A whole bunch of recent cryptocurrencies be a part of the market yearly, however Bitcoin nonetheless stands above all of them. Its success will be attributed to many elements, like its mainstream recognition, pioneering standing and, after all, its meticulously designed financial rules.

Central to this design is Bitcoin mining — a course of that enables miners to obtain rewards for validating transactions. Nonetheless, in contrast to many property, Bitcoin has a restricted provide. Consequently, periodically, the mining reward is halved in an occasion referred to as “halving.” I’ve seen firsthand how these halvings can create waves within the crypto trade, influencing each Bitcoin’s value and the overall market sentiment. On this article, I’ll check out what Bitcoin halvings are, why they happen, and the way they will affect the remainder of the crypto trade.

We are going to launch our personal Bitcoin halving countdown later this month.

Key Takeaways: The Upcoming Bitcoin Halving 2024

The subsequent Bitcoin halving will happen in April 2024.

Bitcoin halving is an occasion that cuts the Bitcoin mining reward in half.

Bitcoin halves each 4 years.

The earlier Bitcoin halving occurred in 2020.

What Is Bitcoin Halving (Halvening)?

Bitcoin, one of many world’s most well-known digital currencies, has a novel financial coverage constructed into its code. At its coronary heart is an occasion referred to as the Bitcoin halving. This occasion is basically a discount within the block rewards acquired by miners for verifying and including transactions to the blockchain.

How Does Bitcoin Work? What Is Bitcoin Mining?

Bitcoin operates on a decentralized ledger system referred to as the blockchain, the place transactions are recorded in blocks and validated by a community of computer systems referred to as miners. When somebody needs to commerce Bitcoin and initiates a BTC transaction, it’s broadcasted to the community, the place miners compete to unravel complicated mathematical puzzles to substantiate and bundle these transactions into blocks. As soon as verified, the block is added to the blockchain, making a everlasting and clear file of the transaction historical past.

Miners are incentivized by means of block rewards and transaction charges paid in Bitcoins. This decentralized consensus mechanism ensures the integrity and safety of the community, permitting customers to confidently commerce Bitcoin with out the necessity for intermediaries like banks or governments.

Bitcoin Halving That means

Initially, when Bitcoin was created, miners acquired 50 BTC per block as their reward. Nonetheless, each 210,000 blocks, or roughly each 4 years, this reward is minimize in half. So, after the primary halving, it dropped to 25 Bitcoins per block, to 12.5 after the following, and so forth.

What Occurs Throughout a Bitcoin Halving?

Throughout a BTC halving:

Block rewards that miners obtain for including new transactions to the blockchain are diminished by 50%.

Consequently, the BTC per block that miners obtain as their reward for mining decreases, making the general inflation charge of Bitcoin drop.

Transaction charges don’t get halved. They proceed to offer an incentive for miners to maintain the community safe, particularly as block rewards lower over time.

The crypto market typically reacts to this occasion with elevated hypothesis and discussions about Bitcoin’s future worth and position within the monetary ecosystem.

Why Do Bitcoin Halvings Happen?

Bitcoin halvings are integral to its design and have a number of functions:

Managed Provide. Not like fiat currencies that may be printed in limitless portions by central banks, Bitcoin has a most provide of 21 million cash. The halving mechanism ensures that these Bitcoins are launched into the system steadily, which makes it a deflationary asset over time.

Decreased Inflation. When the provision of Bitcoin decreases, it successfully results in a decrease inflation charge of Bitcoin itself. That is in stark distinction to conventional fiat currencies, the place inflation will be influenced by exterior elements resembling political choices or financial circumstances.

Sustainability. The halving course of ensures that every one 21 million Bitcoins received’t be mined too rapidly, giving the Bitcoin community extra time to develop, mature, and develop into extensively adopted.

Miner Incentive. Though block rewards lower, the hope is that the growing worth of Bitcoin, coupled with transaction charges, will proceed to offer a profitable incentive for miners to keep up the community’s safety and integrity.

Basically, whereas Bitcoin and different digital property proceed to evolve within the ever-changing crypto market, the halving mechanism serves as a balancing act, regulating Bitcoin’s provide and, by extension, its worth towards conventional property and currencies. It stands as a testomony to Bitcoin’s promise to problem the established order of central banks and conventional fiat currencies, providing an alternate within the type of decentralized digital foreign money.

When Is the Subsequent Bitcoin Halving?

The Bitcoin protocol specifies {that a} halving occasion happens each 210,000 blocks. Provided that the final halving befell in Could 2020 at a block top of 630,000, the following halving is anticipated across the 840,000th block. If we take into account {that a} new block is added to the Bitcoin blockchain roughly each 10 minutes, the following halving is projected to happen in April 2024.

How Will Halving Have an effect on Miners?

As I discussed earlier, the April 2024 Bitcoin halving will considerably improve mining and money prices as a consequence of halved block rewards. Of their current report, CoinShares initiatives mining prices to rise from $16,800 to $27,900 and money prices from $25,000 to $37,800 per Bitcoin. The common price post-halving is predicted to be round $37,856.

CoinShares factors out that whereas firms like Riot, TeraWulf, and CleanSpark are well-equipped for this transformation, a drop in Bitcoin value beneath $40,000 may very well be difficult for all miners. Regardless of extra environment friendly mining know-how, the report signifies a rise in power prices, rising from 68% to 71% of complete bills.

The halving is predicted to tighten miners’ revenue margins, with solely probably the most environment friendly surviving. CoinShares additionally anticipates a discount in mining issue and doable miner exits after the halving, resulting in a fancy affect on Bitcoin costs.

The report suggests that prime costs might cut back miner earnings, creating promoting stress, but the halving might additionally positively affect Bitcoin’s worth. They don’t present any Bitcoin value prediction post-halving. This means enormous uncertainty surrounding post-halving costs, although one factor we are able to predict for certain — the halving occasion will generate important market hype.

How Will Halving Have an effect on Bitcoin value? 10 Essential Theories

The way forward for Bitcoin and the general crypto market post-halving stays a thriller to consultants worldwide. To shed some mild on the potential outcomes, I’ve compiled 10 distinguished theories. Let’s delve into these hypotheses and discover what would possibly unfold.

1. Mining Dying Spiral Put up-Halving

The speculation means that the halving’s discount in mining rewards might result in unprofitable mining, inflicting a major drop in hashrate and slower block manufacturing. This might spiral into diminished system utility and additional value drops. Nonetheless, sensible concerns, like the size of the mining trade and contractual obligations, make such a situation unlikely.

2. Inventory-to-Move Ratio and Value Stress

Proposed by economist Safedean Ammous and quant researcher PlanB, this mannequin predicts a value improve post-halving as a consequence of a doubled stock-to-flow ratio. Nonetheless, whether or not this discount in provide alone will considerably affect Bitcoin’s value stays a topic of debate and skepticism.

3. Speculative Demand Shift

This speculation means that the pre-halving value is inflated by hypothesis and will result in post-halving sell-offs, much like fairness market dynamics. Whereas some speculative demand is probably going, its conversion to provide isn’t anticipated to drastically have an effect on costs.

4. Elevated Promoting Stress from Miners

Put up-halving, miners might face ROI challenges and promote extra Bitcoins, together with tapping into reserves, to keep up profitability. This might briefly improve promoting stress. Nonetheless, halving additionally reduces Bitcoin manufacturing by 50%, probably offsetting this stress.

5. Halving as a Non-Occasion

Some consider the halving received’t considerably disrupt Bitcoin’s value or technical operations, value volatility will stay inside regular bands, and supply-demand stability results will materialize slowly. The speculation means that the market will regulate post-halving, with miners upgrading or exiting the trade. Such adjustments on the provision aspect might probably result in a optimistic long-term affect on Bitcoin’s value.

6. Acceleration of Institutional Adoption

This idea posits that the halving occasion would possibly catalyze elevated curiosity and funding from institutional gamers. The narrative is that the diminished provide and elevated notion of Bitcoin as a scarce asset might make it extra interesting to institutional buyers in search of a hedge towards inflation or a brand new asset class. Nonetheless, the extent to which institutional adoption can affect the general market stays a matter of hypothesis.

7. Enhanced Public Consciousness and FOMO

The halving occasion typically brings Bitcoin into the limelight, probably growing public consciousness and curiosity. This heightened consideration might set off worry of lacking out (FOMO) amongst retail buyers and, subsequently, drive up demand and costs. Nonetheless, the affect of such sentiment-driven rallies is unpredictable and may result in elevated market volatility.

8. Technological Developments and Effectivity Features

One other idea focuses on the technological progress in mining {hardware}. The halving might incentivize miners to spend money on extra environment friendly mining applied sciences, resulting in long-term positive aspects in community effectivity and sustainability. Whereas this may not have a direct affect on Bitcoin’s value, it might improve the general robustness of the Bitcoin community.

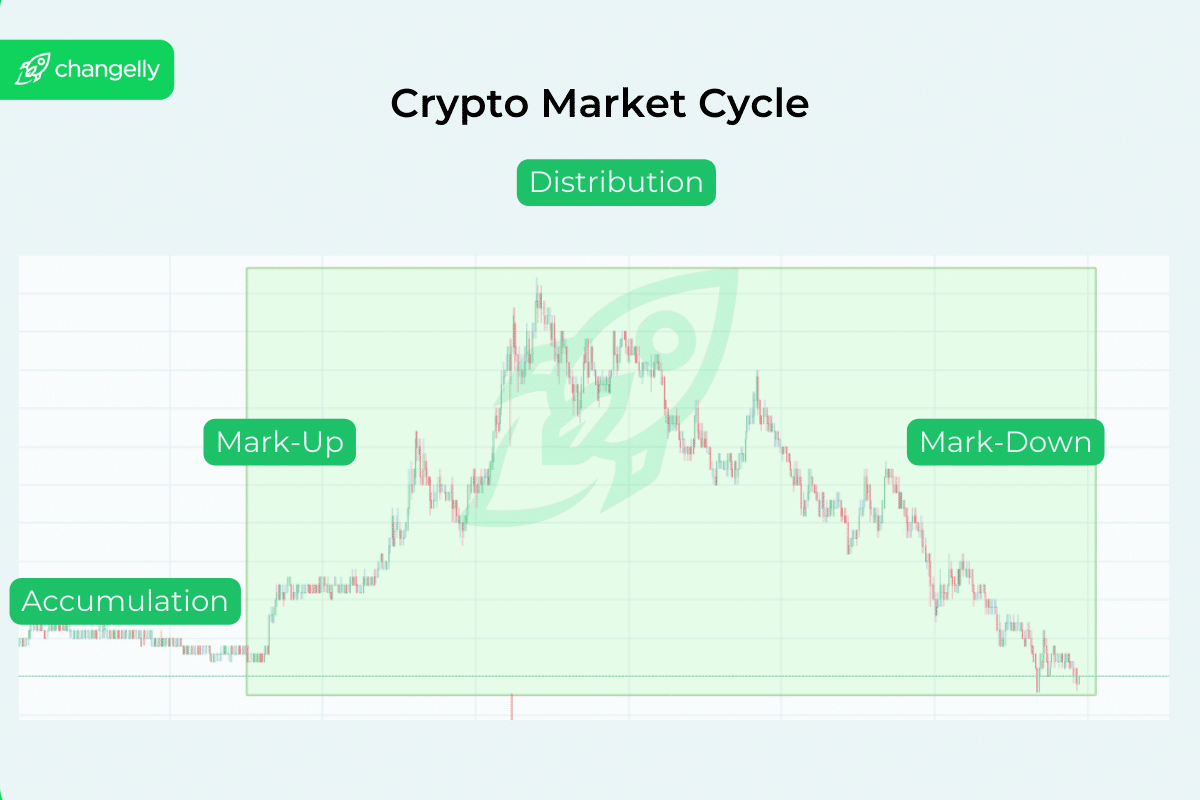

9. Market Cycle Alignment

This angle examines the halving within the context of Bitcoin’s historic market cycles. Some analysts counsel that halvings are likely to coincide with the start phases of main bull markets in Bitcoin.

The cycle is usually known as being round 4 years, largely due to Bitcoin’s halving occasions. Nonetheless, previous efficiency isn’t a dependable indicator of future outcomes, and every halving happens below distinctive market circumstances.

10. Regulatory Atmosphere Shifts

Put up-halving, regulatory reactions and coverage adjustments might considerably affect Bitcoin. If the halving results in increased costs and elevated market exercise, it might entice extra regulatory scrutiny or, conversely, result in regulatory readability and acceptance.

Every of those theories provides a unique dimension to understanding the potential impacts of the Bitcoin halving, underlining the multifaceted nature of this occasion and its significance within the broader context of cryptocurrency markets.

Bitcoin Halving Historical past

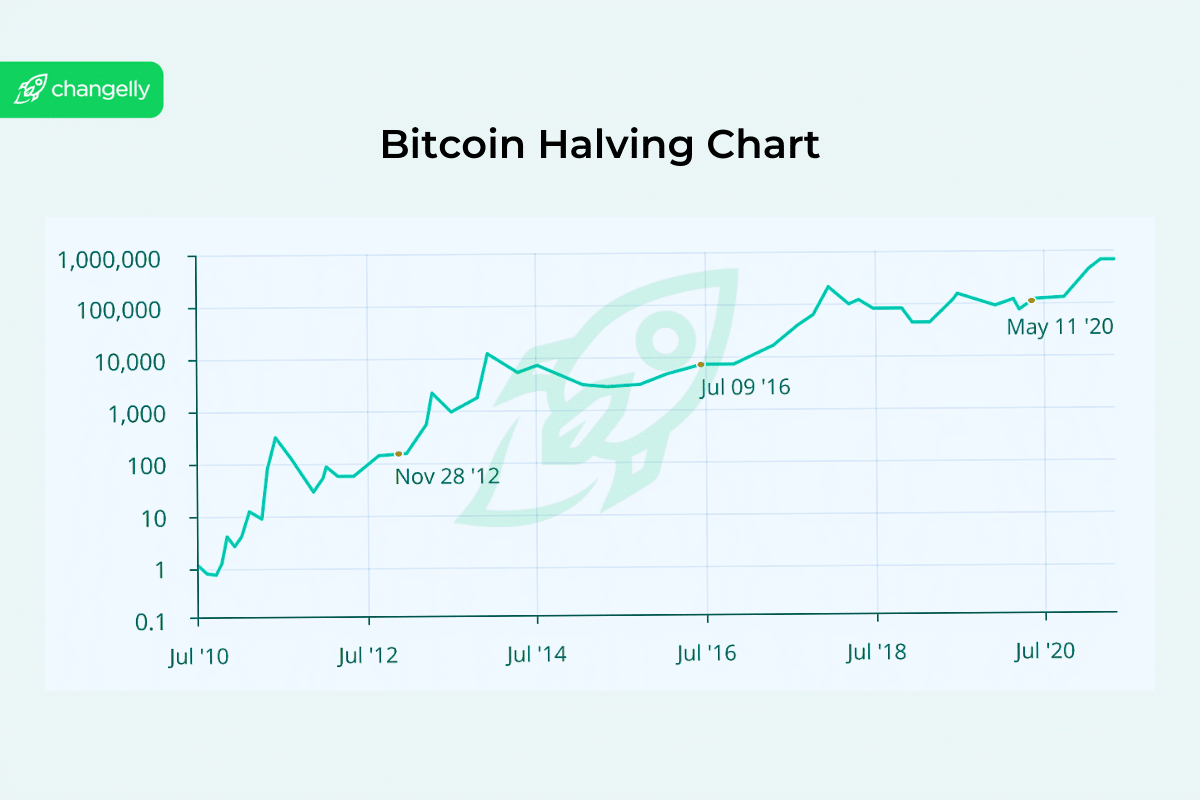

The Bitcoin halving occasion performs a pivotal position in shaping Bitcoin’s financial mannequin and market dynamics. Over time, there have been a number of such occasions, every influencing Bitcoin miners, Bitcoin transactions, and the general crypto market in their very own distinctive methods. Diving into the Bitcoin halving dates historical past may give us a broader understanding of its affect on the digital foreign money’s panorama.

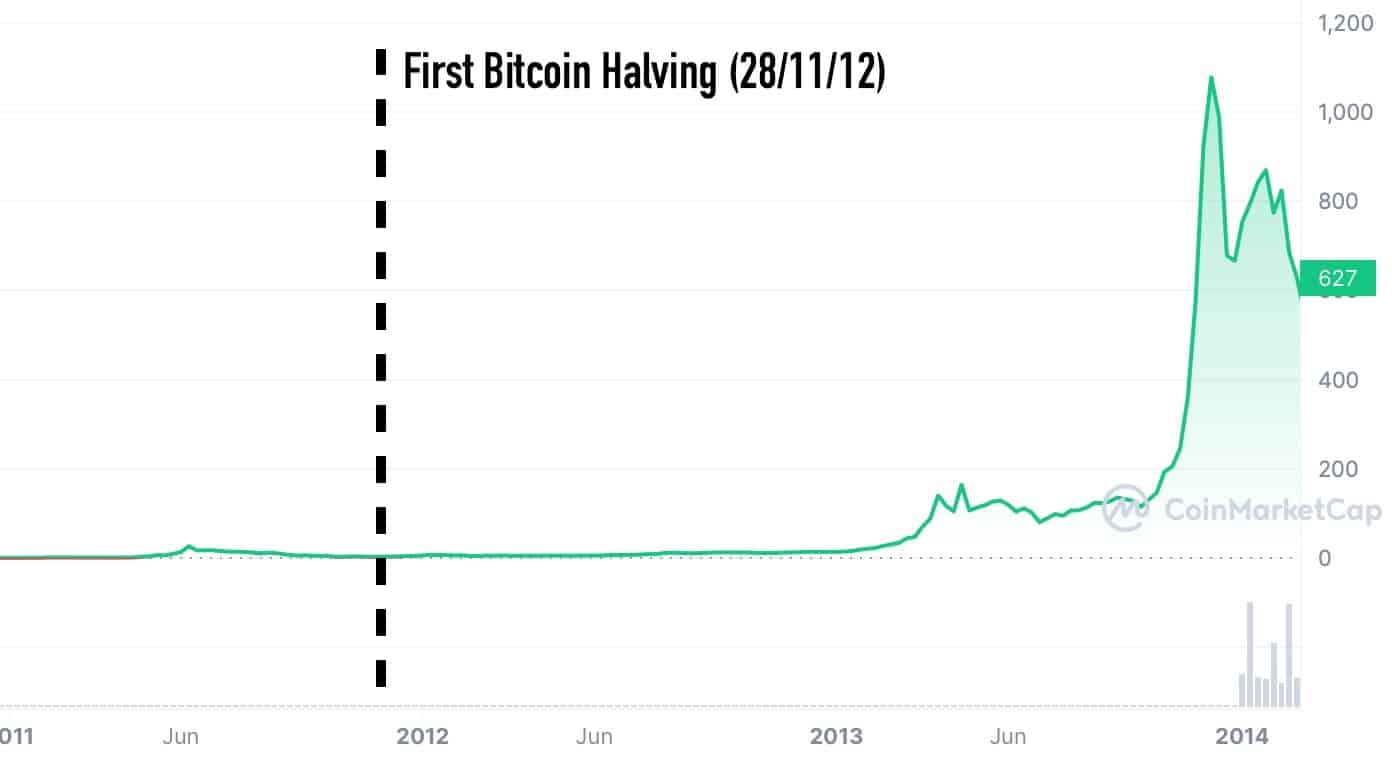

First Bitcoin Halving (2012)

Date: November 28, 2012

Block Reward Earlier than Halving: 50 BTC

Block Reward After Halving: 25 BTC

The primary Bitcoin halving was a major milestone, coming simply three years after Bitcoin’s launch. This occasion set the precedent for future halvings. Whereas it was a second of intrigue inside the crypto neighborhood, the broader world was nonetheless acquainting itself with the idea of Bitcoin. Within the aftermath of this halving, Bitcoin’s value skilled a gradual ascent, signaling the potential for future value surges.

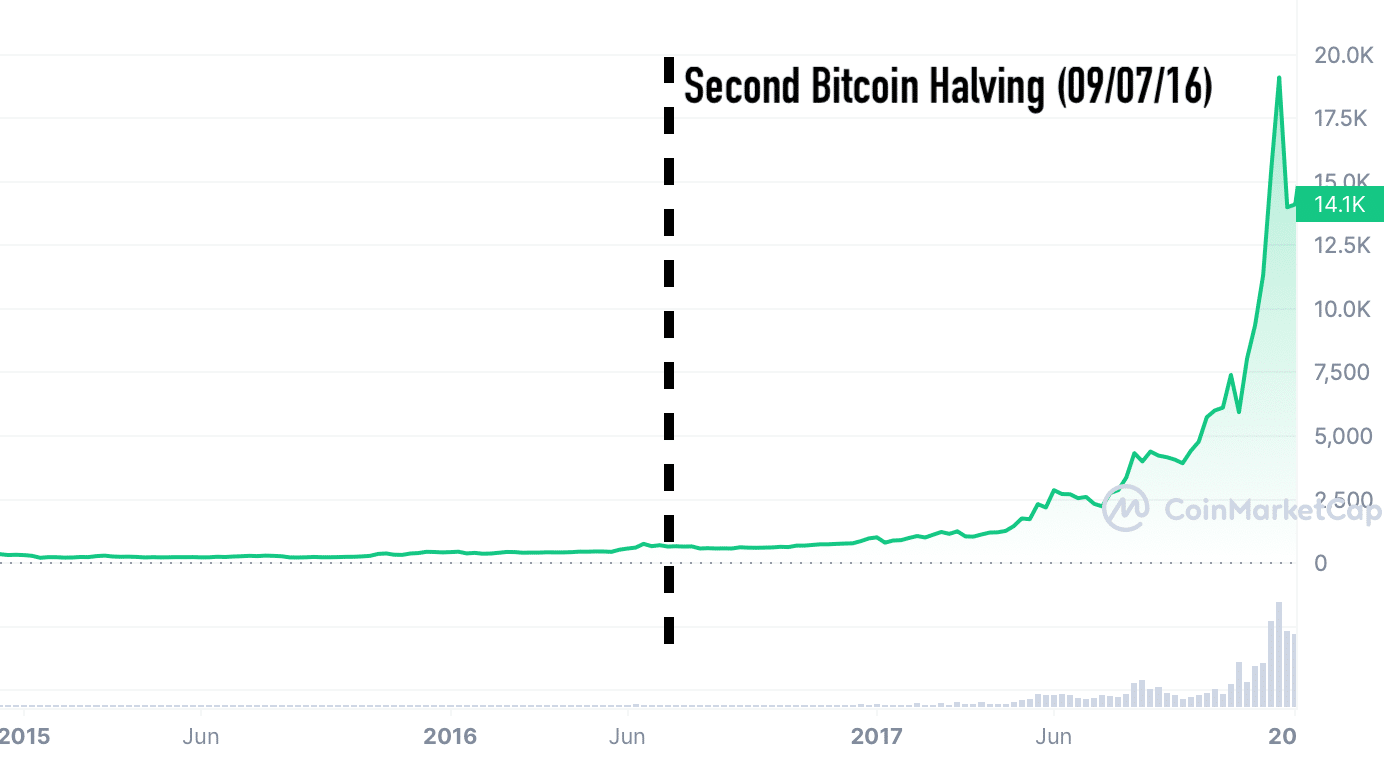

Second Bitcoin Halving (2016)

Date: July 9, 2016

Block Reward Earlier than Halving: 25 BTC

Block Reward After Halving: 12.5 BTC

By the second halving occasion, Bitcoin had garnered important consideration. The crypto market watched eagerly, and the occasion didn’t disappoint. Within the ensuing months, Bitcoin’s worth began climbing, culminating within the exceptional bull run of 2017.

Third Bitcoin Halving (2020)

Date: Could 11, 2020

Block Reward Earlier than Halving: 12.5 BTC

Block Reward After Halving: 6.25 BTC

The third Bitcoin halving occasion was met with a lot anticipation. With a rising acknowledgment of digital currencies and their potential to reshape monetary techniques, this halving drew immense consideration. Following this occasion, regardless of a number of international financial challenges, Bitcoin’s resilience shone by means of because it ventured into new all-time value highs.

The Cyclical Concept of Bitcoin Halvings: Historic Patterns and Modern Skepticism

The cyclical idea of the crypto market, significantly surrounding Bitcoin halvings, is a well-liked idea with many adherents. It’s grounded within the historic context of Bitcoin’s earlier halvings and the market reactions that adopted every of those occasions.

In keeping with this idea, Bitcoin’s halving — an occasion that halves the reward for mining new blocks and happens roughly each 4 years — performs a pivotal position within the cryptocurrency’s market cycles. The halving reduces the inflow of recent Bitcoin into the market, successfully constricting provide. When demand stays fixed or will increase, this provide discount has traditionally led to important value surges. For instance, following the halvings in 2012 and 2016, Bitcoin skilled substantial will increase in worth over the following intervals, reinforcing the idea on this cyclical sample.

Traditionally, each time the Bitcoin halving occurred, it has sometimes been adopted by a interval of robust value appreciation.

The speculation means that the market, in anticipation of the halving, typically enters a bullish part. Buyers and merchants, hoping for post-halving value rises, begin shopping for Bitcoin, probably setting the stage for the anticipated consequence. Moreover, post-halving, the crypto market sometimes undergoes a interval of adjustment. Decreased block rewards affect miner profitability, presumably resulting in the exit of much less environment friendly miners and a subsequent consolidation of the mining panorama.

Every cycle, marked by these halving occasions, not solely impacts costs but additionally seems to extend Bitcoin’s visibility, adoption, and maturity, feeding into the following cycle.

Nonetheless, the cyclical idea isn’t with out its drawbacks and counterarguments.

Critics argue that previous efficiency isn’t a dependable indicator of future outcomes. Every halving occasion happens below distinctive market circumstances, influenced by a myriad of things past simply the halving itself. These embrace regulatory adjustments, advances in blockchain know-how, macroeconomic shifts, and evolving market sentiments.

Moreover, because the cryptocurrency market matures and positive aspects broader adoption, its habits might diverge from previous patterns. Rising institutional involvement and regulatory scrutiny can also play a major position in shaping market dynamics, probably diminishing the affect of halvings over time.

In essence, whereas the cyclical idea based mostly on Bitcoin’s halving occasions has many followers and is rooted in historic information, it’s important to contemplate it inside the broader, ever-evolving panorama of the cryptocurrency market.

FAQ: Bitcoin Halving

How does Bitcoin halving work?

Each 210,000 blocks, the block reward given to Bitcoin miners for processing Bitcoin transactions and including them to the Bitcoin blockchain is diminished by 50%. This occasion is hardcoded into the Bitcoin protocol, making certain that the entire Bitcoin provide doesn’t exceed its cap of 21 million.

Why does Bitcoin halving improve BTC value?

There are a number of explanation why every halving will increase Bitcoin value and why consultants assume the 2024 Bitcoin halving would possibly do the identical, too.

Shortage Impact: Bitcoin halving reduces the speed at which new BTC cash are created, reducing the accessible provide. This shortage tends to extend demand as buyers anticipate future shortage, probably driving up the value.

Provide-Demand Dynamics: With a discount within the provide progress charge, if demand stays fixed or will increase, the equilibrium value tends to rise as a consequence of fundamental provide and demand rules.

Psychological Affect: Bitcoin halving occasions typically generate hype and pleasure inside the cryptocurrency neighborhood, resulting in elevated investor curiosity and speculative shopping for, which may push the value increased.

Historic Priority: Earlier Bitcoin halving occasions have been related to important value rallies within the months main as much as and following the occasion, main some buyers to anticipate related value actions in subsequent halving cycles.

What occurs when there aren’t any extra Bitcoins left?

Bitcoin has a capped provide of 21 million cash. As of now, nearly all of these cash have already been mined, however it’s going to take till roughly the yr 2140 for the final Bitcoin to be mined. After the final BTC has been mined, miners will not obtain block rewards within the type of new Bitcoins.

As an alternative, their incentive to maintain validating transactions and sustaining the community’s safety will come solely from transaction charges. The Bitcoin protocol has been designed with this eventual situation in thoughts, emphasizing the significance of transaction charges within the long-term sustainability of the Bitcoin blockchain.

Will Bitcoin value rise after the following halving?

Whereas previous occasions present insights, they don’t essentially dictate future outcomes. But, they undoubtedly underscore the importance of the halving mechanism in Bitcoin’s design. Traditionally, earlier halvings have been adopted by intervals of serious value appreciation for Bitcoin. Nonetheless, it’s important to grasp that quite a few elements affect the value of Bitcoin, together with however not restricted to market demand, international financial circumstances, regulatory developments, and technological developments.

Whereas the discount within the mining reward tends to minimize the promoting stress from miners (since they’ve fewer Bitcoins to promote), there’s no assured consequence. Previous value actions post-halving function a reference, however they don’t predict future efficiency. It may be helpful to check traits following earlier halvings for informational functions, however one ought to method the long run with an understanding of Bitcoin’s broader ecosystem and the myriad of things that may affect its worth.

Disclaimer: Please observe that the contents of this text will not be monetary or investing recommendation. The data offered on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native rules earlier than committing to an funding.