On Could 9, 2025, the crypto market noticed a robust rally, with Bitcoin (BTC) breaking above $103,000 for the primary time since January. Ethereum (ETH) and plenty of altcoins additionally posted important good points, pushing the overall world crypto market capitalization above $3.22 trillion.

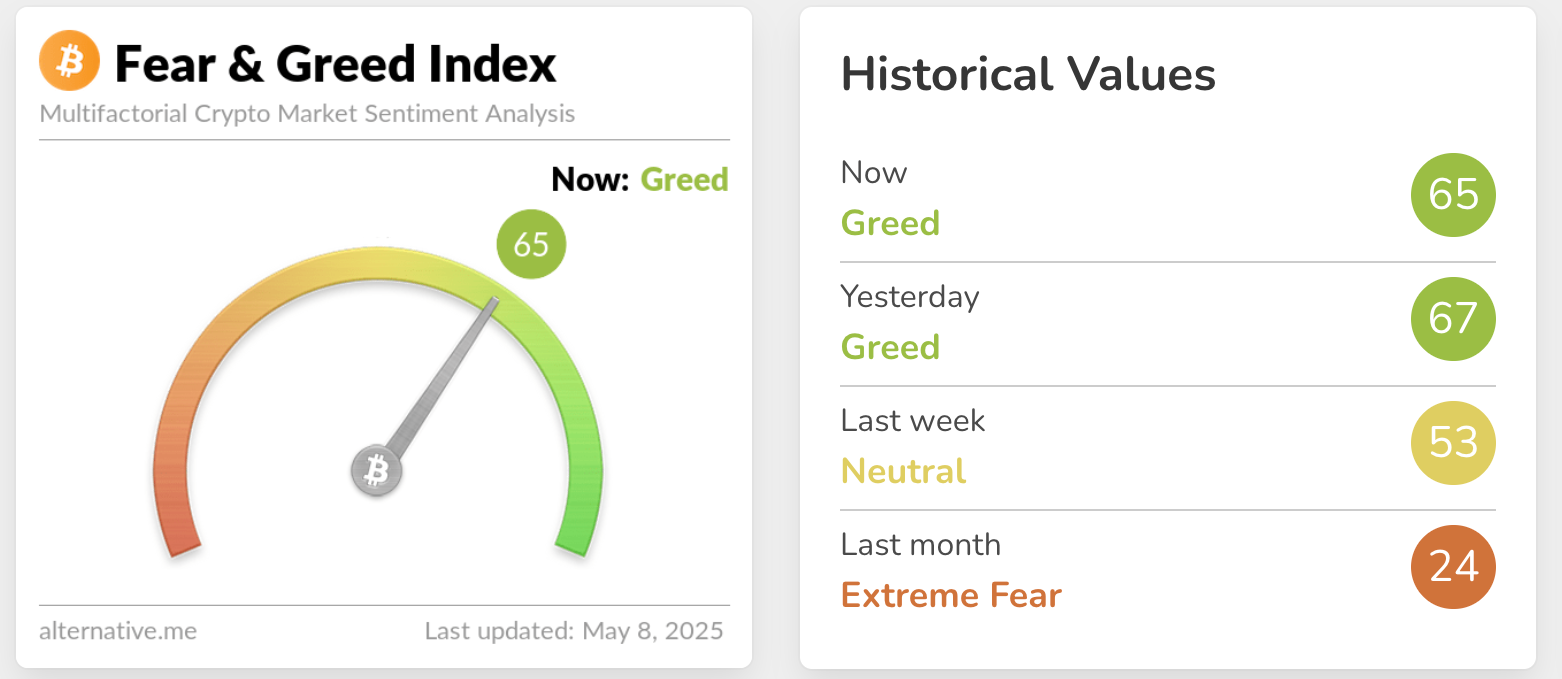

The Concern & Greed Index jumped from 48 (impartial) to 63 (greed) in simply three days. Based on Santiment, the variety of retail wallets shopping for BTC and ETH has elevated sharply because the starting of the week.

So, what’s driving this spectacular restoration?

Supply: Various.me

Rise in Fee Cuts Sentiment

U.S. jobless claims information launched on Could 8 confirmed a slight decline to 228,000 filings, down from 241,000 the earlier week. The sooner spike was largely attributed to seasonal components in New York State and never indicative of a broader pattern in layoffs.

Study extra: Bitcoin Worth Surpasses $100k amid Commerce Optimism

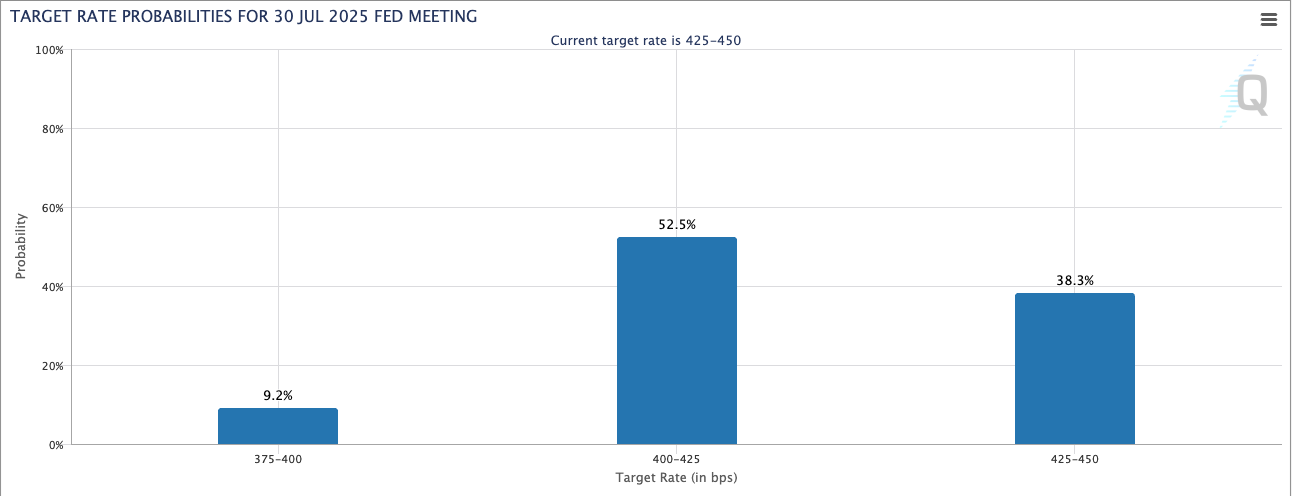

Nonetheless, traders stay involved in regards to the well being of the U.S. financial system, deciphering the Fed’s determination to maintain charges regular at 4.25%–4.50% as an indication that recession dangers are being weighed. Because of this, expectations of charge cuts in Q3 2025 proceed to assist threat property, together with cryptocurrencies.

Supply: CME Teams

The ten-year U.S. Treasury yield fell to 4.38%, whereas the DXY index (which measures the power of the U.S. greenback) dropped to a three-week low, signaling a shift in capital towards speculative property.

One other key issue is rising concern over stagflation – a situation wherein financial development slows whereas inflation stays excessive, prompting traders to hunt store-of-value property like Bitcoin.

With the Fed holding charges regular and providing no clear steerage on cuts in June, markets are more and more pricing in a extra dovish financial stance within the quarters forward.

On this atmosphere, Bitcoin, sometimes called “digital gold,” has emerged as a compelling hedge, significantly because the greenback weakens and macro uncertainty rises.

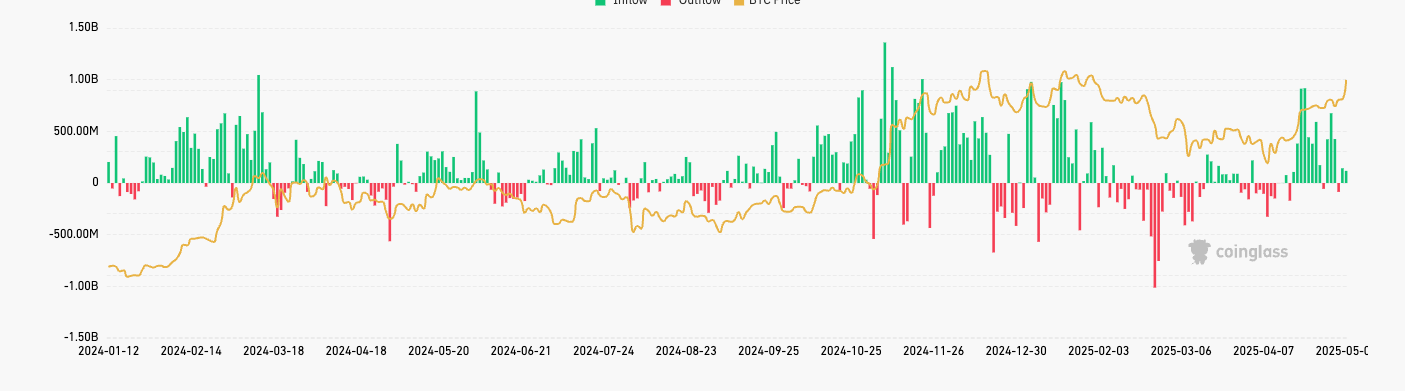

Robust Inflows into Bitcoin ETFs: A Key Catalyst Behind the Market Rally

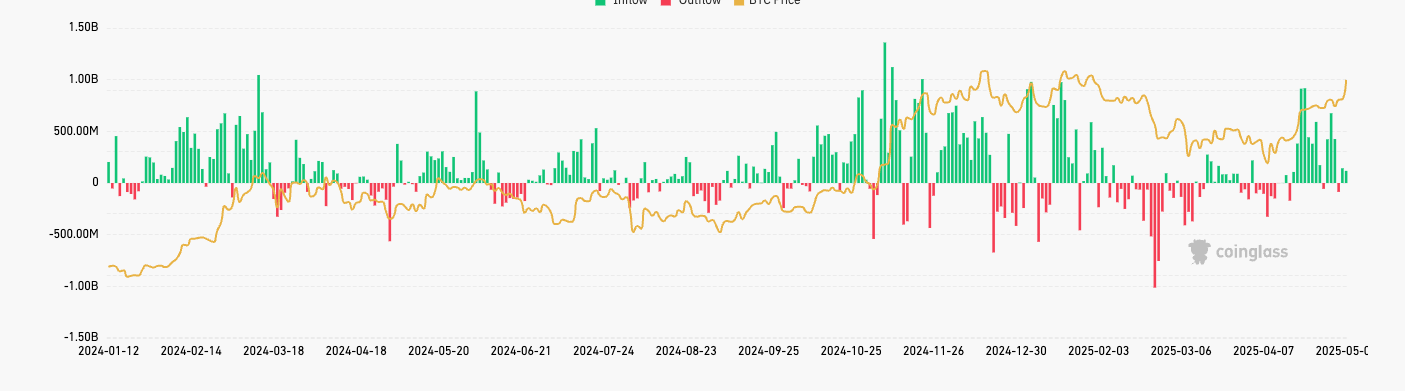

Within the first week of Could 2025, U.S.-listed Bitcoin ETFs witnessed sturdy inflows, highlighting rising institutional curiosity in digital property.

On Could 8, 2025, alone, complete inflows into Bitcoin ETFs reached $117.4 million, with:

BlackRock’s iShares Bitcoin Belief (IBIT) main the pack at $69 million,Adopted by Constancy’s Clever Origin Bitcoin Fund (FBTC) with $35.3 million,And the ARK 21Shares Bitcoin ETF (ARKB) at $13.1 million.

Over the previous three weeks, Bitcoin ETFs have attracted greater than $5.3 billion in cumulative inflows, underscoring a surge in demand from conventional traders.

Notably, because the begin of 2025, IBIT has surpassed the SPDR Gold Shares (GLD) in internet inflows, with over $6.96 billion, signaling a shift from gold to Bitcoin as a most popular retailer of worth asset.

Supply: CoinGlass

Ethereum Boosted by ETF Hopes and the Pectra Improve

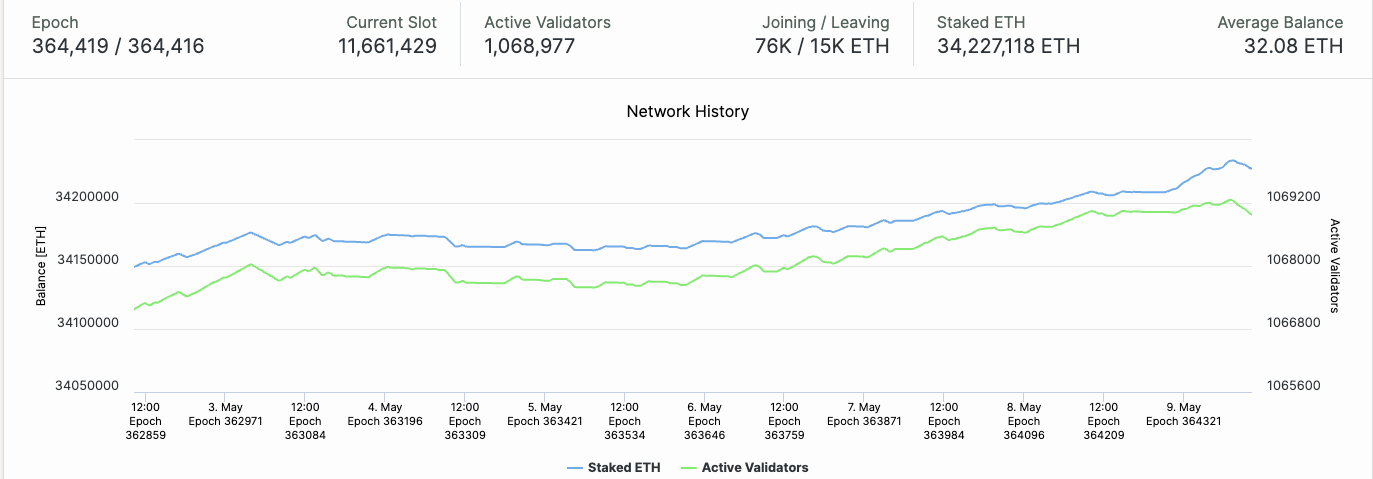

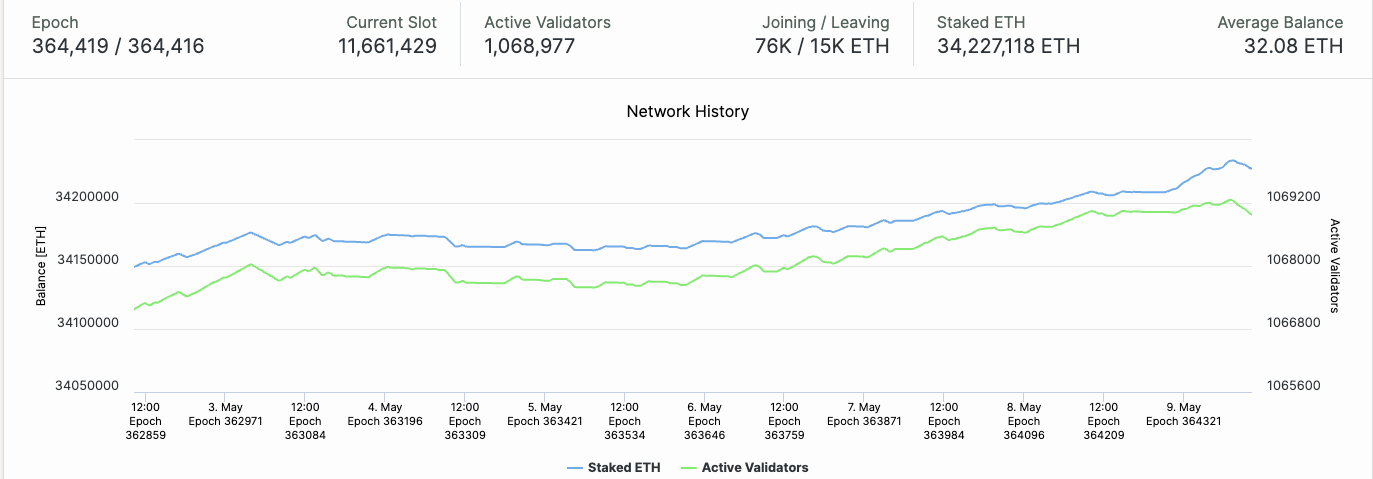

Ethereum has rallied almost 20% over the previous 7 days, pushed primarily by two key catalysts. The profitable rollout of the Pectra improve on Could 7, which improves community efficiency and streamlines staking, and hypothesis that the SEC might approve a number of spot Ethereum ETFs forward of the Could 23 deadline.

The Pectra improve not solely enhances transaction expertise and scalability but additionally revises staking parameters, making it simpler for retail traders to take part in ETH staking – an element that would drive long-term holding demand.

Study extra: ETH Worth Prediction after Pectra Improve in Could

Based on BeaconScan, over 400,000 ETH have been added to staking within the three days following the improve, marking the biggest spike since January 2024.

Variety of Ethereum validator after Pectra – Supply: Beaconcha

Moreover, Bloomberg experiences that the SEC held a number of closed-door conferences with ETF issuers final week, sparking hypothesis of a probably favorable shock determination – very like the approval of spot Bitcoin ETFs earlier this 12 months.

U.S.–U.Ok. Commerce Deal Hopes Enhance Danger Sentiment

Amid ongoing world geopolitical uncertainty, a brand new assertion from U.S. President Donald Trump has helped elevate market sentiment. Trump introduced that the U.S. is making ready to unveil a serious commerce take care of a “very revered” nation, extensively interpreted by analysts to imply the UK.

Markets shortly took this as a sign that the U.S. could also be softening its commerce stance, probably easing tensions with key companions after a chronic interval of tariffs and protectionist insurance policies.

🇺🇸 JUST IN: President Trump publicizes a “main commerce deal” information convention scheduled for tomorrow at 10:00 AM within the Oval Workplace with “a giant, and extremely revered nation.” pic.twitter.com/irsood0JRZ

— Cointelegraph (@Cointelegraph) Could 8, 2025

The constructive temper spilled over into threat property comparable to equities and cryptocurrencies. The U.S. greenback weakened, whereas shares and Bitcoin surged, reflecting a return of speculative capital amid rising optimism for a extra secure world commerce atmosphere.

Technical Evaluation Confirms Bullish Momentum

The overall crypto market capitalization (TOTAL) has rebounded strongly from the $2.4 trillion assist zone and is now holding regular above $3.2 trillion. This restoration coincides with the RSI breaking out of oversold territory and approaching 70, indicating robust bullish momentum.

Furthermore, the transfer above the 200-day transferring common additional confirms {that a} short-term uptrend has been firmly established.

This rally will not be remoted to crypto alone – conventional monetary markets are additionally trending greater:

The Nasdaq index rose 1.8%Gold costs surpassed $2,380/oz

These strikes mirror a rising urge for food for each safe-haven and speculative property. On this context, crypto seems to be benefiting from broader world market dynamics, reasonably than rallying in isolation.

Supply: TradingView

Conclusion

The robust rally on Could 9 was the results of a number of converging components: expectations of a Fed charge minimize, continued institutional inflows into Bitcoin ETFs, the profitable Ethereum improve, and a speedy enchancment in investor sentiment.

Nevertheless, for the rally to develop into sustainable, the market nonetheless wants additional affirmation. Two upcoming occasions will probably be vital:

The Fed’s financial coverage determination in JuneAnd the SEC’s ruling on spot Ethereum ETFs, anticipated by late Could

These will function key turning factors that would form the crypto market’s short-term trajectory.

Learn extra: Will Bitcoin Worth Reaching $100k Set off One other Promote-Off?