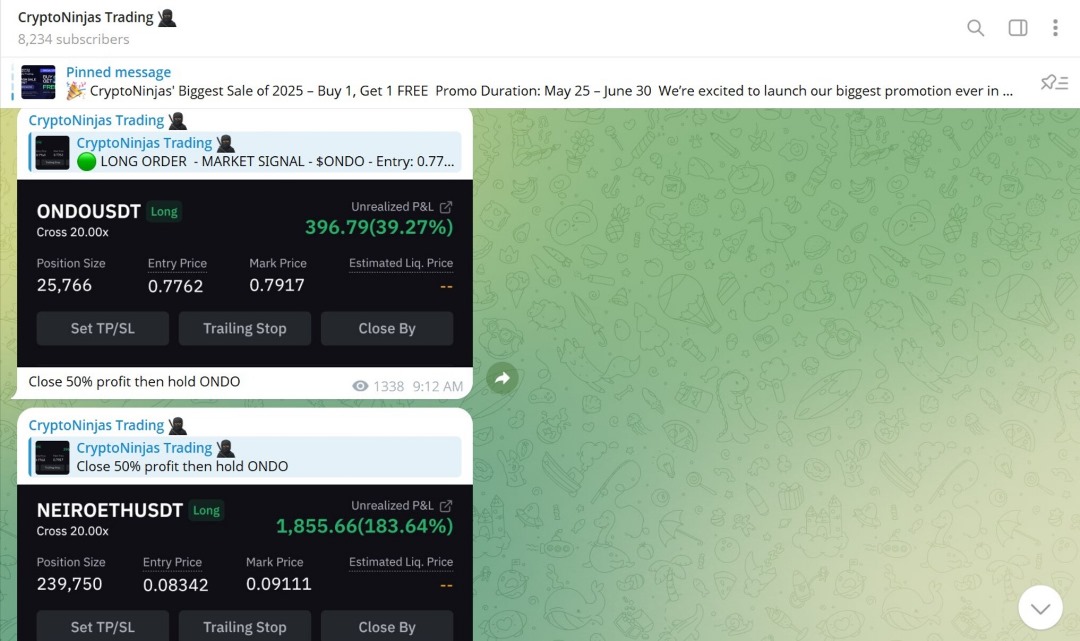

For instance, a sign for ONDO/USDT in futures buying and selling may predict a big value enhance. You enter a brief place at $0.055 (5,500 ONDO at 1x leverage, as an illustration). When ONDO rises by a sure proportion, say 40%, the supplier will advise you to take revenue on 50% of the place and maintain the remaining 50% in anticipation of a better rise that reaches the preliminary take-profit goal you set.

This method helps you lock in partial earnings whereas nonetheless leaving room for probably bigger beneficial properties if the commerce hits the preset take-profit margin. This threat administration technique protects merchants from market volatility.

Cryptocurrency indicators depend on market information, comparable to value charts, quantity, technical indicators, and social media sentiment. Utilizing this information, skilled analysts share predictions to information merchants in cashing in on risky markets.

For the sign teams, suppliers normally provide free and paid companies. Many paid crypto sign teams provide free indicators, with premium customers receiving enhanced insights and steerage. Telegram is a standard platform for delivering these crypto buying and selling indicators due to its real-time message supply, quick notifications, and powerful crypto communities.

How Do Crypto Buying and selling Indicators Work?

Crypto buying and selling indicators work by giving a full plan for coming into and exiting a commerce. This plan tells you when to purchase or promote, the place to take revenue, and when to shut the commerce if the worth goes within the mistaken route. The purpose is to take away guesswork and assist merchants clarify selections based mostly on evaluation.

To get these buying and selling indicators, skilled merchants analyze these information to create actionable indicators, together with value charts, quantity, technical indicators (RSI, MACD, Bollinger Bands), sentiment from social media and information, and on-chain information. With this evaluation, they make predictions and suggest them to their crypto interior circle or sign group. Every crypto buying and selling sign sometimes consists of three major components, that are listed beneath:

1.Entry Worth: That is the worth vary the place the commerce ought to start. It’s the level the place the crypto sign suppliers count on the market to maneuver within the predicted route. Now, say the entry value of a commerce is 0.0950, and you bought the sign a couple of minutes later when the market value has moved a bit, you possibly can nonetheless open your place on the present market value and set the parameters shared within the indicators group.

2. Cease Loss: Cease loss is a value that limits how a lot you possibly can lose if the commerce fails. If the worth drops or rises too far in the wrong way, the commerce closes robotically at this level. This protects your account and prevents one commerce from inflicting vital monetary loss.

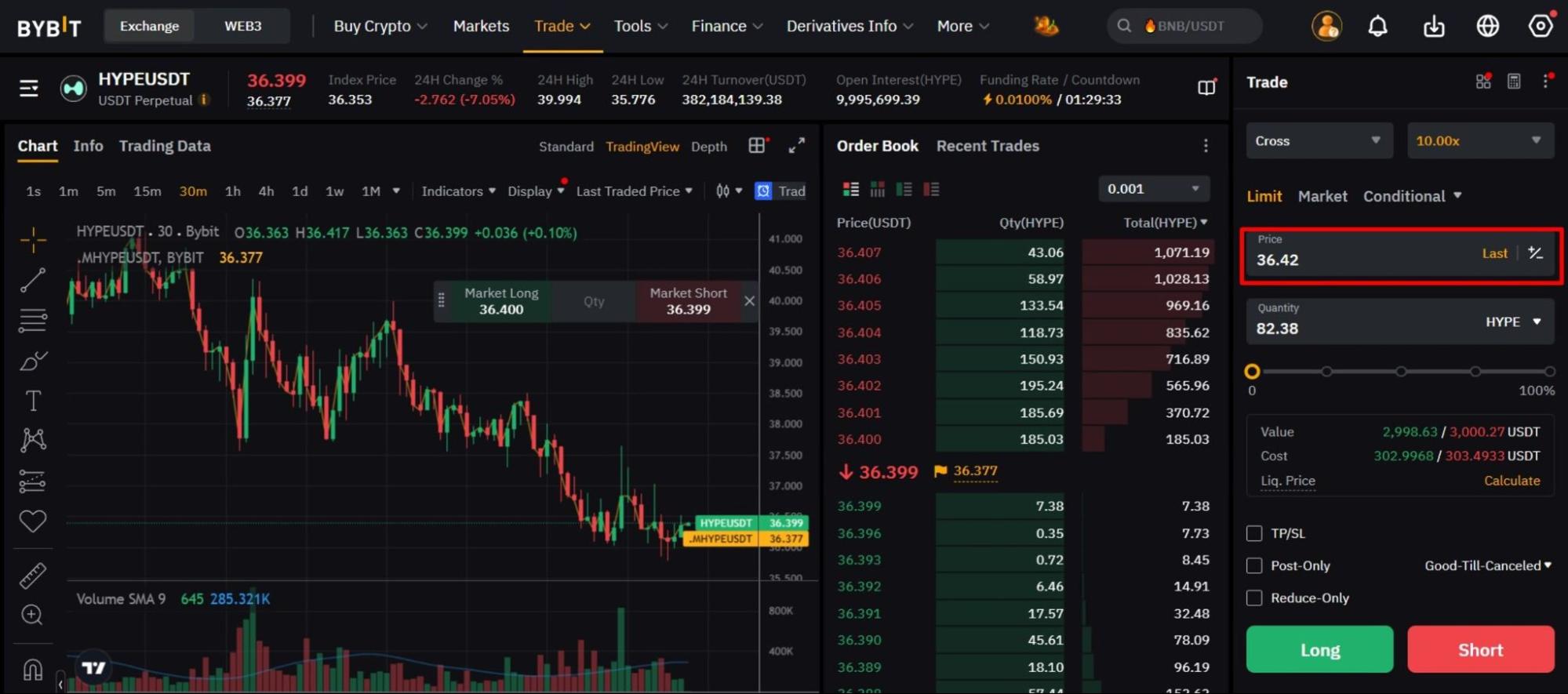

Relying on the crypto trade you’re utilizing to commerce, yow will discover this device on the backside nook of the buying and selling interface, which is normally depicted as TP/SL (Take Revenue/Cease Loss).

3. Take Revenue: Take revenue is the worth at which you shut the commerce with a acquire. Some buying and selling indicators give one goal, whereas others give two or three targets. Merchants can shut the commerce totally at one degree or take a part of the revenue at every stage (that is the place promoting in components or percentages is available in). This technique reduces threat and secures beneficial properties incrementally.

These three buying and selling instruments work collectively to type detailed indicators that merchants can comply with and probably make earnings. Your Telegram crypto sign teams present all the main points for guide indicators. All it’s a must to do is enter these particulars to execute trades shortly with out spending hours watching charts.

Why Telegram for Crypto Indicators?

Skilled merchants and technical analysts use Telegram for crypto indicators as a result of messages are delivered quick. The second a sign is shipped, everybody within the group sees it in real-time. That is vital in buying and selling as a result of crypto market volatility, the place a delay of even one minute can have an effect on the results of a commerce.

Past real-time supply, Telegram fosters dealer connections via neighborhood options. Most crypto sign teams have giant group chats and broadcast channels, making it straightforward to prepare communities round particular buying and selling methods or digital property. Customers also can comply with updates, ask questions, and work together with others whereas getting actionable suggestions from skilled merchants.

What are the Common Sorts of Cryptocurrency Buying and selling Indicators?

The favored varieties of cryptocurrency buying and selling indicators are crypto futures indicators, day buying and selling indicators, and purchase and promote indicators.

Crypto Futures Indicators

Crypto futures indicators are made for merchants who cope with contracts as a substitute of shopping for cash instantly. Right here, merchants predict the token’s future value actions with out proudly owning the property. A crypto futures sign tells you when to enter the commerce, what route to take, the place to exit, and the way a lot leverage to make use of. It additionally features a cease loss, which protects your account if the commerce goes mistaken.

Here’s what a typical crypto futures sign appears like:

Crypto Day Buying and selling Indicators

Day buying and selling indicators are used for brief trades the place merchants must act quick to capitalize on market actions. The concept of this buying and selling model entails opening and shutting trades inside 24 hours. Just like the futures buying and selling sign, the crypto day buying and selling sign additionally consists of detailed sign info just like the cryptocurrency to commerce, entry value, stop-loss degree to restrict losses, and take-profit targets.

Crypto Purchase and Promote Indicators

Purchase and promote indicators are for spot buying and selling. That is while you purchase a coin, maintain it, and promote it when the worth goes up. When following spot buying and selling indicators, buyers instantly personal the underlying crypto property, in contrast to futures buying and selling, the place contracts are used. Spot crypto indicators specify the motion (purchase or promote), the actual coin to commerce (e.g., BTC, ETH), entry value zones, stop-loss ranges to restrict draw back threat, and take-profit targets.

Spot buying and selling indicators assist merchants capitalize on short-term value swings, compound beneficial properties over time, and keep away from funding charges or expiry dates related to leveraged merchandise. With out leverage, spot buying and selling avoids liquidation dangers, making it safer for cautious merchants.

What are the Advantages and Dangers of Crypto Indicators on Telegram

The advantages of crypto indicators on Telegram for learners and superior merchants are real-time alerts, comfort and time-saving, insights from extra skilled merchants, alternatives for studying, and emotion-free buying and selling. In the meantime, the dangers of crypto indicators on Telegram embody a scarcity of assured accuracy, over-reliance on sign teams, and pump-and-dump schemes.

Benefits of Utilizing Crypto Indicators

Under are the benefits of utilizing crypto indicators:

Actual-Time Buying and selling Indicators: Crypto buying and selling sign suppliers provide buyers well timed and dependable indicators, whereas Telegram delivers instantaneous notifications. This pace permits merchants to capitalize on market alternatives while not having to observe charts continuously.Comfort and Time-saving: A high-quality crypto sign offers you a transparent plan with the entry and exit factors, cease loss, and revenue targets. You possibly can place the commerce and go about your day whereas nonetheless staying concerned available in the market. Moreover, Telegram is mobile-friendly and straightforward to make use of, which makes following and reacting to commerce alerts easy and accessible.Insights From Extra Skilled Merchants: Some crypto sign suppliers are skilled merchants or analysts providing high-accuracy indicators based mostly on market insights, sentiments, and technical evaluation. Buying and selling indicators shared by merchants with expertise give learners a head begin. It may additionally assist merchants who don’t have the time to conduct detailed market evaluation with their crypto buying and selling technique.Alternatives for Studying: After interacting with a number of crypto buying and selling indicators, sure value ranges and setups start to turn into recognizable. Over time, this helps you make higher selections by yourself since you perceive the pondering behind these strikes.Emotion-free Buying and selling: Buying and selling indicators cut back impulsive selections pushed by feelings like concern or greed. Crypto indicators restrict impulsive modifications, selling disciplined buying and selling..

Potential Dangers and Challenges of Utilizing Crypto Indicators

Under are the potential dangers and challenges of utilizing crypto indicators:

No Assured Accuracy: Anybody can open a crypto Telegram channel and begin sharing commerce concepts. That doesn’t imply they know what they’re doing. If the buying and selling indicators should not based mostly on sturdy market analysis, you possibly can lose cash quick. Even reliable analysts could be mistaken as a result of the crypto market is unpredictable, so there is no such thing as a assure of correct indicators or earnings.Over-reliance on Sign Teams: Merchants may rely solely on the crypto indicators suppliers as a substitute of doing their very own analysis and turning into extra accustomed to technical evaluation to comfortably make modifications to the suggestions acquired. If all of your trades come from one individual or group, you’re putting full belief of their judgment. In the event that they go mistaken, you go down with them.Market Manipulation (Pump-and-Dump Schemes): Some teams coordinate to artificially inflate the worth of a low-volume coin after which dump it as soon as others purchase in, leaving followers with losses. So, keep away from crypto indicators Telegram teams that promise enormous earnings or 100% assured wins.

The way to Learn Crypto Commerce Indicators on Telegram

Right here’s the right way to learn crypto commerce indicators on Telegram like a professional.

Entry Worth: That is the quantity that tells you when to open the commerce. Some crypto buying and selling indicators give one clear value. Others present a small vary, which implies the commerce could be entered wherever between two values. If the worth remains to be outdoors the vary, set a restrict order with the worth you need to purchase/promote at.Cease Loss: If the market strikes in the wrong way of the commerce, the cease loss is the place you shut the place and take the loss.Take Revenue: Indicators usually embody a number of revenue targets. Every goal is a value degree the place you possibly can shut half or the entire commerce. You possibly can resolve whether or not to take your full revenue on the first degree or maintain a part of the place for later targets.Route Tells You Whether or not to Purchase or Promote: If the sign says “lengthy order,” the dealer expects the worth to go up. If it says “quick order,” the purpose is to revenue from the worth drop of the crypto asset.Sign Kind: Some crypto buying and selling indicators are for spot buying and selling (shopping for and holding the precise coin), whereas others are for futures buying and selling (speculating on the long run value of cryptocurrencies with out proudly owning the underlying asset).Leverage: If a sign consists of leverage, it should point out what number of instances to multiply your place. This implies you’re borrowing additional funds to make the commerce bigger. Whereas leverage can enhance earnings, it additionally will increase threat.Screenshots or Chart Hyperlinks: Good crypto sign suppliers generally share a chart displaying the setup. This allows you to see the place the worth is, what sample is forming, and the place the targets sit on the chart.Comply with-up Messages: After a sign is shared, the group may put up updates relying on market circumstances. These might embody messages like “transfer cease loss to entry” or “take partial revenue now.” Don’t ignore these updates. They information you because the commerce unfolds and allow you to handle it higher. All the time hold alerts on in case you plan to behave on buying and selling indicators in actual time.

If you wish to discover extra about sign setups or how merchants use bots with Telegram alerts, this text on Telegram buying and selling bots will perceive how automated buying and selling instruments on Telegram work and the way you should utilize them to execute trades instantly via the Telegram app.

Are All Crypto Indicators Dependable?

No, not all crypto indicators are dependable. The very best Telegram crypto sign teams are backed by analysis and actual expertise, leading to about 90% correct indicators, however others are based mostly on guesses or copied from different teams. To get dependable buying and selling indicators, ask pals for suggestions. Whichever crypto buying and selling indicators group you select, make sure the platform has no less than a 90% success fee.

The way to Select a Crypto Indicators Telegram Group

To decide on a crypto indicators telegram group, it’s essential to first discover a dependable or respected crypto indicators supplier, take note of members’ interplay, after which select trades to comply with.

Test the Sign High quality and How Typically They’re Up to date

Earlier than following a crypto indicators group, begin by becoming a member of the group and watching the way it works. Analysis on the Telegram channel to see if they’ve a monitor file of profitable or failed trades. Then, have a look at how the buying and selling indicators are shared. Test if the group shares frequent indicators and whether or not the messages include all the required particulars.

Along with frequent indicators, severe cryptocurrency sign service suppliers will give updates if the market modifications and can let you know when to shut early, take a proportion of your earnings, or shift your cease loss.

Supported Exchanges and Buying and selling Methods

Confirm if the group helps your most well-liked crypto trade, comparable to Binance, BingX, KuCoin, and Bybit. Then, examine if the buying and selling model the group focuses on aligns with what you want. Keep in mind, the crypto buying and selling varieties to count on embody, however should not restricted to, day buying and selling, fundamental purchase and promote (spot buying and selling), and superior methods within the futures market.

Pricing (Paid Vs. Free Crypto Indicators Channels)

Many teams cost subscription charges starting from $30 to over $150 month-to-month, however some provide free trials, whereas others provide free buying and selling indicators for all times. Such sign teams assist learners and merchants with tight budgets to experiment and earn revenue with out paying for crypto buying and selling indicators. However, paid teams provide unique indicators with greater accuracy, extra complete assist, {and professional} insights, appropriate for high-volume merchants.

Popularity and Person Evaluations

Analysis opinions on platforms like Trustpilot, Reddit, Telegram discussions, and academic assets. Search for and comply with established teams with a big, lively person base and constructive suggestions. A very good place to begin your search could be our detailed compilation of the finest crypto indicators buying and selling Telegram teams to hitch this yr.

Neighborhood Engagement and Help

Whether or not you’re contemplating paid or free buying and selling sign teams, select Telegram channels with lively chats the place members focus on indicators, market developments, and buying and selling methods. As well as, responsive admins and extra assist, like academic supplies, webinars, or customized recommendation, are beneficial.

Academic Content material

Some high teams present academic assets alongside buying and selling indicators, serving to you perceive market evaluation and enhance your crypto buying and selling expertise. For example, Cryptoninjas provide academic assets, together with in-depth guides, exchanges and token opinions, and well timed information on market developments that will help you sustain with happenings within the crypto world.

Along with the suggestions from the crypto indicators group, you should do your personal analysis to grasp the crypto world and know which cash to commerce. That can assist you get began, try this record of the finest low-cap cryptocurrencies to put money into. With this, you possibly can know what cryptos have excessive progress potential, what buying and selling indicators to take part in, and those to disregard.